Jobs Fall but Wage Gains Accelerate in September

The impacts of Hurricanes Harvey and Irma were clearly evident in the September employment report. Nonfarm payrolls, derived from a survey of businesses, fell 33,000 for the month, largely due to a loss of 105,000 workers in the restaurant industry. Other industries saw somewhat slower but still positive declines for the month, likely also reflecting the impacts of the hurricanes. Other details of the report — particularly average hourly earnings, the unemployment rate, and, as tallied by the survey of households, the number of people employed — are less likely to be affected by the disruption to business activity. Many of those details suggest the labor market remains quite healthy.

The payroll survey’s employment numbers and the household survey’s employment numbers tend to have similar trends but can vary sharply in any given month. Since 1955, the correlation between the 12-month average change in the two employment figures is 93 percent.

Because of the way the surveys are conducted, the household figures should be less affected by the hurricanes. According to the Bureau of Labor Statistics, “In the establishment survey, employees who are not paid for the pay period that includes the 12th of the month are not counted as employed. In the household survey, persons with a job are counted as employed even if they miss work for the entire survey reference week (the week including the 12th of the month), regardless of whether or not they are paid.” For September, household employment rose by 906,000 compared to the 33,000 drop in payroll employment. The 12-month average increase for household employment was 202,000, compared to 148,000 for the payroll data. Given these results, it seems likely that payroll employment will bounce back once business conditions return to normal in Florida and Texas.

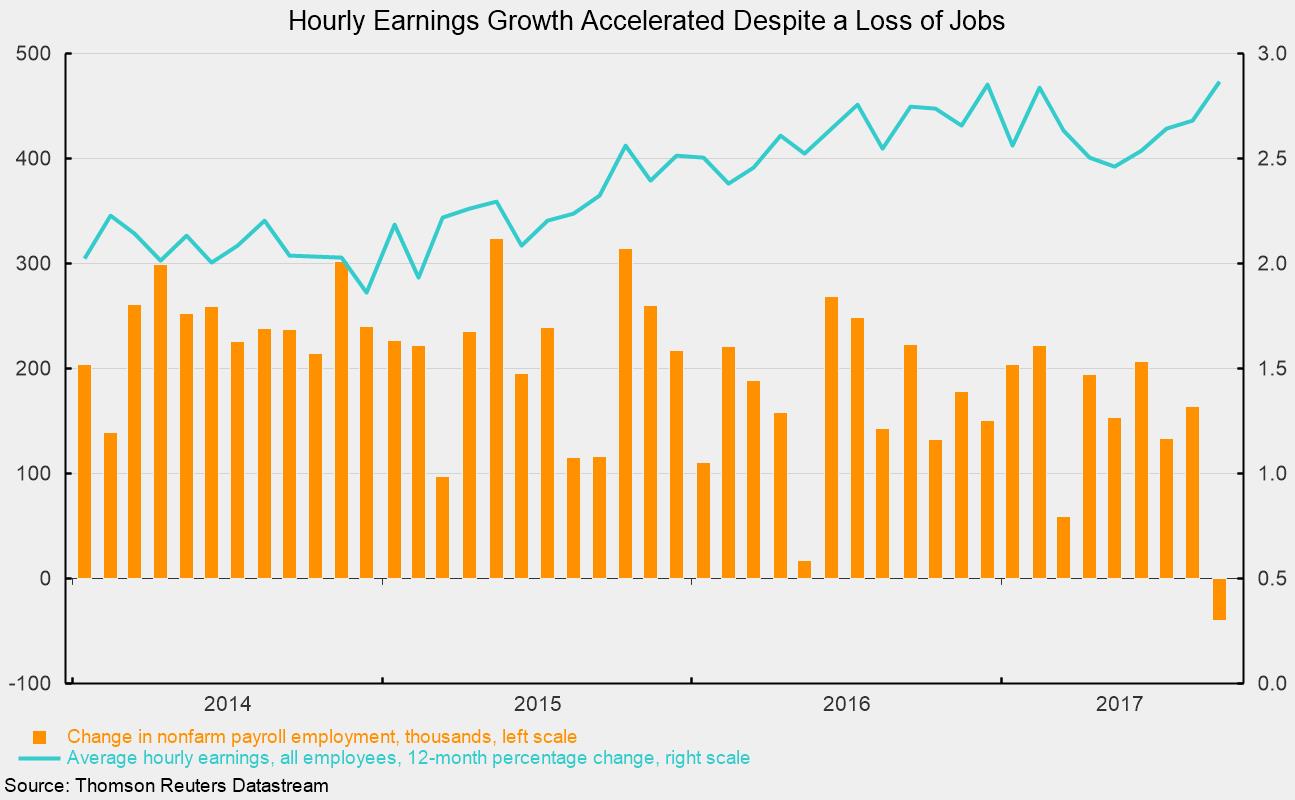

Among the data less affected by the storms, average hourly earnings jumped 0.5 percent for the month, pushing the 12-month gain to 2.9 percent, the highest since 2009. Also from the household survey, the unemployment rate dropped to 4.2 percent from 4.4 percent in August, the lowest since 2001, while the labor-force participation rate rose to 63.1 percent from 62.9 percent, the highest since 2013.

Finally, the aggregate payroll index, a proxy for weekly paychecks for the country as a whole by combining employment with weekly hours worked and hourly earnings, rose 4.3 percent from a year ago, down from 4.7 percent in the prior month but still above the important 4 percent threshold.

Caution is warranted when interpreting the September employment report, given all the distortions. However, the preponderance of evidence suggests the labor market remains robust. Under that assumption, it seems likely that the Fed will continue to raise the federal-funds-rate target slowly: by 25 basis points in December. It also seems likely that the current economic expansion will continue over the next several months and quarters.