Light-Vehicle Sales Increased in January

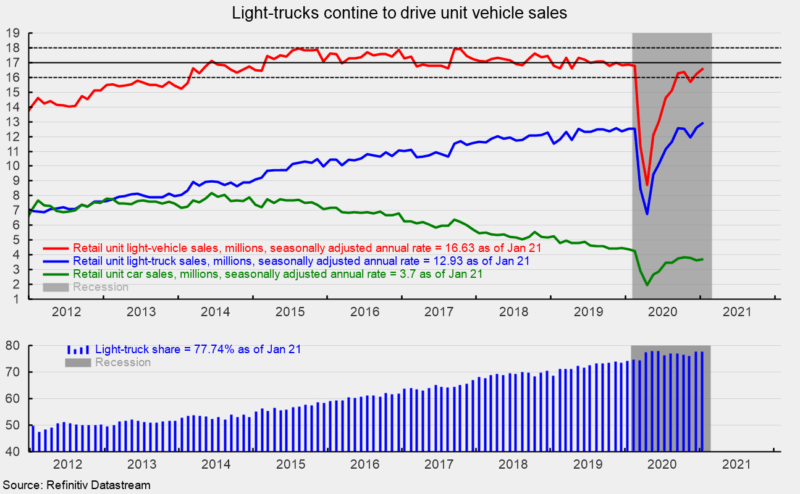

Sales of light vehicles totaled 16.6 million at an annual rate in January, slightly above the 16.3 million pace in December and the fourth month out of the last five back in the 16 to 18 million range. Unit sales plunged in March and April to 11.4 million and 8.7 million annual rates, respectively (see top chart). The pace of sales in April was the lowest on record since this data series began in 1976 and follows a run of 72 months in the 16 to 18 million range from March 2014 through February 2020.

For the month of January, light-truck sales totaled 12.9 million at an annual rate versus a 12.6 million rate in December but well ahead of the 6.7 million rate in April. Car sales posted a modest gain, rising to a 3.7 annual rate versus 3.6 in December and 2.0 in April (see top chart).

The light-truck share stood at 77.7 percent for January, below the 77.9 percent record high in May, but still completely dominating the car share of 22.3 percent. The dominant share of light-trucks continues a long-term trend. As recently as February 2013, the split between cars and light-trucks (SUVs and pick-up trucks) was about even, with both segments selling about 7.8 million at an annual rate.

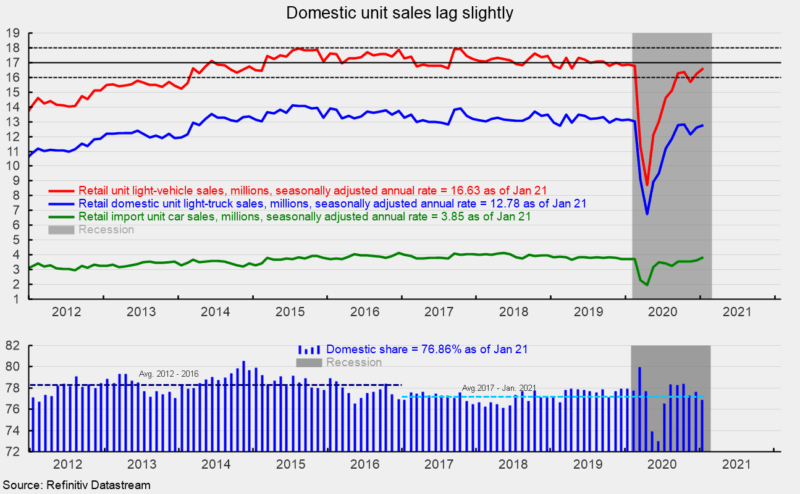

Breaking down sales by origin of assembly, sales of domestic vehicles rose to 10.1 million units versus 9.9 million in December while imports rose to 3.7 million versus 3.6 million in December (see top of second chart). The domestic share came in at 76.9 percent in January versus 77.6 in December (see bottom of second chart). While the share of domestic sales has held relatively steady when compared to the rising trend in the share of light trucks, there has been some weakness in recent years with the average share since 2017 coming in at 77.2 percent versus an average share of 78.3 from 2012 through 2016 (see bottom of second chart). If the economic chaos of 2020 is excluded, the average remains at 77.2 percent for 2017 through 2019.