Long-Discredited Positions on the Monetary System

In a recent New York Times opinion column, former Treasury secretary Steven Rattner criticized the nomination of Judy Shelton to the Federal Reserve Board of Governors. Rattner accuses Ms. Shelton of taking “long-discredited positions on the monetary system.”

Specifically, Mr. Rattner claims that the gold standard magnified economic volatility, resulted in more frequent banking crises, and was “a significant culprit in deepening the Great Depression.” Such beliefs may be common to those unfamiliar with monetary history, but they are not consistent with the findings of modern economic research.

Economic Stability

Mr. Rattner wrongly argues that “a gold standard exaggerates economic swings” and “magnifies [price movements], as a comparison of the pre-Depression period to the post-World War II era makes clear.” While such claims were commonly believed in the 1960s, economists have long since overturned those older ideas.

Research by Christina Romer, who served as chair of the Council of Economic Advisers under President Obama, shows that increased stability in the post-World War II period is merely “a figment of the data” and that “traditional estimates of prewar GNP exaggerate the size of cycles.” She also finds that postwar employment stability “is an artifact of improvements in data collection procedure.”

A number of studies have built on Romer’s research. Joseph Davis finds that the Fed has not reduced the frequency or duration of industrial fluctuations. George Selgin, William Lastrapes, and Lawrence White conclude that the Fed has failed to achieve its stated goals of reducing monetary and financial instability. In my own research, I find that economic volatility did not improve under the Fed until the Great Moderation of the 1980s, while rates of economic growth and price inflation were both better on the pre-Fed gold standard.

Bank Failures and Crises

The narrative that the gold standard led to increased bank failures and financial crises is also inconsistent with historical evidence.

Banking crises have occurred throughout US history, but such problems were not caused by the gold standard. Branch banking restrictions made it difficult for banks to diversify investments, thereby increasing their likelihood of failure. Requirements to back banknotes with government bonds prevented banks from accommodating seasonal changes in money demand, resulting in reserve drains that significantly reduced financial stability. The blame for bank failures and crises thus lies not with the gold standard but on regulatory restrictions that destabilized the banking system.

Nor has the Fed curtailed financial crises, which were actually less frequent under the gold standard. “Since 1973,” Barry Eichengreen and coauthors write, “crisis frequency has been double that of the Bretton Woods and classical gold standard periods.” The admission is especially noteworthy, as Eichengreen is an outspoken critic of the gold standard.

The Fed and the Great Depression

Economists long ago abandoned Rattner’s view that the gold standard caused the Great Depression in the United States. In their 1963 treatise A Monetary History of the United States: 1867-1960, Milton Friedman and Anna Schwartz famously demonstrated that the Fed’s mismanagement—not the gold standard—was to blame.

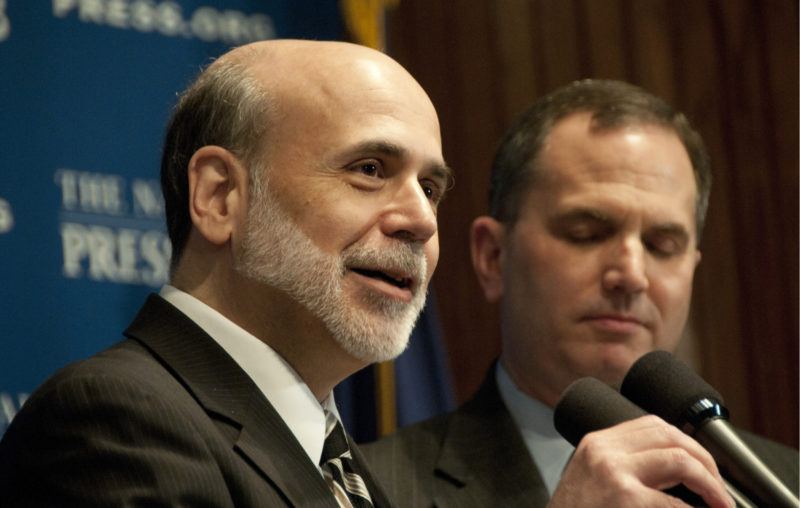

Further research has confirmed the findings of Friedman and Schwartz. For example, former Fed Chair Ben Bernanke and coauthor Harold James find that, rather than being constrained by the gold standard, “the initial [monetary] contractions in the United States and France were largely self-inflicted wounds” due to policy mistakes by their respective central banks.

At a 2002 conference held in honor of Friedman, Bernanke acknowledged the Fed’s error. “Regarding the Great Depression,” Bernanke said, “You’re right, we did it. We’re very sorry.”

Considering the evidence, it appears to be Mr. Rattner, rather than Ms. Shelton, who holds “long-discredited positions on the monetary system.” Historical bank failures and crises, particularly during the Great Depression, are generally attributable to interference by regulators and central bankers, not to the gold standard.

Perhaps such mistakes could be avoided in the future with Ms. Shelton’s guidance.