ISM Reports Suggest Robust Economic Growth

The latest monthly reports from the Institute for Supply Management show that the nonmanufacturing and manufacturing sectors of the economy continued to expand at a robust pace in September. Details in both reports were decisively positive and suggest strong, broad-based growth in the economy.

The ISM’s nonmanufacturing index rose to a reading of 61.6, a new all-time high for this index which began in 2008. For this index, 50 is neutral, with readings above 50 suggesting expansion and readings below 50 suggesting contraction. Typically, the NMI ranges between 50 and 60, with dips below 50 during recessions. Historically, readings above 49.0 have suggested expansion of the overall economy. The September result is the 104th consecutive reading above 50.

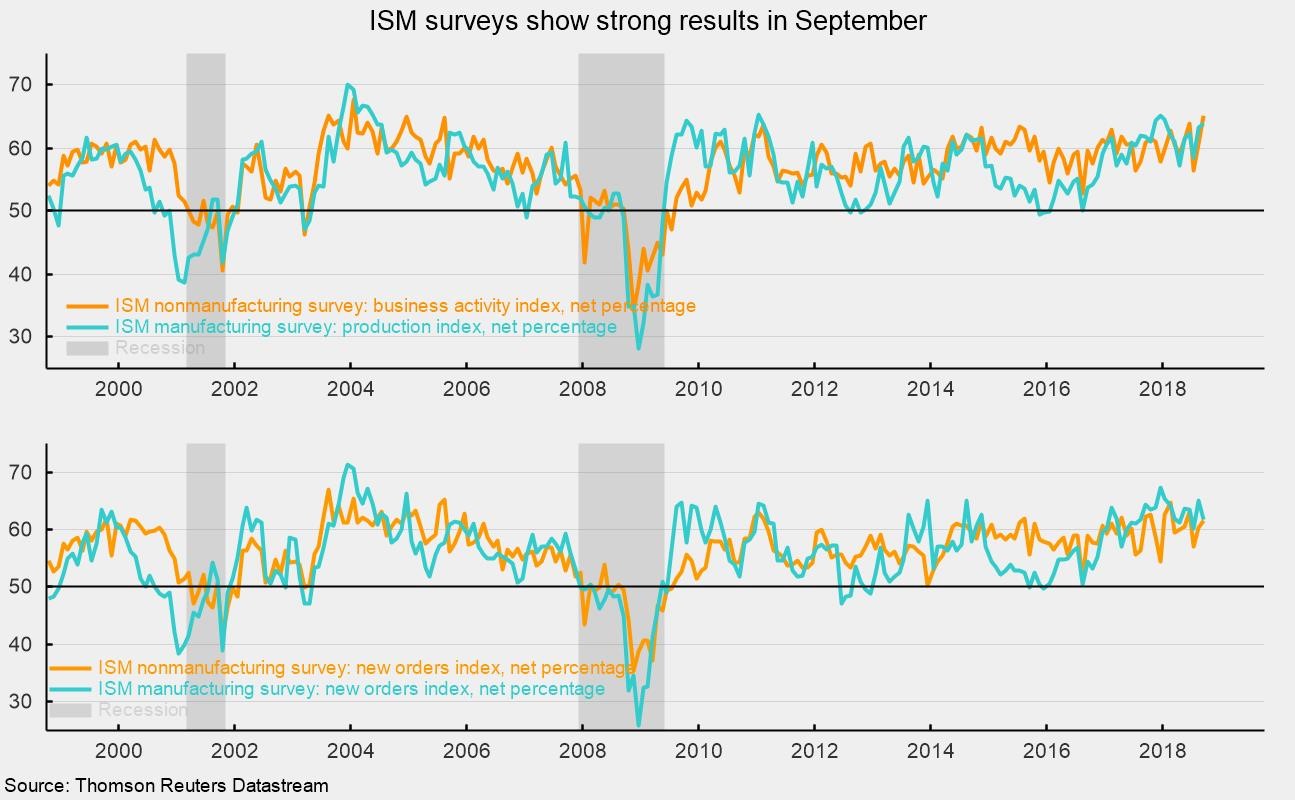

Among the key components of the NMI, the business-activity index (equivalent to the production index in the ISM manufacturing report) was 65.2 in September and is the 110th consecutive month above 50 (see chart). For the month of September, all 17 industries in the nonmanufacturing survey reported growth.

The nonmanufacturing new-orders index came in at 61.6, up from 60.4 in August. September was the 92nd month of readings above 50 (see chart). The new-export-orders index, a separate index that measures only orders for export, was 61.0 in September and has been above 50 for 20 consecutive months.

The nonmanufacturing employment index increased to 62.4 in September, versus 56.7 in August and has been expanding for 55 consecutive months. Thirteen industries reported expanding employment in September while 2 reported contraction.

Supplier deliveries, a measure of delivery times for suppliers to non-manufacturers, came in at 57.0, up from 56.0 in August. It suggests suppliers are falling farther behind in delivering supplies to non-manufacturers, and the slippage has accelerated a bit from the prior month.

The one component that raised concern in the nonmanufacturing report was the prices index. It rose to a reading of 64.2 in September versus 62.8 in August. September was the 31st month in a row that the prices index has been above 50. This result suggests nonmanufacturers are experiencing materials-costs increases.

The Manufacturing Purchasing Managers’ Index from the Institute for Supply Management registered a 59.8 reading in September, down from 61.3 in August. Despite the slight drop in the month, that is the 25th month in a row above the neutral 50 level. Typically, the PMI ranges between 45 and 65. Historically, readings above 43.2 suggest expansion for the overall economy. September is the 113th month in a row above 43.2.

Among the five components of the PMI (New Orders, Production, Employment, Supplier Deliveries, and Inventories), two showed stronger readings in September while three were slightly lower, though all five remain well above 50. The new-orders index came in at 61.8, down from 65.1 in August. September was the 33rd consecutive month of readings above 50. A new-orders index above 60 is strong by historical measures, and September marks the 17th month in a row that the index has been above 60 (see chart).

The production index was 63.9 in September, up from 63.6 in August and the highest since January (see chart). September marks the 25th month in a row above 50. Historically, readings above 51.5 are consistent with growth in the industrial-production index from the Fed. In September, 14 of the 17 industries surveyed reported growth while none reported a decrease in production.

The employment index rose to 58.8 in September, up from 58.5 in August. The favorable reading suggests employment in manufacturing likely increased again in September. Twelve industries reported growth in employment while 3 saw decreases.

Supplier deliveries, a measure of delivery times for suppliers to manufacturers, came in at 61.1, down from 64.5 in August. It suggests suppliers are still falling farther behind in delivering supplies to manufacturers but the pace has slowed modestly.

The inventories index was 53.3 in September, down from 55.4 in August, suggesting slower growth in inventories. The inventories index has been above 50 for 9 consecutive months.

Furthermore, backlogs of orders fell 1.8 percentage points to 55.7 percent in September from 57.5 in August while the new export-orders index came in at 56.0, up 0.8 percentage points from 55.2 in the prior month. Backlogs of orders have been growing for 20 straight months while new export orders have been growing for 31 consecutive months.

As with the nonmanufacturing survey, the one component that raises concern is the price index. The price index fell 5.2 percentage points to 66.9 in September from 72.1 in August. