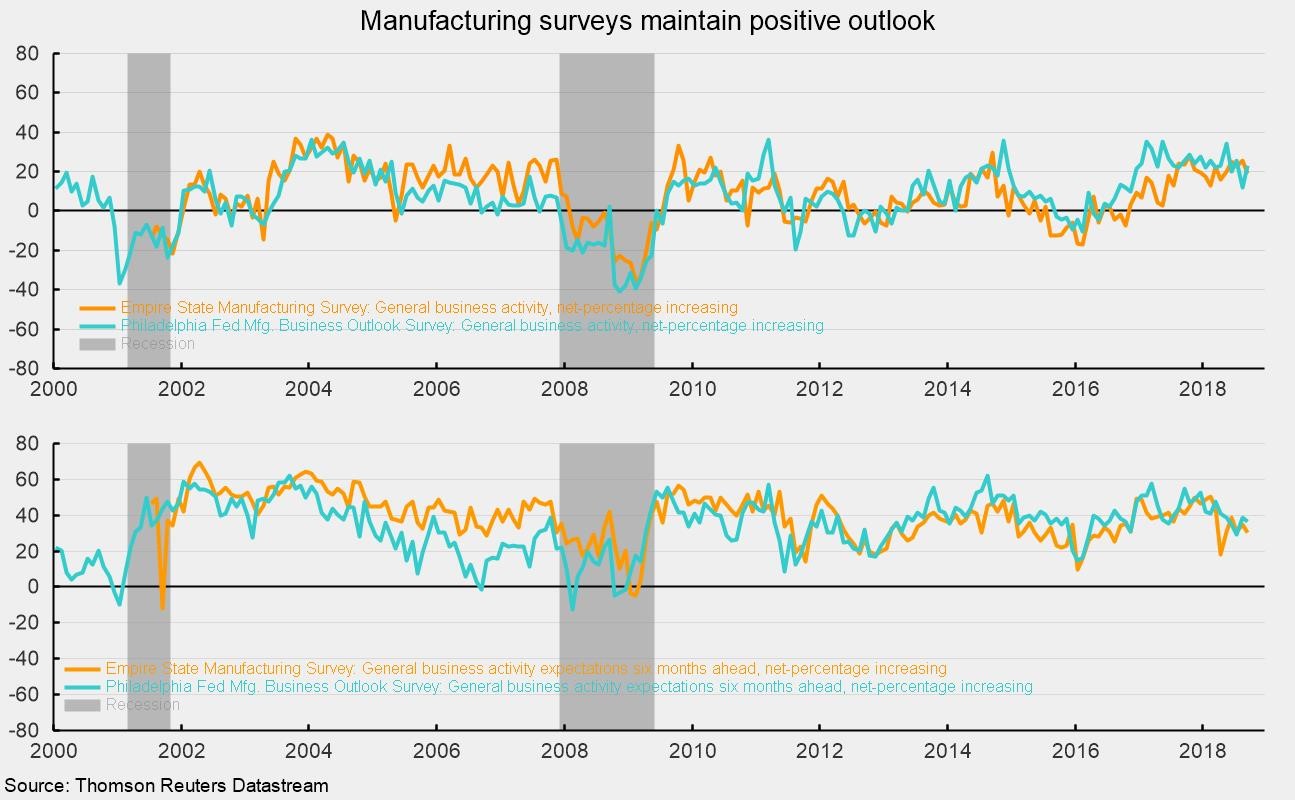

Manufacturing Surveys Remain Positive

The Empire State Manufacturing Survey from the Federal Reserve Bank of New York and the Manufacturing Business Outlook Survey from the Federal Reserve Bank of Philadelphia both showed generally favorable results in September. While many of the individual indicators within the surveys ticked down in the latest month, most are well into favorable territory and suggest a positive outlook for manufacturing.

The results of the Philadelphia Fed’s Manufacturing Business Outlook Survey were generally more favorable than the results of the Empire State Manufacturing Survey. Among the former survey’s current-conditions indexes, general business activity jumped 11 points to 22.9 while new orders rose to 21.4 from 9.9 in the prior month and shipments added 3 points to 19.6 from 16.6.

Labor indicators strengthened, with number of employees increasing to 17.6 from 14.3 while the average workweek rose to 14.6 from 10.7.

There was some positive news on prices as the index of prices paid (for input materials) fell to 39.6 from 55.0, though there was a corresponding drop in the prices-received (for goods sold) index, falling from 33.2 to 19.6.

Among the forward-looking indicators, most had small declines but remained well above the neutral zero threshold. The general-business-conditions index fell to 36.3 in September from 38.8 in August. The new-orders index fell to 34.7 versus 38.1 in the prior month. Both the prices-paid index and the prices-received index declined in September but remain quite elevated while the two labor indicators posted declines. The expectations for capital spending dropped just slightly, registering 26.7 versus 27.1 in the prior month.

For the current-conditions indexes within the Empire Manufacturing Survey, general business conditions fell to 19.0 in September from 25.6 in the prior month while new orders fell just slightly to 16.5 from 17.1 and shipments fell to 14.3 from 25.7. Despite the drops, these indicators remain solidly above the neutral zero line.

For the labor indicators, number of employees ticked up to 13.3 from 13.1 while the average workweek added 2.6 points to 11.5 versus 8.9 in August. The positive trends in the labor indicators suggest continued tightness in the labor market.

One point of concern was the combination of a notable increase in the prices-paid index and a fall in the prices-received index. The prices-paid index rose to 46.3 from 45.2 and has been trending higher since early 2016, suggesting rising pressure on input costs. At the same time, the prices-received index fell to 16.3 from 20.0. The combination of higher input costs and weakening ability to raise selling prices could pressure profit margins.

Among the forward-looking indicators, the general-business-conditions index fell 4.5 points to 30.3 in September, from 34.8 in August. The new-orders index fell by 2.7 percentage points to 33.3 versus 36.0 in the prior month. Both the prices-paid index and the prices-received index rose in September while the two labor indicators fell, with the average-workweek indicator falling to −1.6. Expectations for capital spending and expectations for technology spending both ticked down for the latest month but also remain well into positive territory.

Overall, the two reports tilt to the favorable side, but significant concerns remain regarding the tight labor market and rising input-cost pressures.