Judy Shelton: Golden Nominee for a Tarnished Fed

Dr. Judy Shelton is polite, soft-spoken, and diminutive – yet she seems capable of scaring the bejesus out of full-grown adults and “leaders” in American politics, academia, and media. Why? For decades she’s been a global expert on money, monetary policy, and crises. She’s been a prolific author and speaker, a scholar at the Hoover Institution (1985-1995), and, since March 2018, director of the European Bank of Reconstruction and Development. Shelton’s intelligence and eloquence is visible in online interviews.

So far so good – or so you might think. But Shelton’s foes don’t think much. Mostly they emote. In recent weeks Senators, policymakers, and pundits have claimed Shelton is dangerous. Just search online for “Shelton” and “dangerous,” to observe the hysteria.

What’s the problem, exactly? Surely Shelton’s credentials are fine. Analytically, she’s also been prescient. Her first book defied the “consensus” view of the U.S.S.R., explaining its latent frailty and predicting its imminent demise (The Coming Soviet Crash, 1989). At that same time, MIT professor and Keynesian icon Paul Samuelson, in his best-selling college textbook, claimed that the Soviets would soon surpass the U.S. economically.

Shelton’s second book warned that volatile, politically-manipulated currencies would continue to instigate crises and undermine economic growth, absent adoption of rational monetary reform (Money Meltdown: Restoring Currency Order to the Global Currency System, 1994). Few bothered citing her when Mexico devalued in 1994, or during the Southeast Asian currency debacles of 1997-1998, or when Russia devalued (and defaulted) in 1998, or when U.S. officials depreciated the dollar by 44% versus the yen from 2002 to 2011 and then, over the next four years, Japan depreciated the yen by 39% in U.S. dollars.

Since the early 1990s Keynesian icon Paul Krugman, now fond of ridiculing Shelton as among the “gold bugs for Trump” (who’ve “sold their principles”), has advised Japan’s leaders to “stimulate” the local economy by perpetual injections of money, massive debt monetization, and zero-to-negative interest rates, hoping to “euthanize” the public bondholders upon which Japan relies so heavily. Thanks not to Shelton but to Krugman, Japan has “stimulated” itself into a prolonged stagnation. Its annual growth in industrial production in the thirty years before 1990 was 7.5%, but in the thirty years since, 0.0%.

Shelton’s most recent book (Fixing the Dollar Now, 2010) argued that U.S. money needs a fundamental fix, a genuine reform, so it’s no longer the plaything of policymakers who believe stability and prosperity are attained by gyrating interest rates and exchange rates. Why all the gyrating? Fed policymakers, trained to be dutiful Keynesians, believe in the Phillips Curve dogma, the theory that inflation worsens due to “excessive” economic growth (“over-heating!”) and a low jobless rate. They blame inflation not on central bankers or finance ministers but on prosperity. Just when economic-financial times are best, such policymakers can’t leave well enough alone; they feel obliged to raise interest rates to slow the economy and boost joblessness, if necessary, by causing a recession.

Many Treasury officials, trained as much as central bankers in Keynesian fallacies, are imbued with the mythologies of mercantilism, which Keynes eagerly extolled and which dominated policymaking in the 17th century, before political economy became scientific and systematic with Adam Smith’s Wealth of Nations (1776). It declares trade deficits as inherently bad and surpluses inherently good. Officials actively depreciate their currencies to gain a “competitive advantage” versus trading partners, who pursue the same policy, in turn, which only debases the purchasing power of money universally.

One of the grave fallacies of mercantilism, which Keynes and his many anti-scientific acolytes partially revived starting in the 1930s, holds that an economy must eventually falter or shrink due to aggregate “overproduction” (or “deficient demand”), and also declares that the cure isn’t more wealth production but more (non-gold) money creation. The fallacy, flowing from a brazen rejection of Say’s Law, is still a commonplace today.

This is but a scintilla of the inanity Judy Shelton has been fighting so gallantly in recent decades. Many of her respondents are unworthy, mere entrenched dogmatists who fear and fight her by twisting her views. Some folks can’t abide a solid case or opposing view.

The main “problem” is that Shelton is an intelligent, experienced, learned proponent of sound money – i.e., the type that retains its real purchasing and thereby serves best as a unit of account, medium of exchange, and store of value. As such, she’s also a steadfast defender of the international gold standard, the only monetary system in history that has embodied these features. I explained and documented this amazing system, years ago, in Gold and Liberty (AIER, 1995), and before that, in Breaking the Banks: Central Banking Problems and Free Banking Solutions (AIER, 1990). More recently, I’ve explained how the Fed could be de-politicized and barred from manipulating money, credit, interest rates, and the business cycle, by being compelled to abide by a genuine gold price rule.

