Jobs Report Boosts Labor Market Concerns

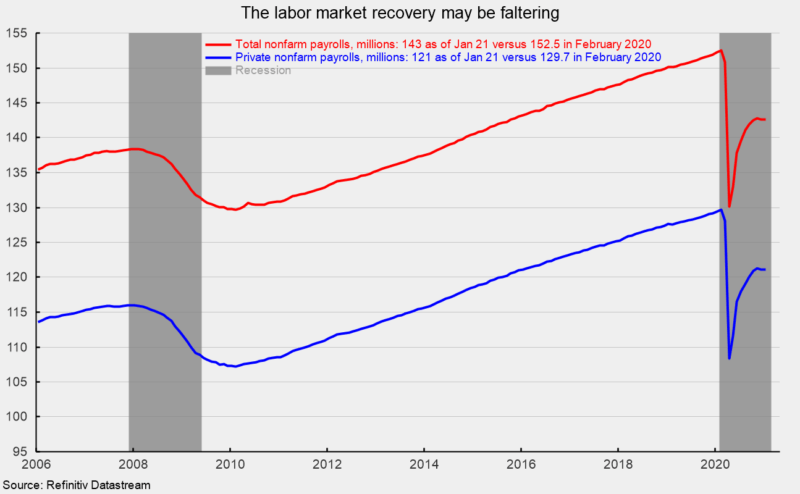

U.S. nonfarm payrolls added just 49,000 jobs in January, after a drop of 227,000 in December (December was the first monthly decline since the historic, shutdown-driven plunges in March and April). The gain brings the nine-month post-plunge recovery to 12.47 million and is far from offsetting the 22.36 million loss in March and April, leaving nonfarm payrolls 9.9 million or 6.5 percent below the February 2020 peak (see first chart).

Private payrolls rose by a very disappointing 6,000 jobs in January, which brings the nine-month recovery to 12.79 million versus a loss of 21.35 million in March and April, leaving private payrolls 8.6 million or 6.6 percent below the February 2020 peak (see first chart).

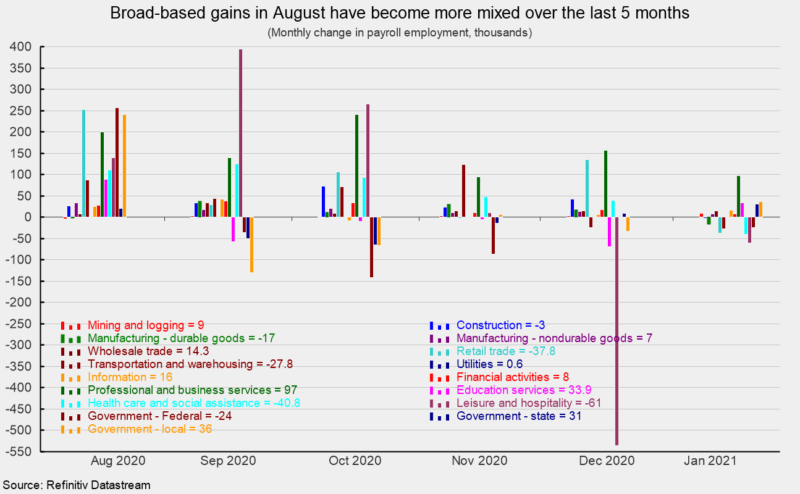

The details of the report are worrisome with a clear deterioration in the breadth of gains over the last five months (see second chart). While August showed gains for nearly every industry, subsequent months have shown few gains and more declines. Overall, the report suggests that the payroll recoveries of many industries within the economy are faltering. The uneven performance of the different industries particularly as large gaps to full recovery persist is raising doubts about the strength and durability of the recovery.

Within the 6,000 gain in private payrolls, private services added 10,000 while goods-producing industries lost 4,000. For private service-producing industries, the gains were led by a 97,000 rise in business and professional services and a 34,000 rise in education services. Offsetting those gains were a 61,000 decline in leisure and hospitality, a 41,000 drop in health care and social assistance, a loss of 38,000 in retail, and a 28,000 fall in transportation and warehousing (see second chart).

Within the 4,000 drop in goods-producing industries, construction lost 3,000 jobs, durable-goods manufacturing decreased by 17,000, nondurable-goods manufacturing rose by 7,000, and mining and logging industries added 9,000 jobs (see second chart).

