Jobs Growth Is Rebounding and Hourly Earnings Growth Is Accelerating

Payrolls in the United States rose by 223,000 in May, solidly beating an expected gain of 188,000. The strong result follows the two softer monthly gains, below 160,000, in March and April. In addition to the healthy payrolls increase, average hourly earnings rose and the unemployment rate dropped. Overall, the May jobs report was very positive and supports an optimistic outlook for the economy.

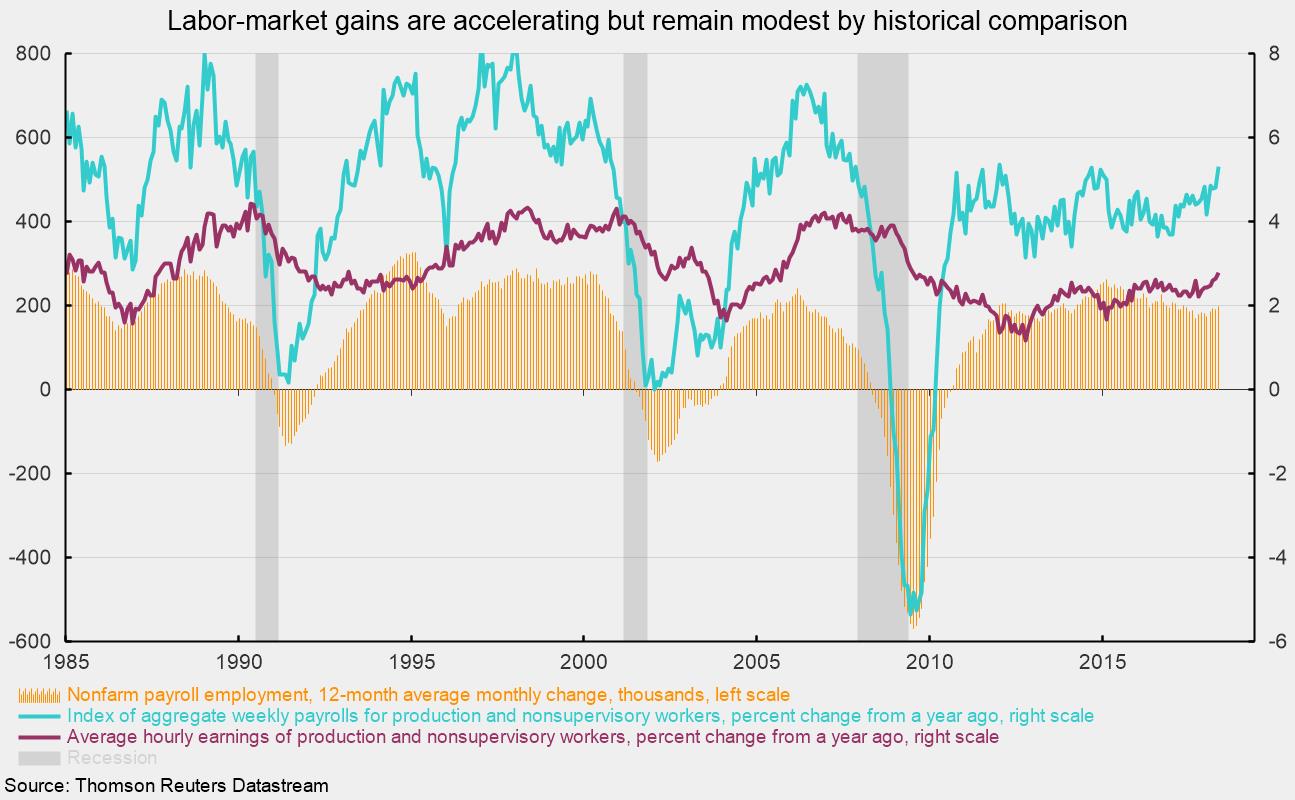

The private sector added 218,000 jobs, above the ADP Research Institute estimate of 178,000 new private sector jobs. Over the past three months, total payrolls have risen an average of 179,000 while private sector payrolls averaged a gain of 178,000. Those compare to 12-month average gains of 197,000 for total payrolls and 195,000 for the private sector. Both 12-month averages are up from recent lows of 168,000 and 166,000, respectively, in September 2017 (see chart). The reacceleration of payroll gains despite the falling unemployment rate is a favorable sign.

Gains were widespread among the private sector industries in May. Among the private sector gainers, construction added 25,000 jobs versus 21,000 in April, manufacturing industries added 18,000 jobs for the month compared to 25,000 in the prior month, and mining industries added 4,000 versus 7,000 previously. Combined, good-producing industries added 47,000 new jobs in May.

Private-services industries added 171,000 jobs in May compared to 109,000 in April. Among the individual private-services industries, leisure and hospitality added 21,000 jobs for the month, professional- and business-services payrolls rose by 31,000, and health care added 39,000 employees in May. Retail industries, which have been erratic in their payroll gains, gained 31,100 jobs in May. Overall, gains were broad-based, with utilities and temporary help the only segments shown posting declines for the month.

The solid pace of job creation attracted 12,000 more people into the labor force in May. Despite those new entrants, the labor-force participation rate dropped slightly to 62.7 percent, down from 62.8 percent in the prior month. The unemployment rate dropped by 0.1 percentage points to 3.8 percent in May, hitting a new low for the current cycle.

Average hourly earnings rose 0.3 percent in May, pushing the 12-month change to 2.7 percent. The length of the average workweek held steady at 34.5 hours. Combined, the gains in payrolls, hours worked, and hourly earnings resulted in a 0.5 percent increase in the aggregate-payrolls index in May and a 12-month rise of 5.0 percent. This index is a proxy for take-home pay and has been growing in the 4 to 5 percent range for most of 2011 to early 2018, providing a solid base to support consumer spending.

Overall, the employment report is very positive. The labor market remains the cornerstone of the current expansion and is boosting household incomes as well as consumer confidence, and suggests a positive outlook for the current expansion. Gains in the labor market have accelerated recently, reducing fears of a pending slowdown, yet the gains remain modest by historical comparison, suggesting that the slower and somewhat steadier gains of the current cycle may help prolong the expansion.