Modest Headline Masks a Strong Quarter for U.S. Economy

The initial estimate for fourth-quarter real gross domestic product (GDP) growth came in at 2.6 percent, slightly below the 3.2 percent final estimate for the third quarter and the 3.1 percent gain in the second but ahead of the 1.2 percent increase in the first quarter. Relative to the fourth quarter of 2016, real GDP increased 2.5 percent.

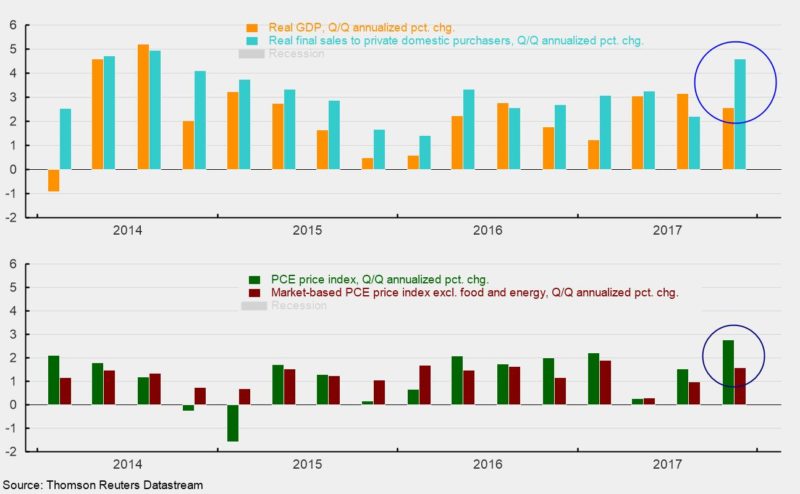

The topline GDP number masks stronger results within the details of the report. Real final sales to private domestic purchasers, a measure of private domestic demand, rose a robust 4.6 percent in the fourth quarter (see top chart), well above the 2.6 percent real-GDP headline. Personal consumption expenditures (PCE), nonresidential fixed investment (NRFI), and residential investment (housing) all posted strong gains in the quarter. Real PCE rose 3.8 percent in the final quarter of 2017, led by a 14.2 percent jump in durable-goods spending. Nondurable-goods spending rose 5.2 percent while services increased 1.8 percent. Every component of PCE grew at a faster pace in the final quarter compared to the third quarter.

NRFI accelerated to a 6.8 percent pace of growth, up from a 4.7 percent rise in the third quarter. All three major segments posted gains, led by an 11.4 percent jump in equipment spending. Investment in structures rose 1.4 percent, compared to a 7.0 percent drop in the third quarter, while investment in intellectual-property products rose 4.5 percent, down slightly from a 5.2 percent pace in the previous quarter. Residential investment jumped 11.6 percent after a 4.7 percent drop in the third quarter.

Outside of private domestic demand, inventories swung from a net accumulation of $33 billion in the third quarter measured in real dollars to a $29.3 billion liquidation in the fourth quarter, subtracting 0.67 percentage points off real GDP growth. Net exports subtracted another 1.13 percentage points from overall real GDP growth as real exports rose 6.9 percent while imports surged 13.9 percent.

The government sector contributed 0.50 percentage points to real GDP growth as the federal government boosted spending at a 3.0 percent pace in the final quarter, led by a 6.0 percent surge in defense spending. State and local government spending rose at a 2.6 percent pace, up from just 0.2 percent in the third quarter.

On the prices side, the total GDP price index rose at a 2.4 percent pace in the final quarter compared to a 2.1 percent rise in the third quarter. The PCE price index, used by the Federal Reserve as a key measure of price stability, rose at a 2.8 percent rate in the fourth quarter, up from just 1.5 percent in the third quarter. All the major components saw faster increases or slower declines in the quarter. Durable-goods prices fell at a 1.8 percent pace versus a 2.5 percent pace of decline in the prior quarter. Nondurable-goods prices, often driven by energy prices, accelerated to a 4.0 percent pace versus 2.4 percent in the prior quarter while services prices accelerated to a 3.1 percent pace versus 1.9 percent in the third quarter.

Overall, the first estimate of real GDP growth and prices in the fourth quarter suggests the U.S. economy is performing well. Private domestic demand is robust, though some of the strength may be related to the recovery from hurricanes. Private domestic demand may slow a bit from the current pace, but a strong labor market, rising incomes, high levels of consumer confidence, and increasing household wealth all support a healthy trend growth rate in consumer spending. The strengthening in NRFI, which had been volatile and somewhat soft for most of the current expansion, also now appears to be well-supported with solid profit growth and rising business confidence in the economic outlook.

The better outlook for real GDP growth and somewhat firmer gains in consumer prices may push the Federal Open Market Committee (FOMC), the monetary-policy-setting group of the Federal Reserve, to boost interest rates four times this year versus the three-increase path now suggested by FOMC projections. If current trends continue, the faster pace of tightening is justified but is unlikely to put the current expansion at risk.

While longer-term risks remain, especially the federal debt load, the U.S. economy appears to be in generally good shape more than eight years after the Great Recession.