Manufacturing-Sector Growth Continued in March

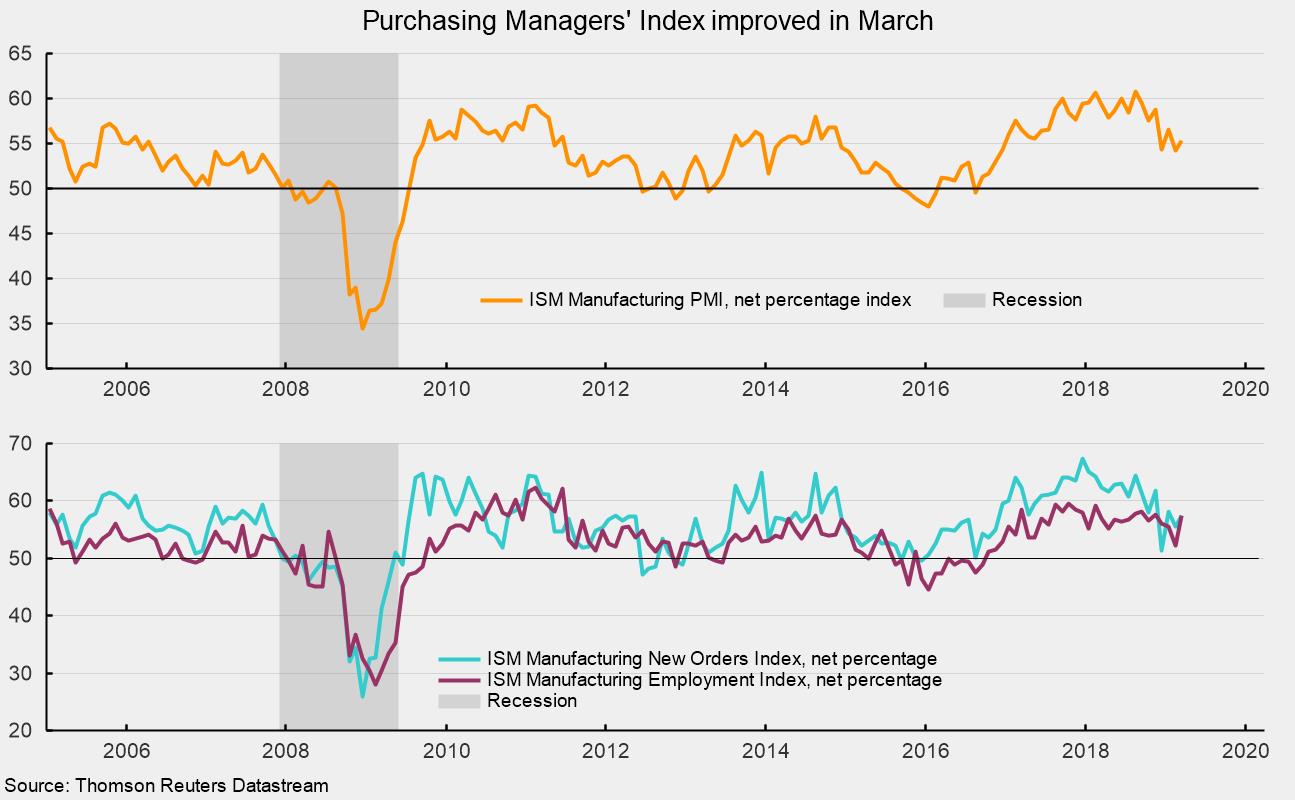

The Manufacturing Purchasing Managers’ Index from the Institute for Supply Management registered a 55.3 percent reading in March, up from 54.2 in February (see top chart). The index remains below the results in the upper 50s of much of mid-2017 and 2018 but solidly above neutral, suggesting continued moderate expansion for the manufacturing sector. According to the Institute for Supply Management, “A reading above 50 percent indicates that the manufacturing economy is generally expanding.” March was the 31st consecutive month above 50. Furthermore, “A PMI above 42.9 percent, over a period of time, generally indicates an expansion of the overall economy. Therefore, the March PMI indicates growth for the 119th consecutive month in the overall economy.”

Among the key components of the Purchasing Managers’ Index, the New Orders Index came in at 57.4 percent, up from 55.5 in February (see bottom chart). March was the 39th consecutive month with a reading above 50. Analysis by the Institute for Supply Management suggests that readings above 52.5 are consistent with rising real new orders for manufacturers.

The production index was at 55.8 percent in March, up from 54.8 in February. March marks the 31st month in a row above 50. The results suggest production grew at a more rapid pace in March compared with February. The faster pace of expansion helped keep the backlog-of-orders index relatively stable with an index of 50.4 in March, just slightly above the neutral threshold.

The employment index posted a sizable 5.2-point jump to 57.5 percent in March, up from 52.3 in February (see bottom chart). The stronger reading suggests employment in manufacturing likely rose in March. The Bureau of Labor Statistics’ Employment Situation report for March is due out on Friday, April 5. Consensus expectations are for 175,000 new nonfarm-payroll jobs including 10,000 new jobs in manufacturing.

Supplier deliveries, a measure of delivery times from suppliers to manufacturers, came in at 54.2, down from 54.9 in February. March was the 37th consecutive month above 50, and the results suggest suppliers delivering to manufacturers are falling behind but at a decelerating pace.

The prices index rose 4.9 percentage points to 54.3 in March following two months below the neutral 50 level. The results hint that after a brief two-month respite from rising price pressures to start the year, input costs may again be on the rise.

Today’s report from the Institute for Supply Management paints a modestly positive picture of the manufacturing sector in March. The positive tone offsets the weak report on February retail sales released earlier in the day. Overall, data on the economy continue to be mixed, suggesting weak but ongoing economic expansion. A heightened degree of caution is warranted.