Manufacturing-Sector Looks Weak Again in February

The Institute for Supply Management’s Manufacturing Purchasing Managers’ Index fell to a 50.1 percent reading in February, down from 50.9 percent in January. The February result was the second month just barely above the neutral 50 threshold following five months below neutral.

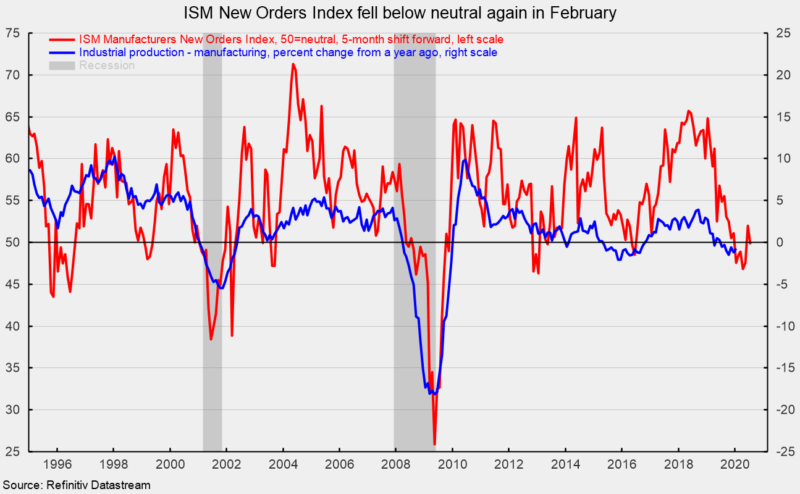

Among the key components of the Purchasing Managers’ Index, the New Orders Index came in at 49.8 percent, down from 52.0 percent in January (see chart). February returned to a below-neutral level after turning positive in January. January was the first month with a reading above 50 percent following five months below neutral. The results suggest production as measured by the Federal Reserve’s industrial production for manufacturing index may continue to be weak in the coming months (see chart). The New Export Orders Index came in at 51.2 percent in February, down 2.1 percentage points from a 53.3 percent result in January.

The production index was at 50.3 percent in February, down from 54.3 percent in January. The weaker performance for production contributed to an increase in the backlog-of-orders index. That index came in at 50.3 percent in February, up from 45.7 percent in January.

The employment index improved to 46.9 percent in February, up from 46.6 percent in January. Despite the slightly higher reading, the result remained below neutral and suggests employment in manufacturing likely fell in February. The Bureau of Labor Statistics’ Employment Situation report for February is due out on Friday, March 6. Consensus expectations are for 175,000 new nonfarm-payroll jobs including a drop of 3,000 jobs in manufacturing.

Supplier deliveries, a measure of delivery times from suppliers to manufacturers, came in at 57.3 percent, up from 52.9 percent in January. February was the 4th consecutive month above 50, suggesting suppliers delivering to manufacturers are falling behind at a somewhat faster pace. Slower supplier deliveries are usually consistent with stronger manufacturing activity. According to the report, “Suppliers continue to struggle to deliver at a stronger rate compared to January. The index reached its highest level since November 2018, when it registered 61 percent. Lead times are generally stable. Concerns about current and ongoing reliable Asian supply dominated the comments from panelists.”

The prices index fell 7.4 percentage points to 45.9 percent in February from 53.3 percent in January. Weaker prices were reported for steel, scrap steel, aluminum, natural gas, corrugate, and copper.

Customer inventories in February are still considered too low, with the index falling to 41.8 percent from 43.8 percent in the prior month (index results below 50 indicate customers’ inventories are too low). The index has been below 50 for 41 consecutive months.

Overall, the report notes, “Comments from the panel were generally positive, with sentiment cautious compared to January.” However, the report also noted, “Global supply chains are impacting most, if not all, of the manufacturing industry sectors.” The coronavirus is a major unknown at this stage, but the impact will clearly be negative. The question remains just how significant.