ISM Services Index Remained Strong in December

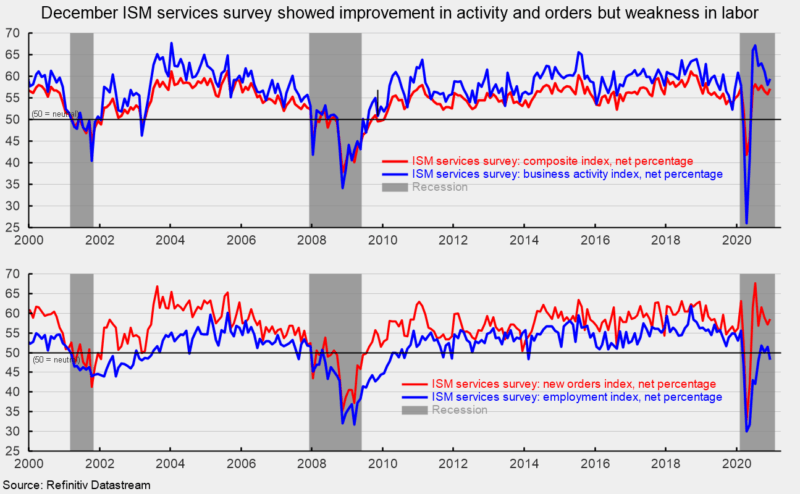

The Institute for Supply Management’s composite services index posted a reading of 57.2 in December, rising 1.3 points from 55.9 in the prior month. The December result is close to the 10-year average of 58.7 for the period ending December 2019, before the pandemic; it remains solidly above neutral and suggests the seventh consecutive month of expansion for the services sector and the broader economy (see top chart).

Among the key components of the services index, the business-activity index (comparable to the production index in the ISM manufacturing report) rose to 59.4 in December, up from 58.0 in November (see top chart). For December, 11 industries in the services survey reported expansion while five reported contraction.

The services new-orders index increased to 58.5 from 57.2 in November, a gain of 1.3 points (see bottom chart). The December result is slightly above the 10-year average of 57.9 for the period ending December 2019. Ten industries reported expansion in new orders in December while five reported declines. The new-export-orders index, a separate index that measures only orders for export, jumped to 57.3 in December versus 50.4 in November. Seven industries reported growth in export orders against three reporting declines.

Backlogs of orders in the services sector likely declined as the index decreased to 48.7 percent from 50.7 percent. Backlogs of orders had grown for six consecutive months before the December result. Seven industries reported higher backlogs in December, matching the seven that reported a decrease.

The services employment index came in at 48.2 in December, down from 51.5 in November (see bottom chart). Employment remains one of the weaker areas of the economy. Just four industries reported growth in employment while ten reported a reduction. The Bureau of Labor Statistics’ Employment Situation report for December is due out on Friday, January 8th. Consensus expectations are for a gain of 100,000 private, nonfarm-payroll jobs including the addition of 20,000 jobs in manufacturing. The unemployment rate is expected to hold steady at 6.7 percent. By contrast, the ADP estimate for private, nonfarm payrolls shows a drop of 123,000 for December.

Supplier deliveries, a measure of delivery times for suppliers to nonmanufacturers, came in at 62.8, up from 57.0 in the prior month. It suggests suppliers are falling further behind in delivering supplies to services businesses, and the slippage has accelerated from the prior month. Typically, slower deliveries are consistent with a strong economy but in this environment, the slower deliveries may be partially a result of production constraints and transportation difficulties. Seventeen industries reported slower deliveries in December.

The latest report from the Institute of Supply Management suggests that the services sector and the broader economy expanded in December. Several respondents to the survey mentioned renewed cases of Covid-19 as an issue, particularly related to supply chain, logistics, and transportations issues and regarding labor difficulties. While the economy is still recovering, the outlook is threatened by renewed restrictions on consumers and businesses driven by surging new cases of Covid-19.