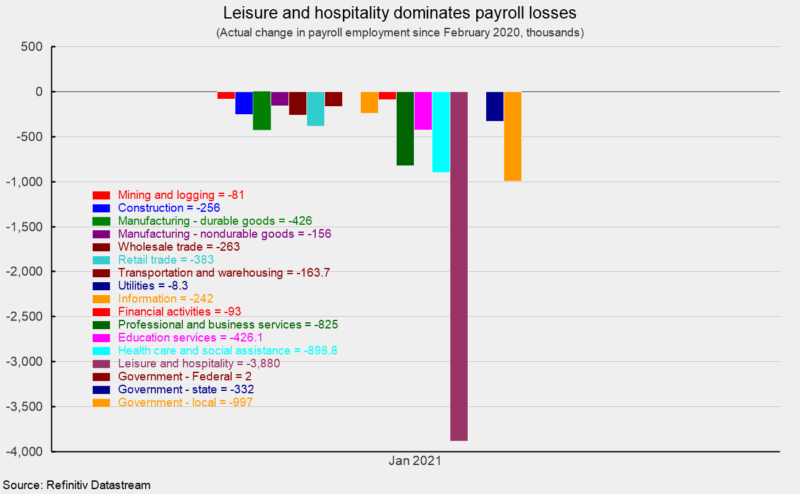

Eleven months after the peak in employment, every private industry group still has fewer employees. The net losses range from about 8,300 in utilities workers to a devastating 3.9 million in leisure and hospitality (see third chart).

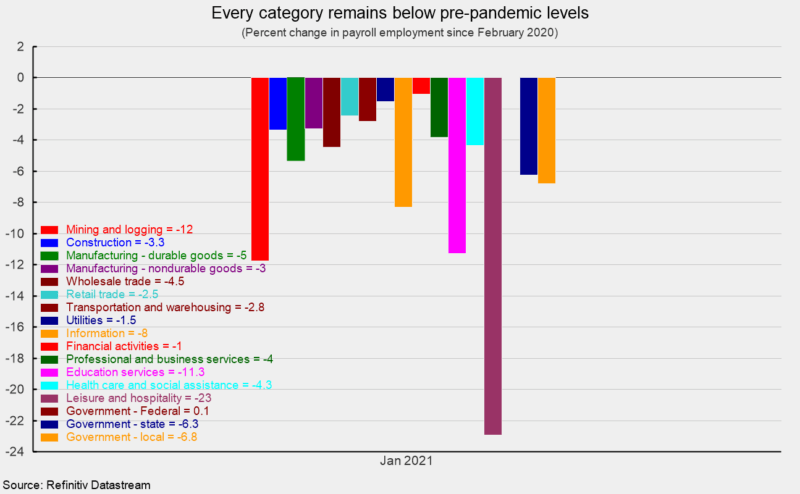

On a percentage basis, the losses are more evenly distributed. Leisure and hospitality still leads with a 22.9 percent drop since February, however, mining and logging comes in second with an 11.7 percent loss followed by education services at 11.3 percent and information services at 8.3 percent. Seven of the 14 private industries shown in the report have declines of four percent or more since February 2020 (see fourth chart).

The government sector added 43,000 employees in January, with local government payrolls rising by 36,000, state government payrolls up 31,000, but the federal government cutting 24,000 workers.

Average hourly earnings rose 0.2 percent in January, putting the 12-month gain at 5.4 percent. The average hourly earnings data should be interpreted carefully as the concentration of job losses for lower-paying jobs during the pandemic distorts the aggregate number.

The average workweek increased in January, rising 0.3 hours to 35.0 hours. Combining payrolls with hourly earnings and hours worked, the index of aggregate weekly payrolls rose 1.1 percent in January following a 0.5 percent gain in December. The index is up 0.6 percent from a year ago.

The total number of officially unemployed fell to 10.130 million in January, a drop of 606,000 from December. The number of officially unemployed in January 2020 was just 5.796 million.

The unemployment rate fell to 6.3 percent while the underemployed rate, referred to as the U-6 rate, fell from 11.7 percent in December to 11.1 in January.

The participation rate also fell in January, dropping to 61.4 percent; the participation rate was 63.4 percent in January 2020. The employment-to-population ratio, one of AIER’s Roughly Coincident indicators came in at 57.5 for January, above the 57.4 ratio in December.

The January jobs report shows that the labor market recovery may be losing momentum, with employment still well below pre-pandemic levels. Government restrictions on consumers and businesses remain a significant threat to the outlook for economic growth. The development and distribution of vaccines are very positive developments and should eventually lead to significantly less government restrictions. In the meantime, the longer the virus continues to spread (along with the possibility of mutations prolonging the outbreak), consumers remain restricted, and businesses remain closed or limited, the more uncertain a labor market recovery becomes and the higher the probability of a slow and drawn-out economic recovery.