Job Openings Reach a New Record While Small Business Confidence Holds at a High Level

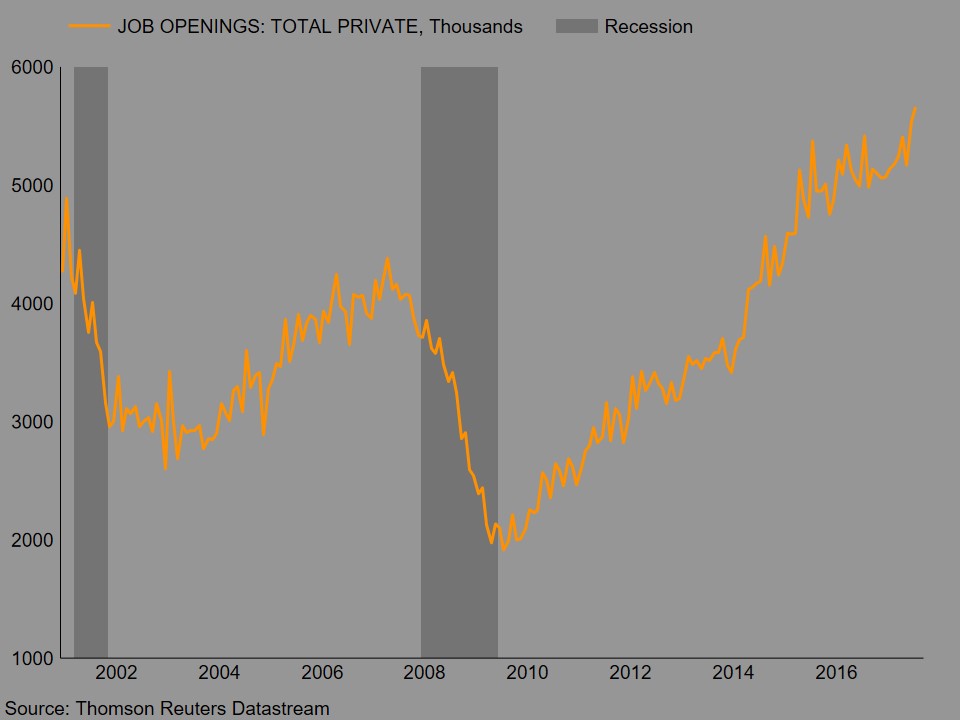

One major measure of labor-market strength, the number of open positions in the United States, hit a new record high at the end of July, increasing 7,000 to 6.17 million. Private industries added 69,000 new openings through the end of July, bringing that total to a record 5.66 million. More than 1 million jobs were available in three different sectors: trade, transportations, and utilities; professional and business services; and education and health services. Another 858,000 openings were tallied in the leisure and hospitality industries while the government sector had 513,000 open jobs.

The overall openings rate, openings divided by employment plus openings, held at 4.0 percent nationwide in July while the private sector had a rate of 4.4 percent, slightly ahead of the 4.3 percent for June. Among the sectors, accommodation and food services had the highest openings rate, at 5.3 percent, followed by the heath care and social-assistance sector and the professional- and business-services sector, both at 5.1 percent. The lowest openings rates were in government (2.2 percent), manufacturing (3.0 percent), and construction (3.2 percent).

Quits, another measure of labor-market strength, rose 30,000 in July to 3.16 million. That is the third-highest level since 2002 but still below the peak of 3.45 million in 2001. The quits rate, quits divided by employment, ticked up to 2.2 percent from 2.1 percent in June. For the private sector, the quits rate held at 2.4 percent. The industries with the highest quits rates are accommodation and food service (4.6 percent), arts, entertainment, and recreation (3.0 percent), retail trade (2.9 percent), and professional and business services (2.9 percent). The lowest quits rate was in government (0.8 percent).

The strong labor market continues to support aggregate income growth, consumer sentiment, and consumer spending. Together, these consumer fundamentals support a positive outlook for the economy overall.

Additional support for a favorable outlook comes from the National Federation of Independent Business economic-trends report. The Index of Small Business Optimism rose 0.1 points to 105.3 in August. That is the third-highest reading since 2005, and the sixth-highest since the monthly survey began in 1985. Small-business optimism surged after the presidential election in November 2016. The index had been below 95 for the period from December 2007 through October 2016 except for a brief surge in late 2014 and early 2015.

Plans to increase capital outlays, expectations for future sales, and the belief that now is a good time to expand were the main contributors to the rise in overall optimism. Taxes, quality of labor, government regulations and red tape, and the cost and availability of insurance are the top concerns for small-business owners, according to the survey.