Keep the Fed’s Decision in Perspective

The Fed’s decision yesterday to raise the federal funds target rate by ¼ point, from a range of 0.25 – 0.50 to 0.50 – 0.75, sent shockwaves through markets. To be more precise, it wasn’t the increase itself, which was possibly one of the most widely anticipated moves in decades. Rather, it was that the Federal Open Market Committee (FOMC) raised its rate policy outlook for next year to include three ¼-point increases instead of two, raising the fed funds target for year-end 2017 to 1.4 percent.

This is being interpreted as a seismic shift in the Fed outlook. Whether one additional quarter percentage point is seismic is up for debate, but it is important information. Any change in the Fed’s assessment of the economy and outlook for future rate policy will affect the economy, but it should be kept in perspective. The forecasts (also known as dot plots) are updated quarterly, allowing participants to incorporate new economic data into their expectations. It also allows participants to reevaluate the scope and impact of potential future outcomes based on new information such as the surprise presidential election results and the potential impact on the economy from new policy.

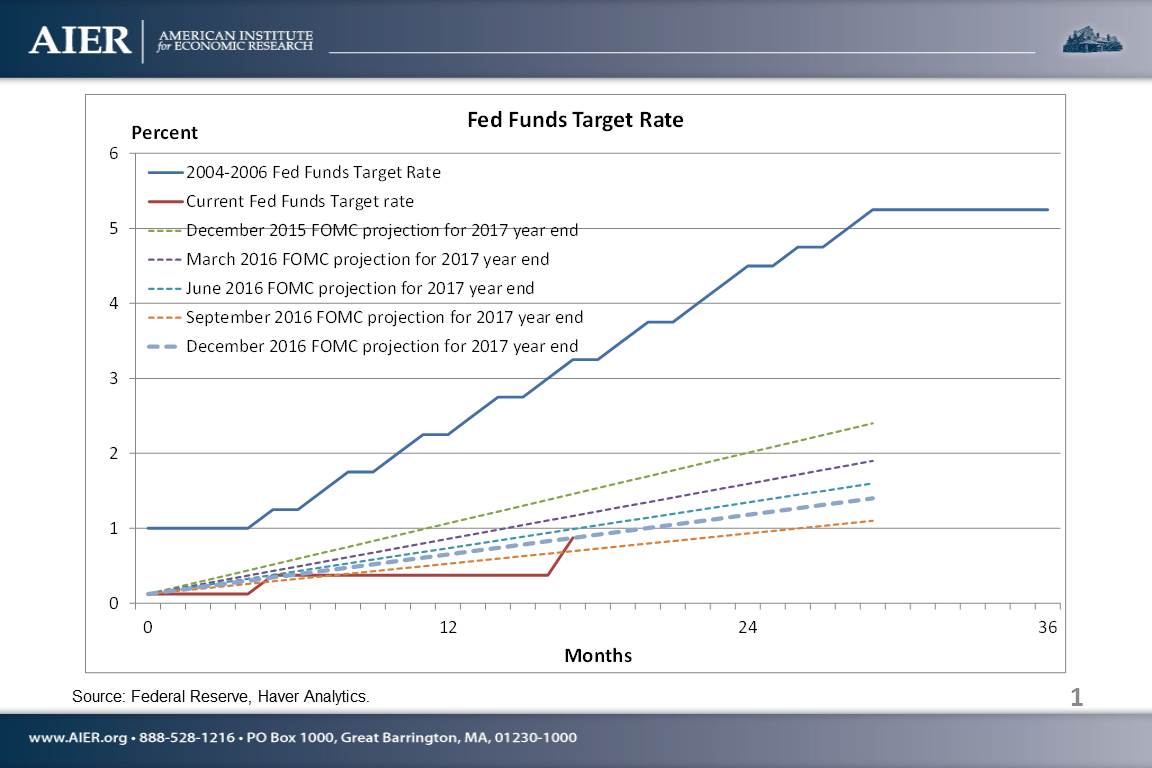

As critics of the Fed will note, its forecasting prowess is far from perfect. Its members and staff are among the most talented economists in the profession, but they cannot accurately predict the future with any certainty. To that point: In December 2015, the FOMC projection for the fed funds rate at the end of 2017 (the period for which the FOMC just changed its latest forecast) was 2.4 percent. In the March 2016 projection, participants lowered their outlook for 2017 to 1.9 percent; in June, they cut it to 1.6 percent; in September, it was cut again to 1.1 percent; then finally in the latest projection, it was raised to 1.4 percent. So, the forecast is back to about where it was in June, and still well below prior forecasts.

Yes, it does represent an increase to the forecast following a string of cuts and that is a positive sign, but it should not change most views of the economy. Everyone inside and outside the Fed see the same economic data and are aware of new developments such as the results of the presidential election. They are doing what every economist does: They update their assessments of the economy and its likely future path based on the latest information about where we are in the business cycle. The Fed’s updated outlook is confirmation of this process, but not a dramatic new piece of information.

What we know:

- The 2007-2008 recession was the most severe since the Great Depression.

- The economic recovery has been slow by historical measures, and growth has been erratic.

- Inflation has been well below the Fed’s long-run target.

- Much progress has been made over the past seven years, with the unemployment rate falling to 4.6 percent in November, and inflation measures moving closer to 2 percent.

- The Fed has been exceptionally accommodative through quantitative easing programs and extremely low interest rates.

- The Fed has said (and shown) that it will be cautious in removing monetary support for the economy.

- The Fed has now raised rates for the second time in two years.

- The Fed’s best ESTIMATE AT THIS POINT is that it will continue to raise rates SLOWLY.

- The current projection calls for three ¼-point increases next year.

- The Fed is data dependent and the path of future rate increases is not locked in.

- Like all economists, its forecasts are subject to revision.

Tracking and understanding developments in Fed policy and FOMC participants’ projections is important. But it should be kept in perspective. It is just one piece of information that should be considered in a prudent and thoughtful analysis of the economy.

Click here to sign up for the Daily Economy weekly digest!