Market Governance and Polycentrism

The contemporary conversation concerning the market vs the state is one that tends to focus on value judgments between greed and altruism, prosperity and equality, and, especially as of late, freedom and security. However, there is an even more important and existential debate regarding whether the market or the state is the optimal mechanism through which to organize society. There are limited resources that exist and the flourishing of society and those within it calls for the most optimal method of allocating goods and services in the face of unlimited demand.

In humanity’s natural state, poverty and deprivation are the baseline. Some form of system, be it the market or the state, is needed to create the conditions for self-improvement via the creation of value and the exchange thereof. In order to manage society, we need a governing system; be it one of freedom and markets or one of authority and direction. This debate regarding the free market vs central planning, liberty vs authority is one that has raged for over a hundred years in the Western World. This essay seeks to deepen this conversation by expounding upon the systems of governance that exist within the free market that allow it to be a superior form of societal management rather than simply a chaotic realm of self-interested interactions.

The Importance of Polycentric Governance

The inspiration for this essay stems from the work of 2009 Nobel Laureate Elinor Ostrom, whose empirical work revealed the importance of polycentric governance: essentially a form of government where power is decentralized. As described in her Nobel Prize biography,

“Challenged the conventional wisdom by demonstrating how local property can be successfully managed by local commons without any regulation by central authorities or privatization.”

Her work described the necessity for power and decision-making rights to be dispersed rather than centralized under one authority. In an essay, Ostrom wrote,

“Research has repeatedly demonstrated that order and high performance are more likely to be achieved in effective, local public economies established within broader national systems where large, medium, and small governmental and nongovernmental enterprises engage in diverse cooperative as well as competitive relationships (see Frey and Eichenberger 1996).”

The most important element of Ostrom’s work is the separation of power via competition and diversity of decision-making rights. Systems become corrupted and incompetent when powerful interests of any kind obtain a monopoly on power. Ostrom is quoted in a book in which she says,

“While all institutions are subject to takeover by opportunistic individuals and to the potential for perverse dynamics, a political system that has multiple centers of power at differing scales provides more opportunities to innovate and to intervene so as to correct maldistribution of authority and outcomes. Thus polycentric systems are more likely than monocentric systems to provide incentives leading to self-organized, self-correcting institutional change.”

Efficient systems of political organization are often polycentric because they are able to incorporate diverse interests, empower those closest to the problem, encourage competition among interests, and prevent the domination of individual interests.

It is through this medium of analysis that we seek to explore how the market and market mechanisms successfully act as a form of polycentric governance. We recognize that Ostrom does not assert that complete privatization or governance by the market is representative of polycentric governance. Rather she advocates for a system that competently employs a combination of state and market mechanisms to address certain collective action problems. We acknowledge this and instead seek to use her insight regarding polycentric governance to explore how market mechanisms and individual liberty mirror the institutions of polycentric governance.

Markets as a Form of Polycentric Governance

Adam Smith observed and articulated in The Wealth of Nations (1776):

“[i]t is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest. We address ourselves, not to their humanity but to their self-love, and never talk to them of our necessities but of their advantages.”

The simple fact that this quote (or some paraphrasing thereof) is relatively common parlance amongst Americans almost 250 years after its publication is proof that Adam Smith identified a self-evident fact of human nature.

Many contemporaries of Smith balked at his attribution of self-interest as responsible for society’s efficient provision of goods and services, instead seeing it as an outright admission of moral failure. In fact, much of the intelligentsia has been at war with money-making, finance and egoism writ large for millennia, as Alan Kahan documents in Mind vs. Money: The War Between Intellectuals and Capitalism.

One particularly prominent political philosopher, Jean-Jacques Rousseau, lambasted Smith’s favorable position on private property in his seminal work, The Social Contract and Discourses (1762):

“The first man who, having enclosed a piece of ground, bethought himself of saying This is mine, and found people simple enough to believe him, was the real founder of civil society. From how many crimes, wars and murders, from how many horrors and misfortunes might not any one have saved mankind, by pulling up the stakes, or filling up the ditch, and crying to his fellows, “Beware of listening to this impostor; you are undone if you once forget that the fruits of the earth belong to us all, and the earth itself to nobody.”