Importantly, Shelton knows that gold standards and gold-price rules, when not politically manipulated, have served economies well for centuries. In the U.S. and globally, the gold standard has been periodically sabotaged and banished by politicians, for example by Democrat President Roosevelt, in the early 193os, and most recently (and permanently) by Republican President Nixon, in the early 1970s, who declared “we are all Keynesians now.” In those cases, the gold standard didn’t “fail,” or suffer reserve “shortages,” or limit growth, or cause deflations and depressions. It was failed by unprincipled politicians.

A secondary “problem” with Shelton is that in July 2019 she had the high honor but distinct misfortune of being nominated by President Trump to fill a vacancy on the Federal Reserve Board. Her nomination was an honor because few people are as accomplished or deserving as she, and fewer still are as equipped to become a voice of reason at so unreasonable a bureaucratic agency. The Fed is a central bank, and central banking is but central (political) planning applied to money and banking. The naïve pretense of most central bankers (qua central planners), who believe they can rationally determine money, credit, interest rates and the economy, defies all reason and logic.

To Shelton’s credit, she at least knows this, which is a main reason she endorses an objective monetary standard. It also explains why she’s been critical of central banking and Fed policy, to the extent it’s been arbitrary. That’s frowned upon by “establishment” or “mainstream” economists, politicians, and policymakers; and it’s especially unwelcome in Fedville, where Groupthink prevails and each must believe as one, pretend as one, speak as one, act as one.

Shelton needn’t feel guilty (she doesn’t) when others locate her views as outside the “mainstream” of current monetary opinion, because that mainstream is a stagnant swamp. Foes of Shelton’s pro-gold views like to cite a 2012 poll of forty top university economists, sponsored by the IGM Forum at the University of Chicago, because none could answer “yes” when asked if “the average Americans” might be better off economically if the U.S. “replaced its discretionary monetary policy regime with a gold standard.” No one concurred, despite the gold standard’s illustrious history. The lack of intellectual diversity here, much like the broad rejection of Say’s Law, is scandalous.

The Fed itself, a huge employer of monetary economists, also biases opinion; those economists not only provide policy advice (and oppose the gold standard) but fill large swaths of monetary academic journals with views that disproportionately favor those of central bankers who prefer ruling without rules. The phenomenon was documented in a 2005 paper by professor Lawrence White, and there’s reason to suspect the bias is even worse today, as central banks since 2008 became even more powerful and discretionary.

Most central bankers today, we know, prefer full discretion with no constraining rules whatsoever; hence no accountability, either. This irresponsibility is portrayed as a virtue – as “central bank independence” from politics. In truth, however, central banks have always been political; now they’re more politically dependent than ever. They’re called upon by profligate Congresses and executive-branch fiscal departments to underwrite and monetize vast new sums of public debt at artificially cheap, near-zero interest rates.

The most bizarre critique launched against Dr. Shelton is that as a board member she might jeopardize the Fed’s much-vaunted “independence.” Allegedly she’d do the bidding of the president who appointed her. That’s rarely said about other Fed appointees. Why? Mr. Trump also nominated Jay Powell, a non-economist (lawyer), as Fed chairman in early 2018; when Powell learned of Shelton’s nomination he felt a need to declare the gold standard “a bad idea.” Well, it sure might be so for a lawyer who heads the Fed, knows nothing of the standard’s history or mechanics, but knows for sure that he and his like-minded cohorts prefer exercising unchecked discretionary power. That’s got nothing to do with Shelton’s views; indeed, it highlights why her views should be heard at the Fed.

