Manufacturing Activity Increases in May

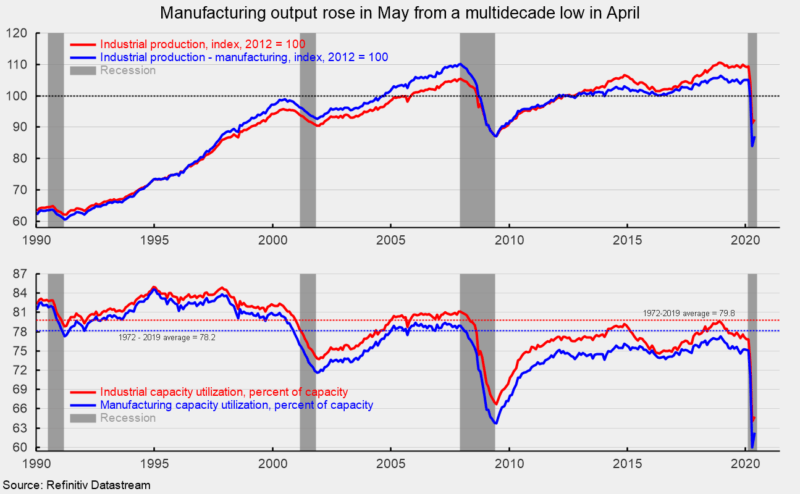

Industrial production rose 1.4 percent in May following a record monthly decline of 12.5 percent in April (see top chart). The May gain is the largest rise since October 2017. Over the past year, industrial production is down 15.3 percent. Total capacity utilization increased 0.8 percentage points to 64.8 percent (see bottom chart).

Manufacturing output, which accounts for about 75 percent of total industrial production, rose 3.8 percent after sinking 15.5 in April. May had the largest monthly gains since December 1959 but still leaves manufacturing output 16.5 percent below year-ago levels (see top chart). Manufacturing utilization rose 2.2 percentage points to 62.2 (see bottom chart).

Mining output posted a 6.8 percent decline for the month, the fourth decline in a row, while utilities output dropped 2.3 percent in May. Over the past year, mining output is down 14.1 percent while utilities output is down 8.0 percent.

The gains in the manufacturing sector in May were widespread across most market groups and industries. Measured by market segment, consumer-goods production was up 3.9 percent in May, with consumer durables rising 23.8 percent and consumer nondurables gaining 0.7 percent. Business-equipment production increased 5.8 percent in May while construction supplies rose 1.6 percent for the month.

Materials production (about 46 percent of industrial activity) continued to show weakness as output decreased 0.8 percent for the month and is down 14.0 percent from a year ago.

Lockdown policies to combat the spread of COVID-19 pummeled economic activity in March and April while the easing of restrictions in May is aiding in the reversal of some of the economic carnage. However, it will likely be a slower path back than there was going in.