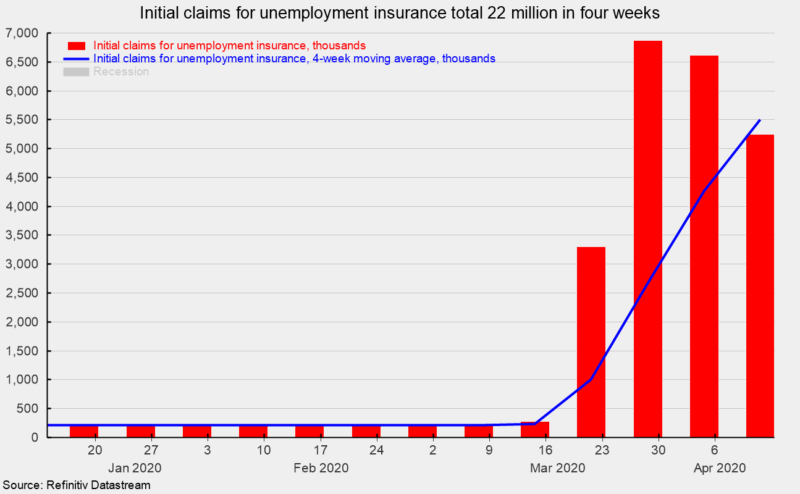

Massive Job Losses Continue for a Fourth Week

Initial claims for unemployment insurance totaled 5.25 million for the week ending April 11, marking the fourth consecutive week of massive, record-shattering layoffs (see chart), and dwarfing the previous high of 695,000 in October 1982.

During the Great Recession in 2008-09, total job losses were 8.8 million over 25 months versus the current 4-week total of 22.0 million initial claims. The unprecedented flood in claims is the leading edge of a tsunami of negative economic statistics that reflect the impact of the COVID-19 outbreak and the drastic policy reactions implemented to contain the spread.

Yesterday, the Commerce Department reported that retail sales and food-services spending plunged 8.7 percent in March following a 0.4 percent drop in February. The 12-month change was -6.2 percent through March, the worst performance since September 2009. Among the 13 categories of retail sales, there were declines in eight, with all eight posting double-digit declines versus five categories posting gains with one posting a double-digit pace. Declines were led by a 50.5 percent drop for clothing and accessory stores, followed by a 26.8 percent fall for furniture and home furnishings, a 26.5 percent decline for food services, 25.6 percent drop for motor vehicle and motor vehicle–parts dealers, a 23.3 percent drop in sporting-goods, hobby, musical-instrument, and bookstores, a 17.2 percent decline for gas station sales, a 15.1 percent decline for electronics and appliance stores, and a 14.3 percent decrease for miscellaneous store sales.

On the positive side, there was a 25.6 percent surge for food and beverage stores, general merchandise store sales rose gained 6.4 percent, health and personal care store sales increased 4.3 percent, nonstore retail sales rose 3.1 percent, and there was a 1.3 percent gain for building-material, garden-equipment, and garden-supplies dealers.

The sharp rise in layoffs over the last four weeks has crushed the labor market, consumer confidence and retail spending. Expect extraordinarily weak economic reports over the next several months.