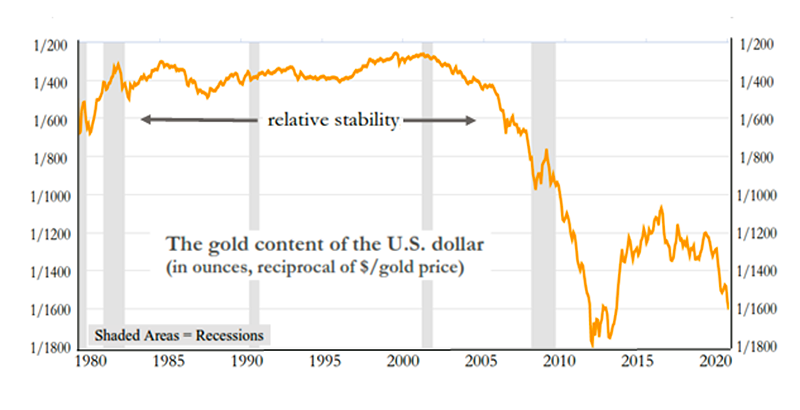

It’s also forgotten that long serving, widely respected Fed Chairman Alan Greenspan (1987-2006) was a lifelong proponent of the gold standard, and remains so today, while recognizing that central banks and fiscal agents today simply refuse to be subjected to it. Nevertheless, it’s no coincidence that Greenspan’s reign at the Fed was responsible and successful to the extent it was accompanied by a relatively stable gold price (close to what occurs under a genuine gold standard). Economists who came to admire the steadily prosperous, low inflation years of 1987-2007, calling it “the Great Moderation,” seemed unaware of the crucial role played by such real monetary stability (nearby graph).

There’s ample evidence that central banking, if it must exist, can be made to operate less politically by making officials abide the signals provided by efficient, forward-looking market prices – such as gold, broad commodity prices, the yield curve, and foreign exchange rates – instead of using backward-looking, oft-revised accounting data or false textbook theories (like the Phillips Curve). At the Fed for a decade until the mid-1990s not only chairman Greenspan but also vice-chairman Manuel Johnson and board member Wayne Angell, each appointed by President Reagan, used a price approach with success. The most authoritative account of the method appeared in Monetary Policy, a Market Price Approach (1996), written by Johnson and Robert Keleher, a career Fed economist.

Dr. Shelton endorses the market-price approach to monetary policy, which the Fed could surely use again. As a long-standing, principled advocate of the gold standard, or a gold-price rule, she’s far more fit than most to take a place at the Fed policy table, if only to check the arrogance and discretion of an array of misguided, ill-informed cohorts. Her policy approach, were it to be adopted, would render the Fed more genuinely independent of political-fiscal pressures. It should never be forgotten that the gold standard, in every version possible, was banished by governments not because it “failed,” but because fiat money issuance and fluctuating exchange rates facilitated governments’ prodigal ends. Shelton’s rational, contrarian, non-mainstream views are no reason to keep her off the Fed’s board; in fact, they’re a good reason to put her on the board as soon as possible.

The two-hour Congressional grilling of Shelton in mid-February was shocking to those of us who hope there might still remain some appreciation or knowledge of real money and rational monetary policy. The Democrats on the Senate Banking Committee were bad enough, but the Republicans weren’t much better, so it’s unclear that she’ll be confirmed.

The New York Times used understatement to report that “Judy Shelton, Trump’s Fed Nominee, Faces Bipartisan Skepticism.” No kidding. She also faced ignorance. In his Twitter feed, Democrat Senator and committee member Sherrod Brown ridiculed Shelton as “so far off the ideological spectrum that even several of my Republican colleagues expressed their concern with her ideas, like replacing the dollar with a global currency and returning the U.S. to the gold standard.” In committee, GOP Senator Richard Shelby asked Shelton to “concede” that a gold standard meant a return to “barter.” GOP Senator John Kennedy asked her to play “monetary queen” for a day, assume a global financial collapse, and convince him she’d make the Fed create as much money as possible, coupled with near-zero (and possibly negative) interest rates. GOP Senator Pat Toomey, a one-time supply-sider, accused Shelton – herself a supply-sider, foe of protectionist currency manipulation, and fan of stable-to-fixed exchange rates – of wanting the Fed and U.S. Treasury to engage in occasional, mutually-destructive currency devaluations with China.

The Fed by now is a badly tarnished institution, less credible and less reputable than ever. Shelton is a high-class, high-quality economist, who should join the Fed not so much to burnish its image but to keep it at least a little bit honest and real. The Fed today doesn’t really deserve Shelton, but Shelton deserves a top place at the Fed. The ignorance, hysteria, and bile thrown at her is indecent. That she would be so resisted as a Fed board member, even as “one small voice” among dozens in Fedville, reveals not that she’d have little or nothing worthwhile to say or contribute, but that her voice might counteract others, which, being nearly identical, effectively congeal into one. It would be Shelton’s view versus a single alternative view. That’s what incumbents fear most. They want Fed seats filled with mindless, Keynesian clones, not well-informed, independent thinkers.