On the other hand, there are those who contend that a system of private property rights, coupled with voluntary trade and association, results in a society in which individuals compete, cooperate and everyone is made better off from such a polycentric arrangement. Alexis de Tocqueville, throughout his sojourning across the U.S. as part of a French envoy studying the American penal system in, posited such an argument in his seminal volume, Democracy in America (1835):

“[T]he principle of interest rightly understood; they show with complacency how an enlightened regard for themselves constantly prompts them to assist each other, and inclines them willingly to sacrifice a portion of their time and property to the welfare of the state… An American attends to his private concerns as if he were alone in the world, and the next minute he gives himself up to the common weal as if he had forgotten them. At one time, [the American] seems animated by the most selfish cupidity; at another, by the most lively patriotism.”

One might think that providing for the common good need not be in conflict with self-interest, but can be reconciled by benevolent governments, i.e. a monocentric system of decision-making and resource allocation. This same person might call for governments to accomplish this task by offsetting the selfishness identified by Adam Smith via wealth transfers from the greedy to the needy, so to speak. Tabling moral qualms against the state’s use of coercion to manage and distribute resources, one might wonder if polycentric systems can function more efficiently than a centrally-planned system in the realm of public good and common pool resources.

Research conducted by Nobel Laureate Elinor Ostrom reveals that such top-down, monocentric systems of resource management, contrary to popular belief, perform worse than polycentric systems. In the public sector, Ostrom and her fellow researchers conducted studies on metropolitan police departments and how their performance varied relative to their degree of centralization.

“We found that while many police departments served the 80 metropolitan areas that we also studied, duplication of services by more than one department to the same set of citizens rarely occurred. Further, the widely held belief that a multiplicity of departments in a metropolitan area was less efficient was not found. In fact, the ‘most efficient producers supply more output for given inputs in high multiplicity metropolitan areas than do the efficient producers in metropolitan areas with fewer producers.’”

Meanwhile, Ostrom contrasted the performance of 37 irrigation systems that were either managed by the government or by farmers. Despite these irrigation systems being common pool resources that some argue are managed most effectively by a monocentric, governmental entity, Ostrom found that,

“[o]f the 37 irrigation systems included in the analysis, 12 were managed by governmental agencies of which only 40 percent (n = 7) had high performance. Of the 25 farmer-managed, over 70 (n = 18) percent had high performance.”

Moreover, unlike freely competing polycentric systems, monocentric systems can be captured by interests that seek to leverage the centralized control of a given resource, market, etc. to their monopolistic advantage. William E. Lewis, a partner at McKinsey & Company for twenty years and the Founding Director of the McKinsey Global Institute, discusses the deleterious consequences of such regulation capture across the world in his book The Power of Productivity (2005).

Lewis explains how Japan’s dual economy of supremely efficient sectors and similarly inefficient sectors results from its domestic industries’ rent-seeking while its manufacturing exporters, namely its automotive companies, compete freely on a domestic and international stage.

“The Japanese [auto-manufacturers] did have intense domestic competition. Six producers fought intensely over market share. Out of this competition emerged Toyota, first as the leading automotive producer in Japan and, later, in the world, and probably the best overall manufacturing company anywhere… [Toyota] can produce an equivalent car with only 70 percent of the labor hours used in the United States.”

Lewis contrasts the Toyota example to Japan’s domestic retail industry, in which inefficient mom-and-pop shops have yet to be replaced by wholesalers:

“Japan’s productivity in retailing is only half that of the United States because the mix of store formats in Japan has evolved much less towards the modern, specialized (and high-productivity) type of store.”

The reason for this unproductive system?

“[T]he Large-scale Retail Location Law… indirectly limits [wholesalers’] entry through ‘social’ screening criteria related to the environment.”

Taken together, the research conducted by Ostrom and the case studies detailed by Lewis demonstrate that the competitive and cooperative elements of polycentric systems, far from making the allocation of resources more “chaotic,” actually results in heightened productivity when compared to centralized, monocentric systems which lack the self-corrective feature of competition and, in worst case scenarios, can be captured by rent-seeking lobbyists.

These observations are congruent with new research regarding the intersection of physics and economics. Dr. Adrian Bejan is a scientist credited with discovering the Constructal Law, which is a law of physics detailing how systems evolve and self-optimize. Bejan explains in his latest book Freedom and Evolution that human society follows these self-optimizing tendencies and it does so best when it is free. Therefore, in designing large systems, polycentric designs that disperse agency rather than consolidate it in a central authority are better able to shift and adapt to become more efficient. A highly centralized and bureaucratic system with a monopoly on power is far less capable of evolving and changing to better address problems.

