Labor Market Shows Resilience in November

The labor market showed remarkable resilience in November, posting sharply higher job gains and solid upward revisions for the second consecutive month. The November report was boosted by the return of General Motors workers who were on strike in October. Nevertheless, job gains were widespread and job creation over the past few months appears significantly stronger than in the first half of the year. However, the pace of gain is still somewhat slower than the strong gains in 2018. Overall, the November report is a positive sign, suggesting support for consumer spending and continued economic expansion.

U.S. nonfarm payrolls added 266,000 jobs in November, after an increase of 156,000 new jobs in October and 193,000 in September. Over the past year, payrolls have expanded by 2.2 million or an average of 184,000 per month.

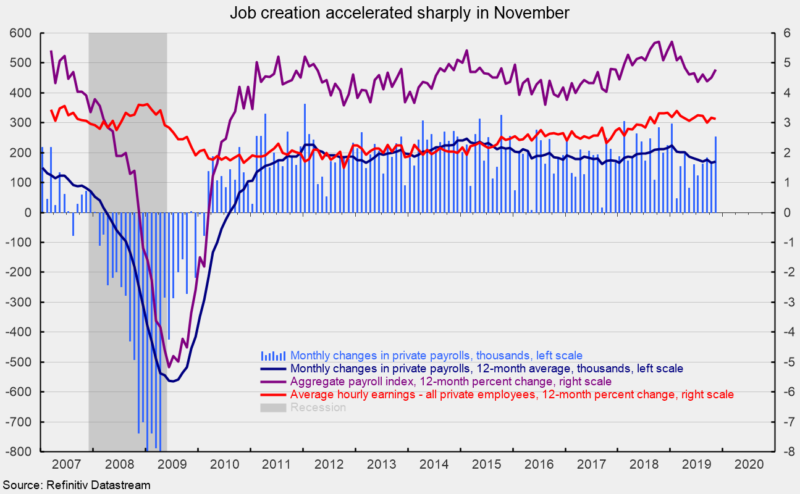

For the private sector, nonfarm payrolls added 254,000 in November following a gain of 163,000 in October and 183,000 in September (see chart). November private payrolls were boosted by the return of 46,000 workers who were on strike from GM. Over the past year, private payrolls have added 2.0 million workers or an average of 170,000 per month, a very solid pace of increase but below the 2018 average of 215,000 new private-sector employees per month (see chart).

Goods-producing industries added 48,000 jobs in November, led by a 44,000 gain in durable manufacturing, including the 46,000 at GM. Nondurable manufacturing added 10,000 while construction industries added 1,000. Mining and logging industries lost 7,000 jobs in November.

Within private service-producing industries, which typically account for the lion’s share of job creation, payrolls rose by 206,000 workers, led by a 60,000 gain in health care and social assistance. Leisure and hospitality industries added 45,000 while professional and business services posted a gain of 38,000 jobs. Transportation industries added 16,000 while financial services and information industries added 13,000 each and retail employment rose by 2,000.

Public sector employment rose by 12,000 in November after cutting 7,000 in October. Census hiring may add volatility to the public-sector numbers over the course of 2020.

The unemployment rate ticked down to 3.5 percent, matching a 50-year low. The labor force participation rate fell 0.1 percentage point to 63.2 percent in November as 40,000 people joined the labor force.

Average hourly earnings rose 0.2 percent in November, pushing the 12-month change to 3.1 percent, down from a cycle peak of 3.4 percent in February (see chart). Average hourly earnings growth has been very slow compared to previous cycles, especially given the low unemployment rate, but has posted 12-month gains above 3 percent since mid-2018.

Combining payrolls with hourly earnings and hours worked, the index of aggregate weekly payrolls rose 0.4 percent in November and is up 4.8 percent from a year ago (see chart). This index is a good proxy for take-home pay and has posted relatively steady year-over-year gains in the 3 to 5 percent range since 2010. Continued gains in the aggregate-payrolls index are a positive sign for consumer income, and are likely to support consumer spending and continued economic expansion.