Manufacturing-Sector Contracts in March; Recession Probability Rising

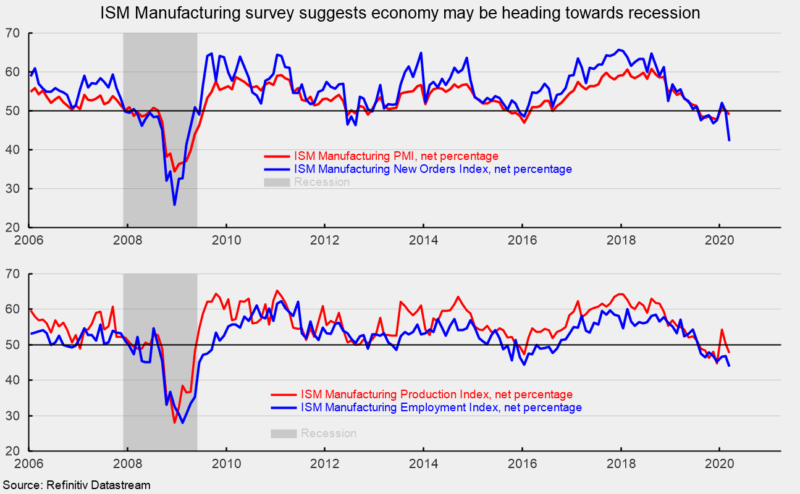

The Institute for Supply Management’s Manufacturing Purchasing Managers’ Index fell to a 49.1 percent reading in March, down from 50.1 percent in February. The March result marks a return to contraction territory after just two months slightly above the neutral 50 threshold which followed a run of five months below neutral from August through December 2019 (see top chart).

Overall, the report notes, “Comments from the panel were negative regarding the near-term outlook, with sentiment clearly impacted by the coronavirus (COVID-19) pandemic and energy market volatility.” The report further notes, “The coronavirus pandemic and shocks in global energy markets have impacted all manufacturing sectors. Among the six big industry sectors, Food, Beverage & Tobacco Products remains strongest, followed by Chemical Products, which in addition to the pharmaceutical component, is a significant contributor to the Food, Beverage & Tobacco Products Industry and beneficiary of low energy and feedstock prices. Transportation Equipment and Petroleum & Coal Products are the weakest sectors. Sentiment regarding near-term growth this month is strongly negative, by a 2-to-1 ratio.”

Among the key components of the Purchasing Managers’ Index, the New Orders Index came in at 42.2 percent, down from 49.8 percent in February (see top chart). March was the weakest reading since March 2009. The results suggest production as measured by the Federal Reserve’s industrial production for manufacturing index may weaken further in the coming months. The New Export Orders Index came in at 46.6 percent in March, down 4.6 percentage points from a 51.2 percent result in February.

The production index was at 47.7 percent in March, down from 50.3 percent in February (see bottom chart). Despite the weaker performance for production in March, the backlog-of-orders index came in at 45.9 percent in March, down from 50.3 percent in February and suggesting a decline in backlogs.

The employment index fell 3.1 percentage points to 43.8 percent in March, versus 46.9 percent in February, and the lowest reading since May 2009 (see bottom chart). The move farther below neutral suggests employment in manufacturing likely fell in March. The Bureau of Labor Statistics’ Employment Situation report for March is due out on Friday, April 3. Consensus expectations are for a loss of 100,000 to 150,000 nonfarm-payroll jobs including a drop of 20,000 to 30,000 jobs in manufacturing.

Supplier deliveries, a measure of delivery times from suppliers to manufacturers, jumped to 65.0 percent, up from 57.3 percent in February. March was the second highest reading since 2004, exceeded only by the 68.2 percent result from June 2018. Slower supplier deliveries are usually consistent with stronger manufacturing activity. However, the slower deliveries in March was more a result of supply chain and logistical constraints. According to the report, “Suppliers continue to struggle to deliver, at a much stronger rate compared to February. The index reached its highest level since June 2018, when it registered 68.2 percent. The coronavirus pandemic was the focus of 66 percent of this subindex’s comments, with a third of those comments related to supply chain constraints from China.”

The prices index fell 8.5 percentage points to 37.4 percent in March from 45.9 percent in February, and the lowest since January 2016. Weaker prices were reported for aluminum and aluminum products, base oils, copper, corrugate, crude oil, diesel fuel, fuel, heating oil, natural gas, oil products, plastic, scrap, and hot-rolled steel.

Customer inventories in March are still considered too low, with the index remaining below 50 at 43.4 percent versus 41.8 percent in the prior month (index results below 50 indicate customers’ inventories are too low). The index has been below 50 for 42 consecutive months.