AIER President Edward Stringham speaks in depth about how private institutions and market mechanisms create order in society. In particular, he outlines how many issues and disputes can be resolved via a system of contracts and private property. Oftentimes there is no need for a large regulatory state because private associations such as stock exchanges, guilds, and otherwise freely associating individuals can resolve disputes at least as efficiently, and most oftentimes moreso, than the regulatory state can. They possess no monopoly on coercive force like the state does, yet they can process many interactions with a great level of efficiency and mutual benefit. This demonstrates the productive forces of polycentric governance that Ostrom describes because competition forces these otherwise self-interested institutions in behaving in such fashion as to guarantee their own status, reputation and well-being.

The capacity for private and voluntary associations to resolve disputes is highlighted by another Nobel Laureate, Ronald Coase, with his articulation of the Coase Theorem. A simple explanation of the Coase Theorem follows,

“In the face of market inefficiencies resulting from externalities, private citizens (or firms) are able to negotiate a mutually beneficial, socially desirable solution as long as there are no costs associated with the negotiation process.”

Essentially, Coase contends that many issues and disputes that arise in society, whether they be negative externalities such as pollution or labor disputes, can be efficiently and voluntarily resolved if there are precisely-defined property rights and no administrative cost imposed by a third party, which would often be a state. This is the basis behind distinguished law professor Richard Epstein’s book, Simple Rules for a Complex World, which explores how society can be vastly improved by resolving most issues with market mechanisms such as private property and contracts. It seeks to move from a model of central authority that concentrates power with the state and demonstrates the polycentric governance abilities of voluntary associations with some basic rules set by the government.

Take, for example, the current system of environmental regulation which strongly deviates from a system of property rights towards one of public ownership and government regulation. This, in turn, not only blinds decision-makers from a marginal cost-benefit analysis but also opens the door for arbitrary and counterproductive rules made from thousands of miles away rather than at the source of the problem. Epstein writes,

“Is cutting timber necessary for the continued vitality of the Pacific Northwest and its lumber industry? The political process leads to grandiose claims of environmental necessity and dire predictions of economic stagnation. The present process of decision making treats the value of the first acre of public land as the same as the value of the last, making it impossible to acquire information to the marginal value of each acre in its alternative uses.”

A market system disperses decision-making rights through a system of private ownership and mutual exchange. Precise analysis over who should be able to use the forest, how much to cut, how much to preserve, what parts should be open to tourism, and so on are made far more easily through this system rather than the central government model. This also prevents arbitrary and coercive self-serving interests from harnessing the state to capture rents from its regulations because a market system pits competing interests and resources against each other.

Markets also follow a polycentric model of power distribution and competition through the use of price mechanisms which are necessary for addressing knowledge problems. This touches on the work of another Nobel Laureate, Friedrich Hayek, who was famous for his refutation of central planning which included the realization that information in society is dispersed. Because of this, a highly centralized system of power cannot make adequate decisions. Per Hayek’s Nobel Prize biography,

“His conclusion was that knowledge and information held by various actors can only be utilized fully in a decentralized market system with free competition and pricing.”

Hayek’s findings provide the foundation for Ostrom’s work regarding the necessity of polycentric governance which disperses decision-making rights vertically and horizontally in order to maximize the scope perspectives. The insight of Hayek on the knowledge problem and Ludwig Von Mises, who explained the necessity of prices and property for calculated decision-making, can therefore be framed as a technical explanation for market mechanisms as elements of polycentric governance.

The Track Record of Polycentric Governance in Politics

The US Constitution is a clear example of a system that incorporates radical polycentric governance when compared to its authoritarian peers. The U.S. Constitution Center explains,

“Instead of placing authority in the hands of one person, like a king, or even a small group of people, the U.S. Constitution divides power. Power is first divided between the national, or federal government, and the state and local government under a system known as Federalism.”

Although the US government is certainly not perfect, nor a complete realization of polycentric governance, we can see the marginal benefits yielded by approaching such a system. Such a system promotes creativity and discretion by distributing powers across the states rather than attempting to run everything from Washington, D.C. It understands that people — be they duly-elected government officials, appointed bureaucrats, or technocrats — are power-hungry and so it pits political ambition against itself via a strong separation of powers, much like how the market pits economic ambition against itself. In the market competition between firms creates better products; in the government, competition between different political interests prevents one side from taking away the freedoms of the other.

The great French philosopher Monetesquieu wrote the following in his book, The Spirit of the Laws (1748),

“If the legislative and executive authorities are one institution, there will be no freedom. There won’t be freedom anyway if the judiciary body is not separated from the legislative and executive authorities.”

