ISM Surveys Show Improvement in January

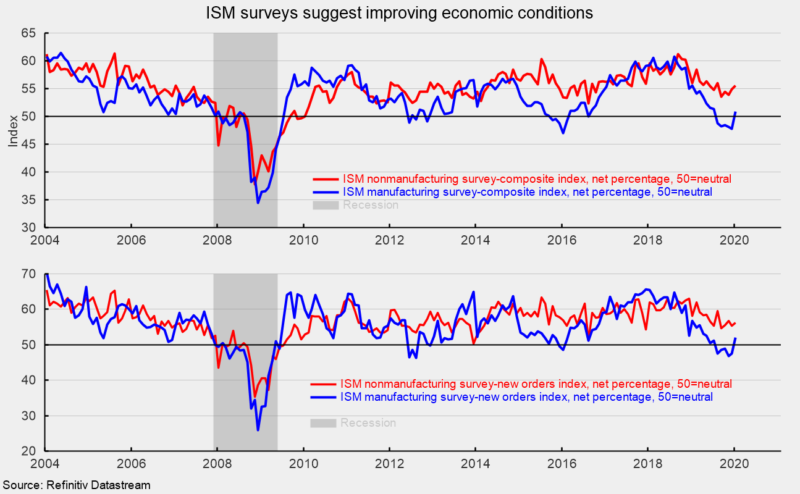

The Institute for Supply Management’s nonmanufacturing composite index rose to a reading of 55.5 from 54.9 in December (see top chart). For this index, 50 is neutral, with readings above 50 suggesting expansion for the sector and readings below 50 suggesting contraction. The January result is the 120th consecutive month above 50 suggesting expansion for the services sector.

Historically, readings above 48.5 have suggested expansion of the overall economy and January was the 126th consecutive month above 48.5. The results complement the ISM Manufacturing Purchasing Managers’ Index, which moved above 50 for the first time since July (see top chart).

Among the key components of the nonmanufacturing index, the business-activity index (comparable to the production index in the ISM manufacturing report) was 60.9 in January, up from 57.0 in December and the strongest reading since February 2019. For the latest month, 12 industries in the nonmanufacturing survey reported growth while four reported contraction.

The nonmanufacturing new-orders index came in at 56.2, up from 55.3 in December (see bottom chart). November was the 126th consecutive month with readings above 50. The new orders index and the activity index were the two major components to show improvement in January while employment and supplier deliveries weakened for the month.

The new-export-orders index, a separate index that measures only orders for export, was 50.1 in January following a 51.0 result in December. The decline suggests continued headwinds for global economic activity.

The nonmanufacturing employment index decreased to 53.1 in January from 54.8 in December. The lower reading contrasts with the strong result of the ADP private-payroll employment estimate released earlier today that predicted a robust 291,000 gain in private payrolls for January. The January jobs report from the Bureau of Labor Statistics is due out on Friday February 7. The consensus estimate is for a gain of 160,000 new jobs with 154,000 coming from the private sector.

Supplier deliveries, a measure of delivery times for suppliers to non-manufacturers, came in at 51.7, down from 52.5 in December. It suggests suppliers are falling further behind in delivering supplies to nonmanufacturers, but the slippage has decelerated a bit from the prior month.

The price index fell to 55.5 from 59.3 in the prior month suggesting continued input cost pressures. Among the industries in the survey, 12 indicated an increase in prices paid while two reported lower prices.

Today’s report from the Institute of Supply Management suggests that growth accelerated slightly in the nonmanufacturing sector in January. The services-sector results complement the manufacturing-sector survey which suggests expansion there for the first time since July. While growth rates may still be modest by historical standards, improving breadth of growth is a positive sign.