Labor Market Weakness Continues

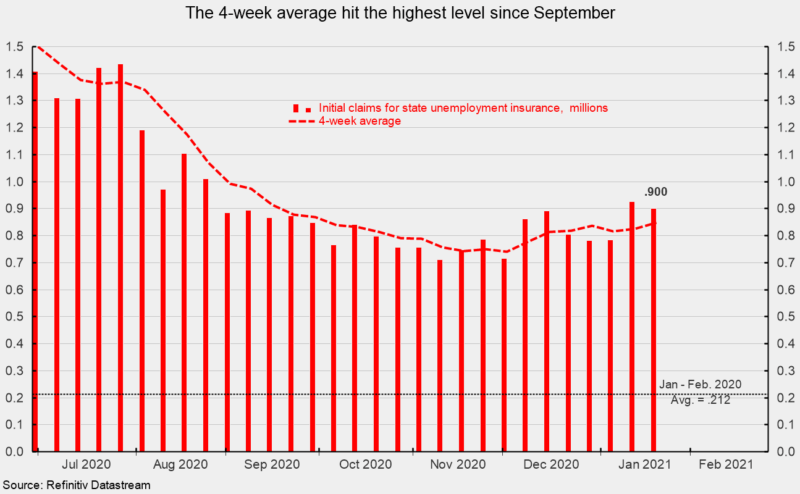

Initial claims for regular state unemployment insurance totaled 900,000 for the week ending January 16, down 26,000 from the previous week’s revised tally of 926,000 (see first chart). Claims have been in the 700,000 to 1 million range for 21 consecutive weeks after hitting a peak of 6.9 million in March.

The four-week average was 848,000, up 23,500 from the prior average. The four-week average has drifted higher in recent weeks posting increases in six of the last seven weeks, hitting the highest level since September 26. Prior to the lockdowns, initial claims averaged 212,000 over the first 10 weeks of 2020. Persistent initial claims at such a historically high level, particularly in light of the recent trend higher, remain a threat for the labor market recovery and the economy (see first chart).

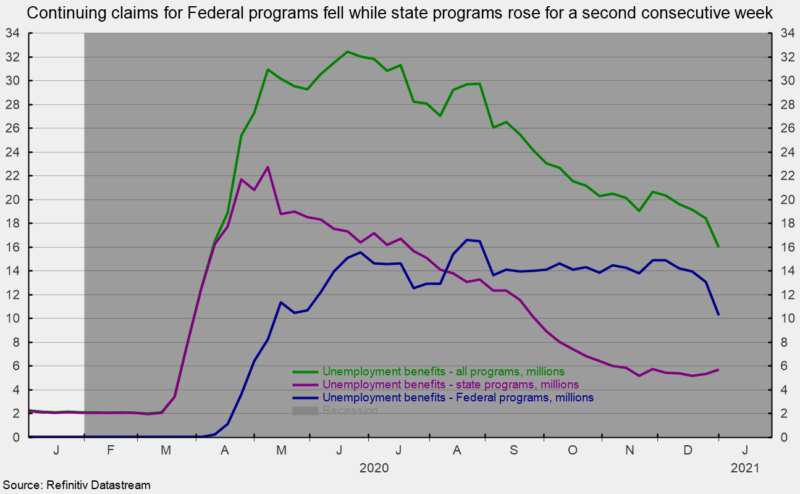

The number of ongoing claims for state unemployment programs totaled 5.733 million for the week ending January 2, up 385,996 from the prior week. State programs have been trending lower since early March, but the downward trend has turned to a slight upward trend over the last two weeks (see second chart). For the same week in 2019, ongoing claims were 2.246 million.

Continuing claims in all federal programs fell sharply in the latest week, coming in at 10.261 million for the week ending January 2, down 2.799 million, the fourth decline in a row and the lowest level since May 8 (see second chart).

The total number of people claiming benefits in all unemployment programs including all emergency programs was 15.995 million for the week ended January 2, down 2.413 million from the prior week. Continuing claims in Federal and state programs are at the lowest level since April 4.

Renewed government restrictions on consumers and businesses amid resurging Covid-19 cases pose a significant threat to the outlook for economic growth. The longer the virus surge continues, consumers remain restricted, and businesses remain closed or limited, the more uncertain a labor market recovery becomes and the higher the probability of a slow and drawn-out economic recovery.