Liquidity and the Transmission of Monetary Policy

People may talk about how the Fed “prints money” or “lowers interest rates” as if it involves pressing a button. However, modern central banks can implement monetary policy only indirectly. In the United States, for example, the Fed intervenes in the federal funds market and Treasury market.

The channel by which the Fed’s actions in the Treasury market are transmitted to the broader financial and monetary markets is unclear and hotly debated in economics. Understanding more deeply the transmission mechanism is key to understanding the effects of central banks’ actions.

A new NBER working paper by Ricardo Lagos and Shengxing Zhang studies the transmission mechanism. In particular, they look at how actions in the federal funds market affect stock prices and trade volume. As is typical in the monetary search literature, formally writing down a model that connects all the points of interest requires lots of mathematical work. However, the broad mechanism is straightforward and intuitive, once Lagos and Zhang have done the math and explained it for the rest of us.

Consider many investors who each have three possible assets: money, one stock, and the rest of their portfolio. Consider their decisions to buy or sell stocks. Each day, the value to each investor of the stock (as compared to its price) is based on the expected return of money, the expected return of the stock, and how the stock fits with the rest of the investor’s portfolio. On any particular day, the stock is highly valuable or not for each particular investor.

Low-value investors want to sell their stock to high-value investors, but that ability depends on how liquid the market is. The price of the stock is determined by the marginal investor’s willingness to buy or sell, which in turn depends in part on how liquid they believe the market will be in the future. The connection between the policy lever (inflation or interest rates) and asset prices is partially through changes to liquidity.

Now suppose the inflation rate increases. Then equilibrium real money balances drop (because the return on money falls), and the investor that was indifferent between stocks and money under the lower inflation rate now prefers equity and goes to buy the stock. However, that only takes into account the immediate effects. The value of resale is also changed because the marginal investor who determines the price of the equity has a lower valuation than before: it will be harder to find buyers in the future — that is, the liquidity of the asset is lower — so the real equity price is driven down today.

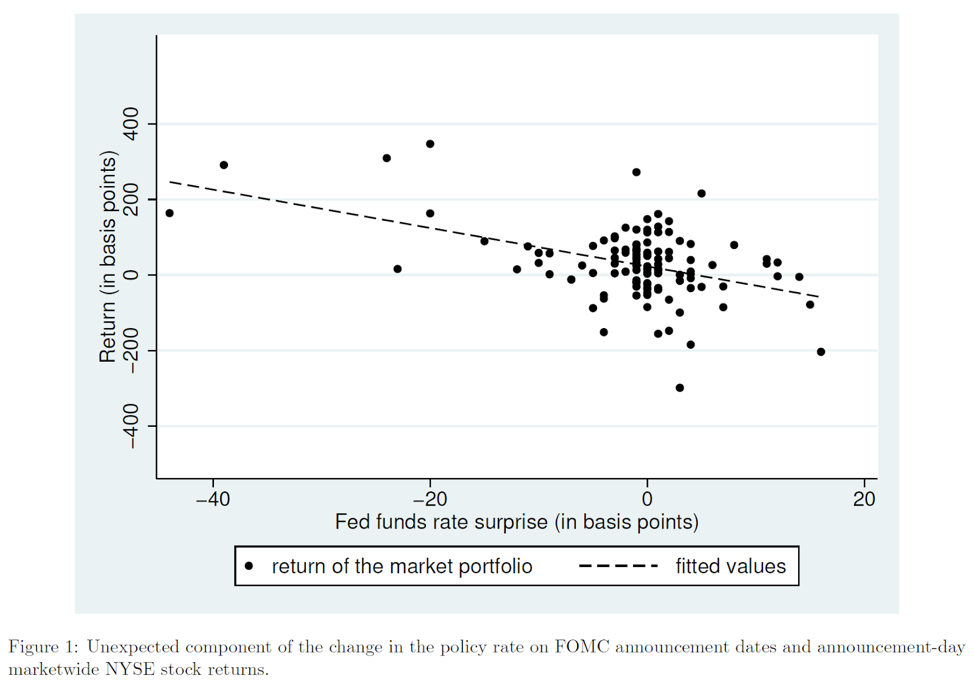

The model has two immediate testable implications. First, any surprise change in the fed funds rate will lower the return on assets. Lagos and Zhang look at stock returns on the day of Federal Open Market Committee (FOMC) announcement dates and plot the results in figure 1 below.

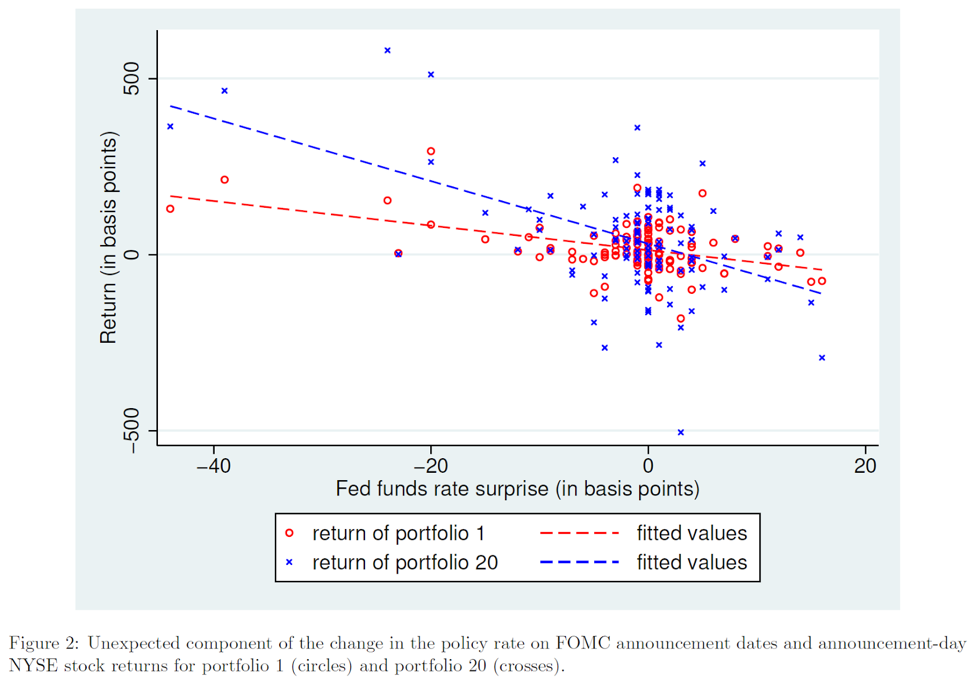

In addition, their model suggests that Fed surprises affect different types of stocks to varying degrees. For example, some stocks are priced higher because buyers know they can easily sell the stock in the future. In that case, people are paying for the liquidity, as compared to just receiving a dividend. A surprise increase in inflation, by decreasing liquidity, will severely impact those stocks that are priced high because of their liquidity. At the other extreme, a stock that is valued solely for the dividend will not be affected by the surprise inflation.

To test this hypothesis, Lagos and Zhang bundle stocks into 20 different portfolios based on the turnover rate during the four weeks prior to the policy announcement. The turnover rate of Portfolio 1 is the lowest and that of Portfolio 20 is the highest. The differential impacts on portfolios are shown in figure 2 below.

This line of research is technically challenging and may scare off some people. However, I encourage readers to follow it. It is the best available option for incorporating the insights of basic economics — human actions, marginal analysis, and market interactions — into the study of complex interactions in financial markets that is required for understanding the transmission mechanism of monetary policy.