Manufacturing Recovery Continued in January

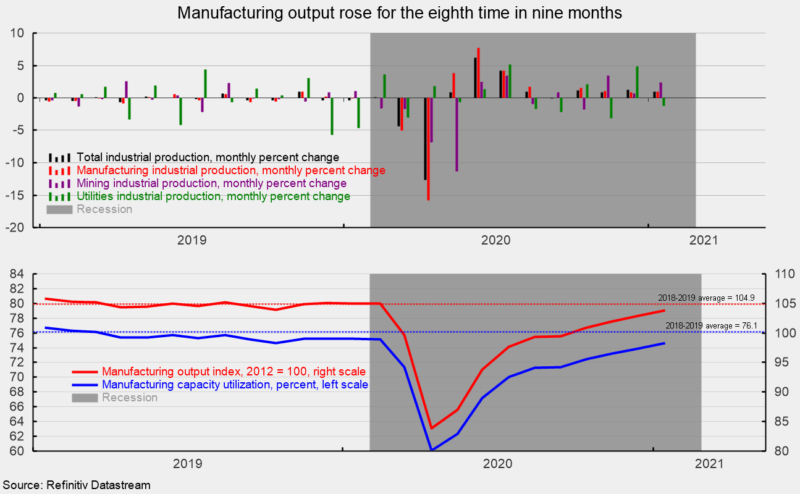

Industrial production rose 0.9 percent in January following a gain of 1.3 percent in December, 0.9 percent in November and 1.1 percent in October (see top chart). Industrial output has risen in eight of the last nine months. However, the gains were still not enough to overcome the back-to-back declines of 4.4 percent and 12.7 percent in March and April, respectively. Over the past year, industrial production is down 1.8 percent and 1.9 percent below the pre-pandemic level in February.

Manufacturing output, which accounts for about 75 percent of total industrial production, rose 1.0 percent after a gain of 0.9 in December, 1.0 percent in November, and 1.5 percent in October (see top chart). Manufacturing output has risen for eight of the last nine months and follows declines of 5.0 percent and 15.8 percent in March and April. The eight gains still leave manufacturing output 1.0 percent below year-ago levels and 1.0 percent below the 2018-2019 average index level (see bottom chart).

Mining output accounts for about 14 percent of total industrial output and posted a 2.3 percent increase in the latest month (see top chart). The gain followed a 0.7 percent gain in December. Over the last 12 months, mining output is down 11.5 percent. Utility output, which is typically related to weather patterns, is about 11 percent of total industrial output, and fell 1.2 percent for the month following a 4.9 percent surge in December. From a year ago, utility output is up 6.6 percent.

Among the key segments of industrial output, energy production rose 0.9 percent for the month but is still down 4.9 percent from a year ago. Motor-vehicle production, one of the hardest-hit industries during the lockdowns, fell 0.7 percent in January after a 0.2 percent drop in December. Motor-vehicle production is up 1.7 compared with January 2020. Total vehicle assemblies fell to 10.7 million at a seasonally-adjusted annual rate. That consists of 10.47 million light vehicles and 0.29 million heavy trucks. Within light vehicles, light trucks were 8.42 million while cars were 2.04 million.

High-tech industries output rose by 1.5 percent in January and is up 6.8 percent versus a year ago. All other industries combined (total excluding energy, high-tech, and motor vehicles; about 2/3rds of total industrial output) gained 1.1 percent in January but are still 1.1 percent below January 2020.

Total industrial utilization rose to 75.6 percent in January from 74.9 percent in December. That is well below the long-term (1972-2020) average utilization of 79.6 percent. Manufacturing utilization rose 0.7 percentage points to 74.6 percent, well below the long-term average of 78.1 percent and below the 2018-2019 average of 76.1 percent (see bottom of first chart).

January data suggest that manufacturing output continues to recover but that output and utilization remain slightly below pre-pandemic levels. The combination of the ongoing distribution of vaccines, declining cases of Covid-19, and easing of government restrictions on consumers and businesses is helping support the continued rebound in manufacturing output. The positive momentum needs to be sustained and spread to other areas such as the labor market before an all-clear signal can be issued, but the continued recovery in manufacturing is a favorable sign.