New Orders for Durable-Goods Pull Back Slightly in February

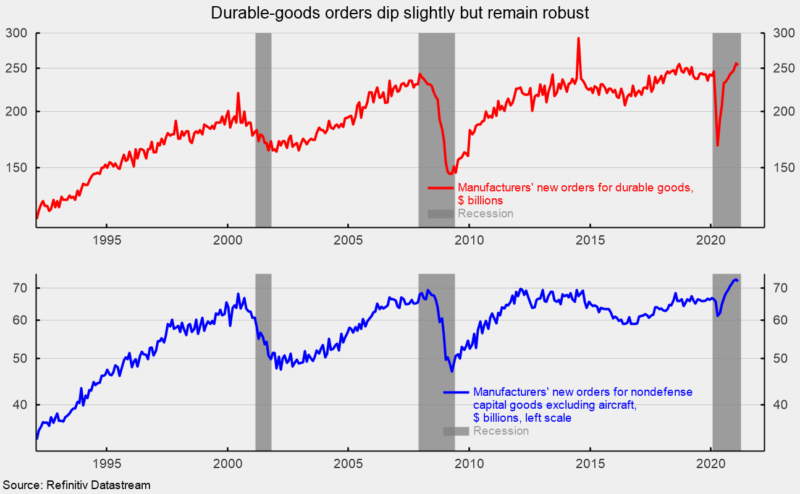

New orders for durable goods posted a decline in February following nine consecutive gains from May through January. Durable-goods orders fell 1.1 percent following a gain of 3.5 percent in January. Total durable-goods orders are up 4.7 percent from a year ago. After the drop in February, durable-goods orders were still at the fourth-highest level on record (back to 1992; see top of first chart).

New orders for nondefense capital goods excluding aircraft, a proxy for business equipment investment, fell 0.8 percent in February after gaining 0.6 percent in January, putting the level at $72.5 billion, just slightly below the record high in January. This important category had been in the $65 to $70 billion range for several periods over the past 15 years before dropping to $61.3 billion in April 2020. The $61.3 billion pace was the slowest since June 2017 (see bottom of first chart). February is the fifth consecutive month above $70 billion. The high level of orders is a positive sign for the overall economic outlook.

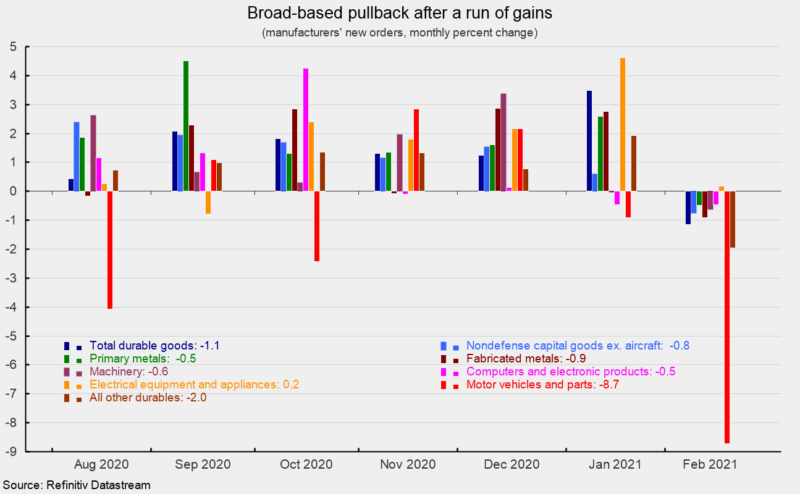

Most of the major categories of durable goods shown in the report had a decline in the latest month except for electrical equipment and appliances which gained 0.2 percent, and nondefense aircraft which surged 103.3 percent. Among the other individual categories, primary metals fell 0.5 percent, fabricated metal products lost 0.9 percent, machinery orders were off 0.6 percent, computers and electronic products declined 0.5 percent, motor vehicles and parts orders sank 8.7 percent, defense aircraft decreased 3.7 percent, and the catch-all “other durables” category was off 2.0 percent (see second chart).

The broad-based declines among new orders for durable goods follow a very strong recovery from the government lockdowns in 2020. The pullback is unlikely to be the start of a period of weakness as other parts of the economy continue to open up in response to the ongoing distribution of vaccines. Overall, the economic outlook continues to improve as government restrictions are lifted.