Morawetz on Central Banking

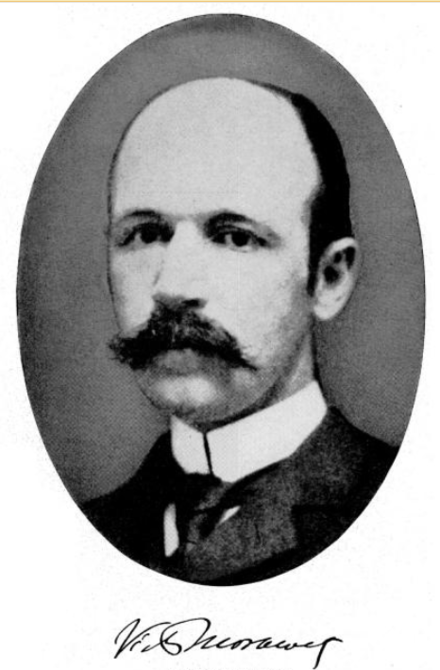

The level of discourse in the lead up to the founding of the Federal Reserve System in 1913 is quite remarkable. Consider the work of Victor Morawetz, a corporate lawyer whose book, The Banking & Currency Problem in the United States, was published in 1909. Morawetz opposed the establishment of a “great central bank” (p. 349).

Morawetz worried that regional differences would undermine central bank independence. Since “business conditions in the different sections of the United States vary widely,” he thought the central bank would “often be called upon to meet demands due to sectional self-interest and would often be subjected to unjust criticism due to the ignorance or prejudice of those unable to understand the complicated and difficult problems of finance” (p. 350).

In view of the sectional questions with which a central bank would have to deal and in view of our political history and our political methods, is it reasonable to expect that the management and policy of such a bank would be kept out of politics? From the beginning of our government to the present day banking and currency problems have been treated as fit subjects of party politics (p. 351).

It seemed unlikely to Morawetz that the politicization would end with the creation of a great central bank.

As Morawetz lamented, central banking would only work well if the right people were put in charge.

A central bank would not prove a safe and useful institution in the United States unless its management could always be kept in the hands of experienced and able men free from political influences and ambitions and enjoying the confidence of the people in all sections of the country. The problem of securing such a management has not been solved (p. 352).

In other words, he believed central banking was not an especially robust institution.

Despite opposing a great central bank, Morawetz was no free banker. He supported a divisional reserve bank system along the lines proposed by Nelson Aldrich and ultimately adopted in the Federal Reserve Act. Ironically, the divisional reserve bank system he preferred would come to look a lot like a great central bank, as power gradually shifted from regional Reserve Banks to the Board of Governors in the years that followed.