ISM Services Index Eases Back in October but Still Suggests Expansion

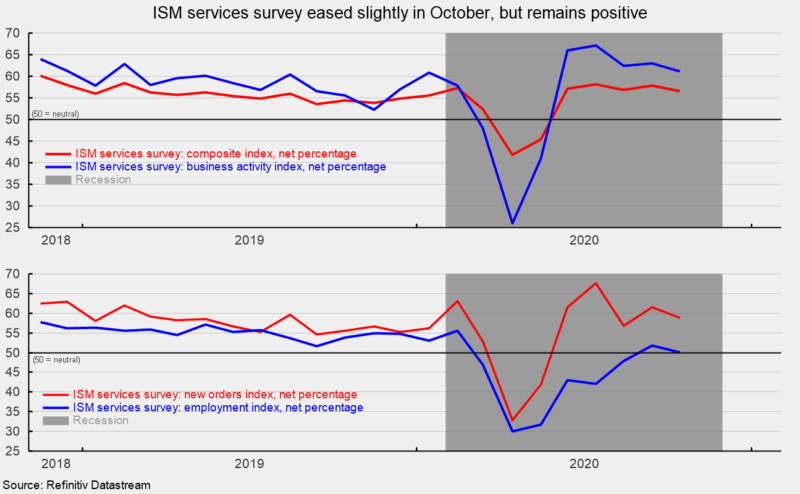

The Institute for Supply Management’s composite services index posted a 1.2 percentage-point decrease in October, dropping to a reading of 56.6 from 57.8 in the prior month. Despite the decline, the October results remain solidly above neutral and suggest the fifth consecutive month of expansion for the services sector and the broader economy, following three months below neutral from March through May (see top chart).

Among the key components of the services index, the business-activity index (comparable to the production index in the ISM manufacturing report) fell to 61.2 in October, down from 63.0 in September (see top chart). For October, 16 industries in the services survey reported expansion.

The services new-orders index fell to 58.8 from 61.5 in September, a drop of 2.7 points (see bottom chart). Fifteen industries reported expansion in new orders in October. The new-export-orders index, a separate index that measures only orders for export, was 53.7 in October, versus 52.6 in September. Seven industries reported growth in export orders.

Backlogs of orders in the services sector likely rose as the index increased to 54.4 percent from 50.1 percent. Backlogs of orders have grown for five consecutive months with eight industries reporting higher backlogs in October.

The services employment index came in at 50.1 in October, down from 51.8 in September (see bottom chart). Employment remains one of the weaker areas of the economy. Six industries reported growth in employment while eight reported a reduction. Despite the large gains in jobs over the last five months, total employment remains well below pre-pandemic levels. Furthermore, ongoing high levels of initial claims for unemployment insurance and high levels of continuing claims for unemployment insurance suggest continued economic recovery remains somewhat uncertain.

Supplier deliveries, a measure of delivery times for suppliers to nonmanufacturers, came in at 56.2, up from 54.9 in the prior month. It suggests suppliers are falling further behind in delivering supplies to services businesses, and the slippage has accelerated from the prior month. Typically, slower deliveries are consistent with a strong economy but in this environment, the slower deliveries may be partially a result of production constraints and transportation difficulties. Twelve industries reported slower deliveries in October while six reported no change and none reported faster deliveries. According to the report, “Increased back orders and raw materials shortages are increasing late deliveries,” while also reporting, “deliveries are delayed due to service issues from small package carriers.”

The latest report from the Institute of Supply Management suggests that the services sector and the broader economy expanded in October but at a slightly slower pace.