Manufacturing Outlook Remains Positive

Industrial production from the nation’s manufacturers, mines and utilities increased 0.9 percent in October following a 0.4 percent rise in September. Over the past year, total output is up 2.9 percent. Among the major components of industrial production, manufacturing output gained 1.3 percent in the latest month following a 0.4 percent rise in the prior month while utilities output gained 2.0 percent and mining output fell 1.3 percent.

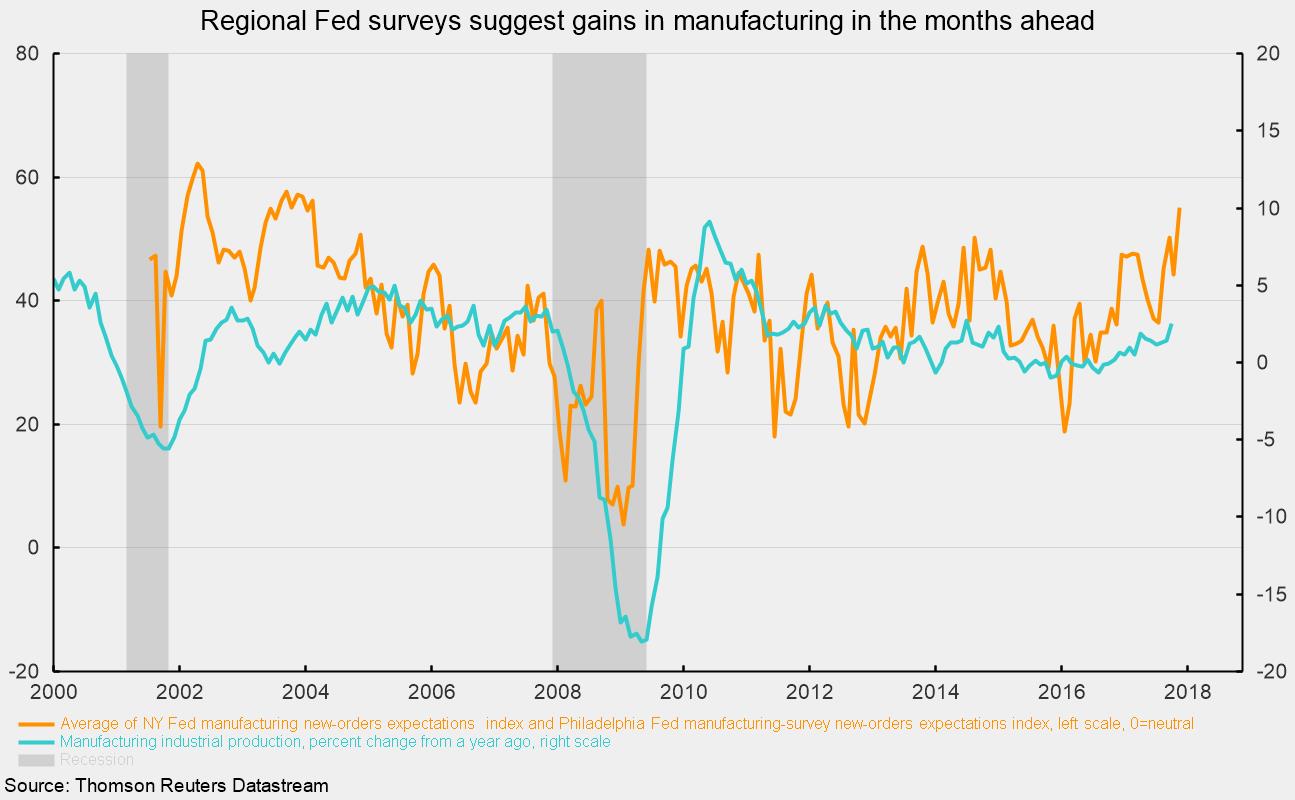

Manufacturing accounts for about 75 percent of total industrial production, mining for 15 percent and utilities for 10 percent. Given the importance of manufacturing in total industrial output, upbeat data from both the New York Fed and Philly Fed about new orders for manufactured goods suggest continued gains for industrial output in the months ahead (see chart).

The gain in manufacturing was led by a 2.3 percent jump in the production of nondurable goods. The major contributors were chemicals (12.4 percent weight), rising 5.8 percent in October, petroleum and coal products (3.0 percent weight), gaining 4.0 percent for the month, textiles (0.7 percent weight), up 1.6 percent, and apparel (0.23 percent weight), up 1.3 percent for the month.

Durable-goods production increased 0.4 percent for the latest month, following a 1.4 percent jump in September. The largest contributors were motor vehicles (5.8 percent weight), rising 1.0 percent, and primary-metals production (2.3 percent weight), gaining 0.9 percent.

Manufacturing surveys from the New York Fed and the Philadelphia Fed both showed mixed results overall in November, with many components posting small declines. However, both surveys showed improvement in the current-new-orders index and expectations for new orders six months ahead.

In the Empire State Manufacturing Survey, the index for current general business conditions fell to 19.4 from 30.2. The index represents the net percentage of positive responses. So while the index dropped 10.4, it is still solidly above neutral. The current-new-orders index added 2.7 points to 20.7 from 18.0 in October. The indexes for shipments and number of employees both fell but also remained well above neutral. The Manufacturing Business Outlook Survey from the Philadelphia Fed showed a nearly identical pattern of movements, with current business conditions, new orders, employment and shipments all remaining solidly above neutral, though new orders was the only index of those four to improve in the latest month.

Both surveys contain questions on expectations six months ahead. On those questions, the surveys showed even better results. In the New York survey, expectations of general business conditions rose 5.1 points to 49.9, new orders rose 8.9 points to 53.7 — the highest result since 2004 — shipments added 7.4 points to 50.8 and number of employees rose 3.6 points to 20.8. In the Philadelphia Fed survey, the expectations of general business conditions rose to 50.1, new orders rose to 56.4, shipments increased to 47.8, and number of employees added 2.5 points to 41.2.

Solid gains for actual industrial production in October, especially manufacturing, combined with positive results from the November Fed surveys, suggests a positive outlook for the manufacturing sector over the coming months.