A failure to recognize the necessity for the separation of powers has led to tremendous acts of violence and oppression as seen in countries like the former Soviet Union, Nazi Germany, China, and even in more limited capacities presently in the United States, oftentimes a product of inadequate checks on power.

Another important factor when it comes to centralized power and decentralized power is delivering goods and services. In the United States and other liberal nations, the execution of economic activity is largely left to the market as compared to more centrally planned economies such as those that embrace Communism. In particular, the effectiveness of markets as polycentric mechanisms to manage scarce resources can be seen clearly in China and Vietnam’s move towards market economies from their prior Communist models. Today, these countries have seen enormous increases in standards of living and economic growth as a direct result of these market reforms, whereas only decades before tens of millions of people starved to death or were murdered in China as a result of the Great Leap Forward. A similar degree of human suffering, starvation and outright genocide occured in Stalin’s USSR under the centralized agricultural policies which resulted in the Holodomor. Lest one erroneously think that such failures are consigned to the oblivion of history, we are witnessing something remarkably similar happening in Maduro’s socialist Venezuela. This is illustrative of the necessity for polycentric institutions, not just in the economic sense to promote efficiency in day-to-day activity but also as it pertains to power over individuals to prevent disturbing acts of domination.

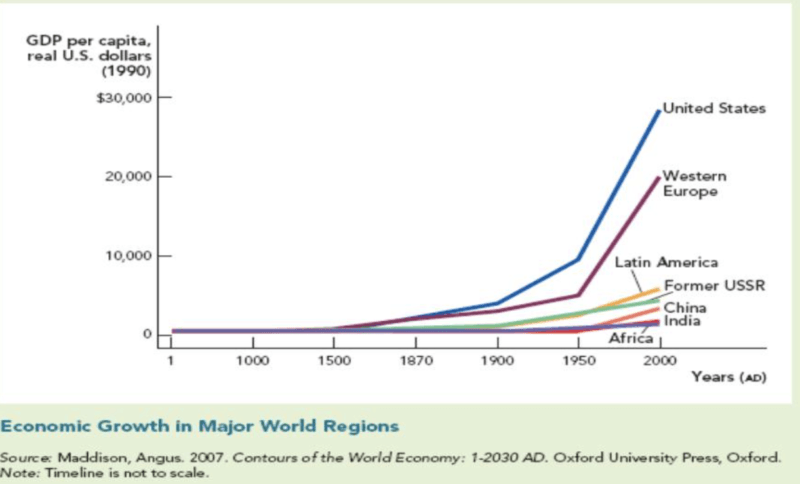

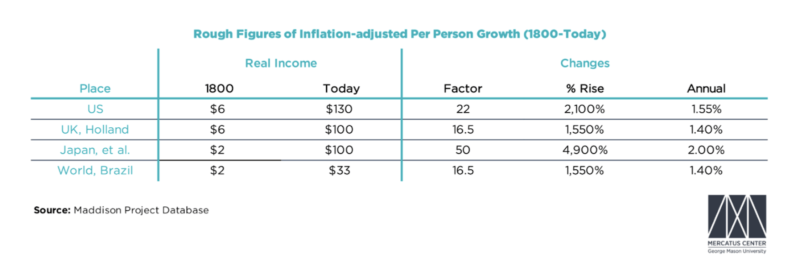

Across the world, there has been a noted correlation between economic freedom and prosperity, which further lends credence to the ability of the market to act as a polycentric form of social management that generates beneficial outcomes. In fact, such a realization is seen as the driving force of the Great Enrichment which as detailed in the chart below depicts our current time period as one of exponential economic growth as compared to most of human history.

The striking thing is that the freest and most market-based societies, the United States and Western Europe, saw this explosion of prosperity first and as these ideas slowly became adopted by other countries, similar results occurred. In particular, these ideas are believed to have stemmed from the Dutch Revolt (1566) which implemented contemporary ideas pertaining to individual liberty and markets. In essence, the adoption of market mechanisms and their polycentric attributes that shattered entrenched power structures and leveraged competing self-interests as acceptable ways to run society. Such an experience demonstrates that not only do polycentric systems of governance produce superior results for society over centralized systems, but that such productive mechanisms and their benefits can be observed as institutions reflected by the market. Institutions that disperse decision-making rights, provide checks on power, and create systems of order by driving cooperation from a diverse array of actors.