Job Openings Rise in March

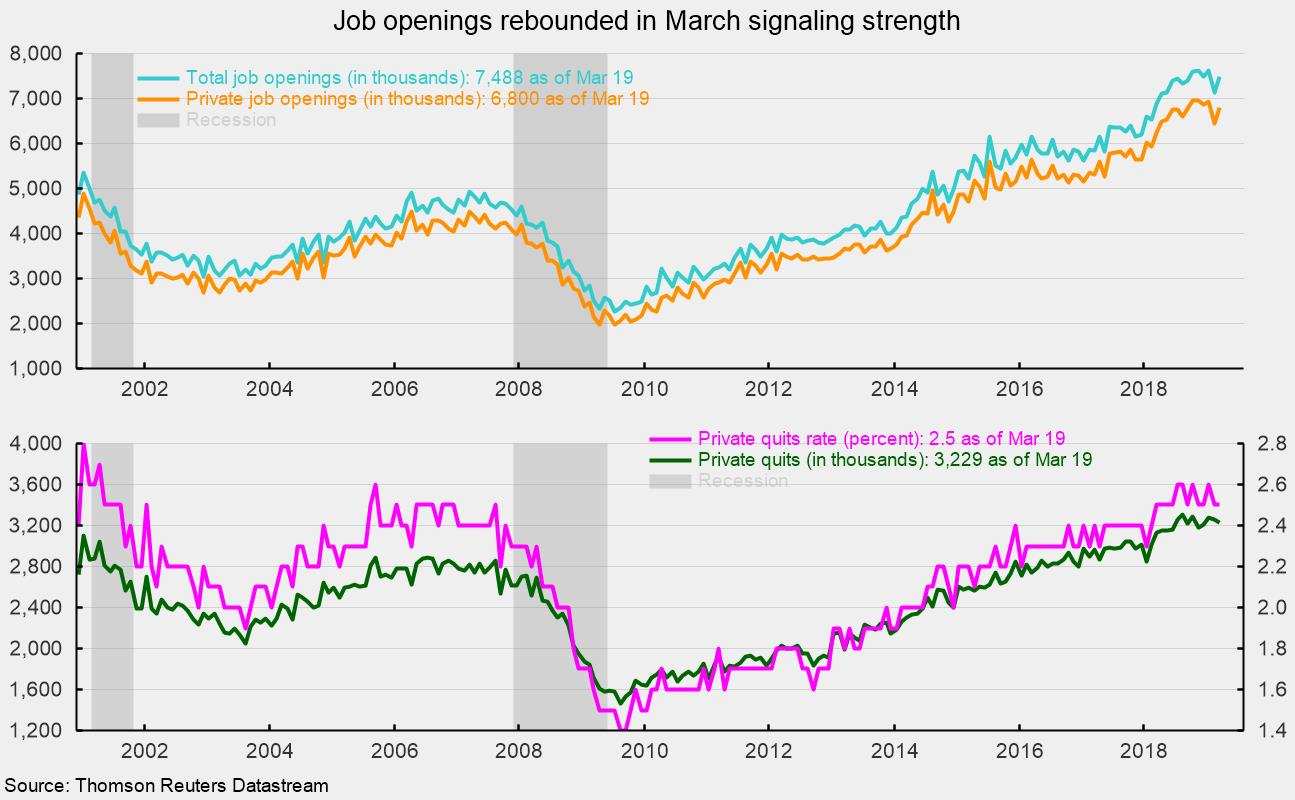

The latest Job Openings and Labor Turnover Survey from the Bureau of Labor Statistics shows the number of open positions in the economy was up sharply in March to 7.488 million, just below the record-high 7.626 million in November 2018. Private job openings in the United States totaled 6.800 million in March versus 6.437 million in February and just below the record 6.962 million in November (see top chart).

The industries with the largest number of openings were professional and business services (1.435 million), health care (1.187 million), leisure and hospitality (1.023 million), and retail (860,000).

The job-openings rate, openings divided by the sum of jobs and openings, rose to 4.7 percent while the openings rate for the private sector came in at 5.0 percent. The private sector rate is just 0.2 percentage points below the all-time high of 5.2 percent reached in October and November 2018. The highest openings rates were in professional and business services (6.3 percent), leisure and hospitality (5.8 percent), information industries (5.7 percent), and health care (5.5 percent).

A further sign of labor-market strength may be seen in the number of quits, which likely reflects confidence in the labor market. Quits totaled 3.229 million for the private sector in March versus 3.259 million in February. The number of quits has been above 3.2 million for four consecutive months, a very strong performance (see bottom chart). The private sector quits rate held at 2.5 percent in March, just below the cycle high of 2.6 percent but 0.4 percentage points below the all-time peak of 2.8 percent in January 2001.

The layoffs rate, another key indicator for the labor market, fell to 1.1 percent for private employers, tying the all-time low and consistent with the historically low initial claims as a percentage of employment. Combined, the high number of openings, the high openings rate, the high quits rate, and the low layoffs rate all suggest the labor market remains very tight.

Overall, the data relating to the labor market show renewed strength. A strong labor market should support personal incomes and consumer confidence, which should support future consumer spending.