New-Home Construction Falls While Permits Rise in January

Housing activity was mixed in January as starts fell but permits posted a gain. Despite the mixed results for January, starts and permits are up sharply from a year ago.

Total housing starts fell to a 1.567 million annual rate from a 1.626 million pace in December, a 3.6 percent fall. The dominant single-family segment, which accounts for about two-thirds of new home construction, fell 5.9 percent for the month to a rate of 1.073 million. Starts of multifamily structures with five or more units increased by 3.0 percent to 547,000. From a year ago, total starts are up 21.4 percent with single-family starts up 4.6 percent and multifamily starts up 77.6 percent.

Among the four regions in the report, total starts fell in two, the South (−5.4 percent) and the Midwest (−25.9 percent), while the Northeast surged 31.9 percent and the West gained 1.2 percent. For the single-family segment, starts fell in the South (−12.2 percent) and the Midwest (−15.1 percent), while the Northeast increased 3.1 percent and the West jumped 14.2 percent.

For housing permits, total permits rose 9.2 percent to 1.551 million from 1.420 million in December. Total permits are 17.9 percent above the January 2019 level. Single-family permits were up 6.4 percent at 987,000 in January while permits for two- to four-family units gained 7.7 percent and permits for five or more units increased 15.2 percent to 453,000. Permits for single-family structures are up 20.2 percent from a year ago while permits for two- to four-family structures are down 6.7 percent and permits for structures with five or more units are up 16.0 percent over the past year.

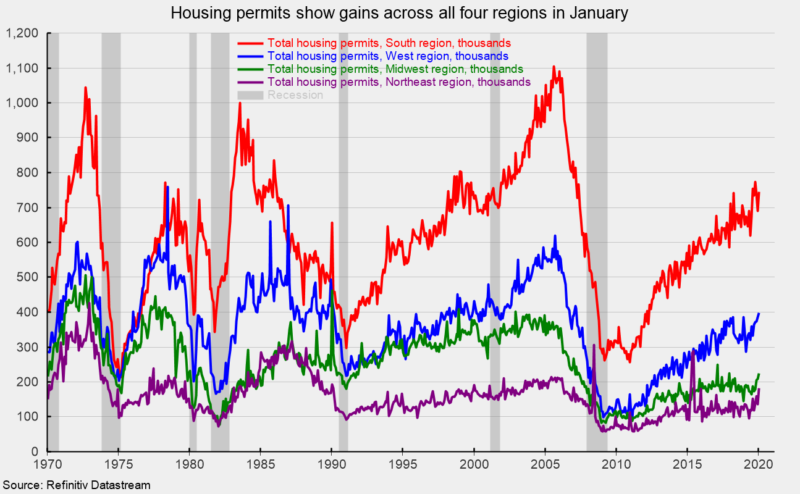

Permits rose across all four regions in the report, with the South up 8.0 percent, the West posting a 3.1 percent rise, the Midwest gaining 8.2 percent and the Northeast surging 34.6 percent (see chart). From a year ago, the South is up 14.3 percent, the West is 16.7 percent higher, the Midwest gained 20.3 percent and the Northeast surged 34.6 percent.

Home construction continues to rebound from a period of weakness in the first half of 2019. While construction has made significant gains since the end of the Great Recession of 2008-2009, activity levels are still below peaks of prior expansions, even with extraordinarily low interest rates and a multidecade low unemployment rate. Significant and sustained gains from here seem unlikely.