Natural Disasters Hitting Economic Data

The first signs that Hurricanes Harvey and Irma are impacting economic activity came in retail sales, industrial production, and consumer sentiment data released today. All three measures came in below expectations. Two, industrial production and consumer sentiment, gave some quantitative assessment of the impact while the retail sales data release said that the impact was not able to be quantified. Measures of economic activity over the next few months are likely to be significantly impacted by the storms. Negative impacts in the short-term will likely be followed by a significant rebound as life returns to normal in many areas, and clean-up and rebuilding efforts accelerate in the hardest hit areas.

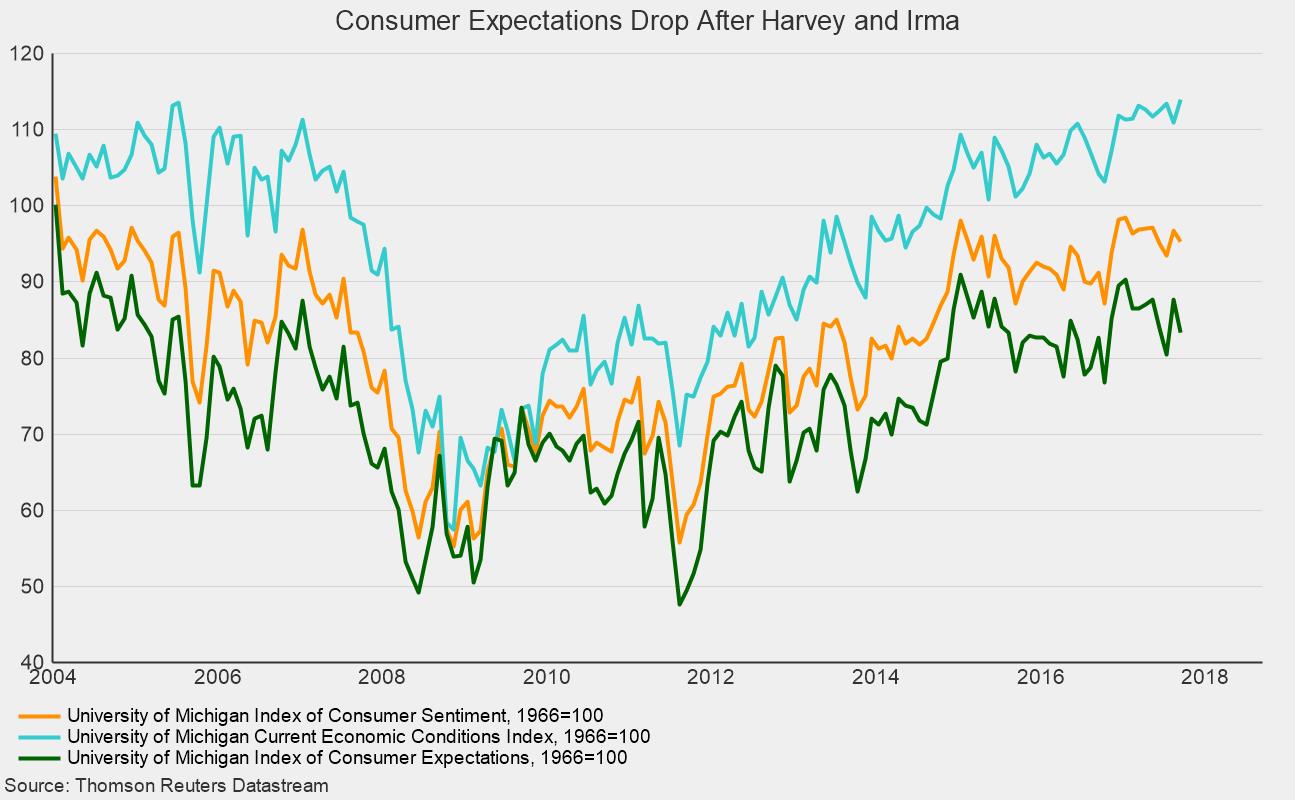

Consumer sentiment fell to 95.3 in early September, down from 96.8 in August, a 1.5 percent decline though the index is still up 4.5 percent from a year ago. The two sub-indexes had opposing performances in early September with the current economic conditions index increasing to 113.9 from 110.9 in August. That is a 2.7 percent rise for the first part of the month and a 9.3 percent increase from September 2016. The index of consumer expectations, one of the AIER leading indicators, fell 4.9 percent for the month but still had a slight 0.8 percent gain from the prior year. According to the press release, “Across all interviews in early September, 9% spontaneously mentioned concerns that Harvey, Irma, or both, would have a negative impact on the overall economy. Among those who mentioned the hurricanes, the Sentiment Index was 80.2, while among those who did not spontaneously mention either hurricane, the Sentiment Index remained unchanged from last month at 96.8.” The press release goes on to say, “Renewed gains in incomes as well as rising home and equity values have acted to counterbalance the negative impacts from the hurricanes. Given the current resilience of consumers, recent events are unlikely to derail confidence.”

Retail sales fell 0.2 percent in August led by broad-based declines across most discretionary industries. Discretionary industries posted an 0.8 percent drop for the month while staples rose 0.9 percent. Among the discretionary industries, auto sales fell 1.6 percent, clothing store sales dropped 1.0 percent, electronics and appliance stores lost 0.7 percent and building materials and garden equipment store sales fell 0.5 percent. Furniture stores, restaurants, and sporting goods, hobby, book, and music store sales managed gains of 0.4 percent, 0.3 percent, and 0.1 percent, respectively.

Among the staples retailers, food and beverage store sales rose 0.3 percent, health and personal care stores added 0.1 percent, while gasoline station sales gained 2.5 percent driven largely by a 3.5 percent increase in the price of gasoline.

Industrial production dropped 0.9 percent in August led by a 5.5 percent plunge in utility output. Manufacturing, which accounts for about 76 percent of total industrial output, fell 0.3 percent while mining output lost 0.8 percent. Statisticians at the Federal Reserve estimated that the impact of Harvey lowered total output by about three-quarters of a percentage point. They also estimated that the manufacturing sector had a negative impact of about three-quarters of a point implying that manufacturing would have posted a gain if not for the storm.

The effects of the two storms on aggregate economic statistics will be significant and continue for a number of months. The impacts on the areas directly affected will be enormous and will go on far longer. In the short-term, the challenge will be to discern the underlying trends particularly when judging the risk of recession for the overall economy. Based on history, it’s unlikely the current expansion will be at risk but patterns of activity will be altered.