New Home Sales Tumble in October; Corporate Profits Hit a New Record

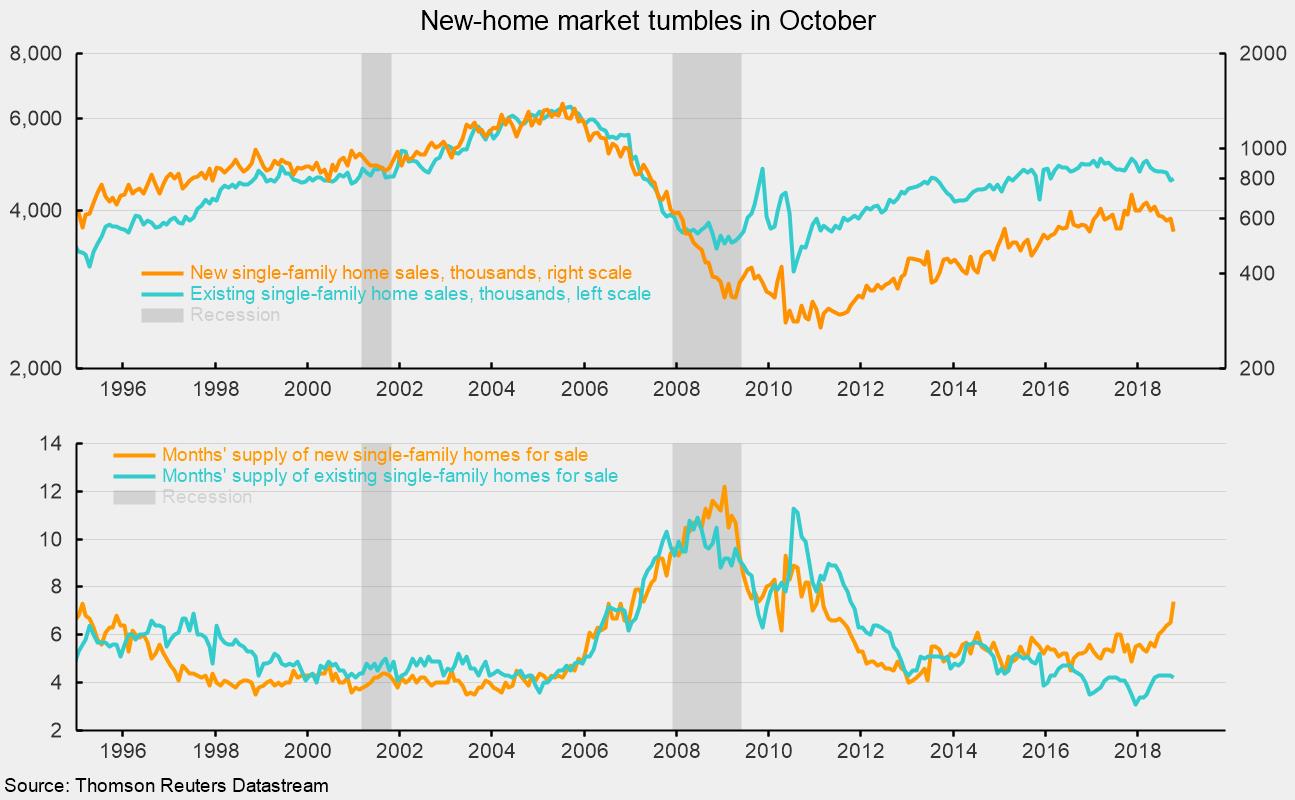

Sales of new single-family homes came in at 544,000, a drop of 8.9 percent, in October versus the 597,000 pace in September. From a year ago, sales are off 12.0 percent; they are down 23.6 percent from a recent peak in November 2017 (see top chart). That performance is significantly weaker than the performance of existing single-family homes. Sales of existing homes were up 0.9 percent in October though they are still off 5.3 percent from year ago.

Sales of new single-family homes fell across the four regions in October, falling 18.5 percent in the Northeast, 22.1 percent in the Midwest, 7.7 percent in the South, and 3.2 percent in the West. From a year ago, sales are off a whopping 46.3 percent in the Northeast, 16.7 percent in the Midwest, 11.6 percent in the South, and 1.3 percent in the West.

Total inventory of new single-family homes for sale rose 4.3 percent in October and is 17.5 percent above the year-ago level. That increase has pushed the months’ supply (inventory times 12 divided by the annual selling rate) to 7.4, the highest since November 2010 (see bottom chart). The inventory of existing single-family homes for sale declined 1.8 percent to 1.63 million in October, the fourth decrease in a row, leaving the months’ supply at 4.2. That is down from 4.3 in each of the last four months but still well above the recent low of 3.1 months in December 2017.

The combination of rising home prices and higher interest rates is weighing on housing activity. Home affordability overall has been trending lower after surging from 2009 to 2012 because at that time a combination of extraordinarily low interest rates and falling home prices made for a buyer’s market. For the housing market overall, affordability remains marginally favorable, though the declining trend is likely to continue. Sales are unlikely to move significantly higher in the coming months, and new-home construction is unlikely to contribute significantly to growth in gross domestic product in coming quarters. Still, the economy overall remains healthy, supported by a tight labor market, rising incomes, strong balance sheets, and high levels of consumer confidence.

Also out this morning were revised estimates for third-quarter gross domestic product and corporate profits. The revised estimates show the U.S. economy grew at a 3.5 percent annual rate in the third quarter, unchanged from the initial estimate. In general, the revisions were small. There were upward revisions to business fixed investment, residential investment, and inventories, but offsetting downward revisions to consumer spending, state and local government spending, and exports.

Included with today’s release were estimates of corporate profits. Corporate profits after tax on a NIPA (national income and product accounts) basis rose 3.3 percent in the third quarter following a 2.1 percent rise in the second quarter. From a year ago, profits are up a robust 19.4 percent. Removing inventory-valuation adjustments (IVA) and capital-consumption adjustments (CCADJ) made for NIPA accounting methods — bringing the figure closer to private sector accounting standards — after-tax profits rose 0.7 percent in the third quarter following a 3.3 percent gain in the second quarter. After-tax profits on this basis totaled $1,975.7 billion at an annual rate, a new record. After-tax profits are benefiting from strong economic growth and from cuts to corporate tax rates. Solid corporate-profit growth helps support future hiring and investment as well as stock prices.

Overall, third-quarter real GDP looks similar in the revised estimate and shows growth decelerated modestly from a strong second quarter. Price increases remain moderate by historical measures. Record-high corporate profits continue to be a very positive element in the latest report.