New GDP Data Reveal Slightly Faster Growth

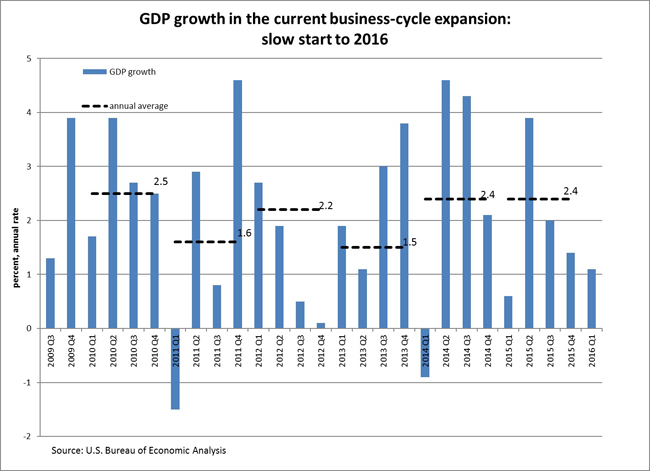

This morning’s release from the Bureau of Economic Analysis reveals that U.S. economic growth in the first quarter of 2016 was a bit faster than we previously thought. U.S. gross domestic product, the broadest measure of the economy’s output, grew at 1.1 percent (annual rate) in the first three months of the year, somewhat faster than the 0.8 percent growth reported in the previous estimate a month ago. But still, the pace of growth is considerably slower than the average growth in the past two years (see Chart 1), leaving unchanged the overall picture of a slowdown in growth at the end of last year and the start of this one.

Today’s estimate is based on more complete data than the earlier ones, but it is still not the final word on GDP growth. Next month the BEA will release its annual revision to the National Income and Product Accounts that can potentially affect the estimates of GDP growth for the past three years.

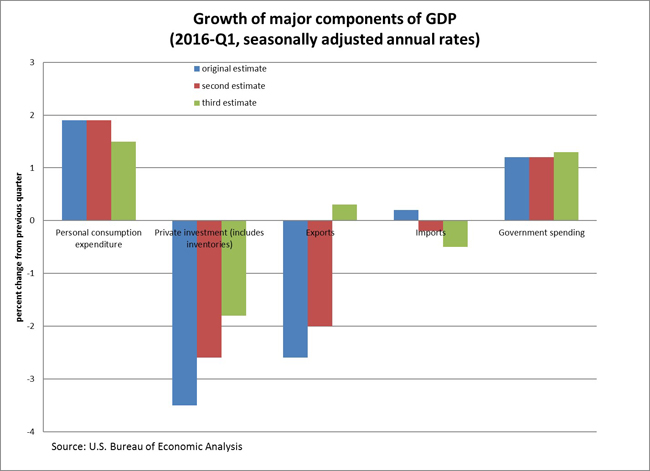

Two main factors are behind the latest estimate showing faster GDP growth than was previously believed: business investment did not shrink as much as we originally thought, and exports did considerably better than previously reported. The newest estimate shows that, in the first quarter of 2016, personal consumption expenditures grew somewhat more slowly than was previously believed; investment shrank, but not as much as we originally thought; exports increased instead of falling; imports (which are subtracted from GDP) fell more than we previously thought; and government spending increased about as much as in the earlier estimates. See Chart 2:

These revisions were necessary because earlier estimates had to rely on incomplete data, making assumptions and extrapolations for the missing information. Once more complete data are available, the previously extrapolated values are replaced by true ones. Thus, the revisions tend to be more substantial in those areas where the data take a while to arrive, and where it’s more difficult to fill in the missing information.

Exports is one category where extrapolating missing data accurately is difficult. This month, exports posted the largest revision of all GDP components: The latest data show that exports rose 0.3 percent in the first quarter of 2016, while the earlier (incomplete) data indicated that exports fell 2 percent.

Another place where extrapolations of missing data is often difficult is within the investment category. The latest data show that private domestic investment (which includes business investment and residential construction) fell 1.8 percent (annual rate) in the first quarter of 2016. This is a smaller decline than the 2.6 percent drop reported earlier. The difference between these two estimates comes almost entirely from business investment, and specifically investment in intellectual property products. It turns out that businesses have increased their spending on software and research and development much more than was previously estimated.

Overall, while this latest estimate paints a picture that is less gloomy, the pace of economic growth early in the year remains quite slow, raising concerns for the vitality of the expansion.

Click here to sign up for the Daily Economy weekly digest!