New Housing Starts and Permits Fall in June as Activity Plateaus

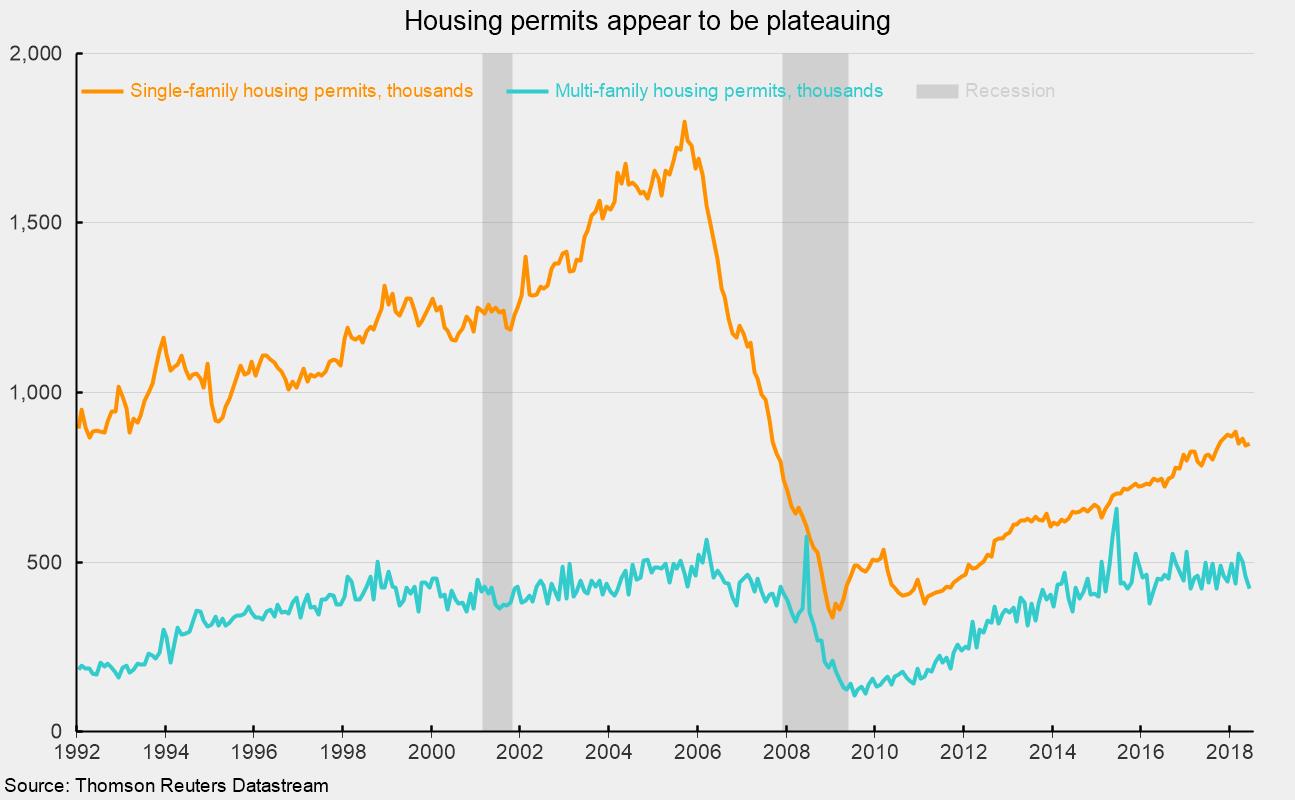

Housing construction fell in June as single-family and multifamily starts declined. Housing permits, an indicator of future activity, also fell in the latest month, pulled down by a plunge in multifamily permits. Overall, housing construction and permits appear to be plateauing after rebounding from the housing boom-bust cycle in the early 2000s. For the single-family segment, the plateau is well below peak levels of activity achieved during previous economic expansions. For multifamily housing, the plateau is about in line with sustained levels in the prior two expansions (see chart).

Total housing starts fell 12.3 percent in June to a 1.173 million annual rate. The dominant single-family segment, which accounts for about three-fourths of new home construction, fell 9.1 percent for the month to a rate of 858,000 units. Starts of multifamily structures with five or more units fell 20.2 percent to 304,000. Among the four regions in the report, total starts fell in all four regions: the Northeast, Midwest, South, and West. For the single-family segment, starts were down in three regions — the South, the Midwest, and the West — but up 3.1 percent in the smallest region, the Northeast.

For housing permits, total permits fell 2.2 percent to 1.273 million from 1.301 million in May. Single-family permits rose 0.8 percent to 850,000 while permits for two- to four-family units were up 5.9 percent and permits for five or more units plunged 8.7 percent to 387,000. Among the major regions, total permits rose 6.2 percent in the South but were down in the Northeast, Midwest, and West. For the single-family segment, the pattern was the same, with the South rising 4.1 percent but the other regions declining.

Housing permits is one of the AIER leading indicators. It had posted a strong run of positive results as the housing market recovered from the Great Recession. However, it registered a neutral reading last month (along with real stock prices), pulling the index to 92 from 100 in the prior month. While the economy remains very solid, some headwinds may restrain further gains for housing.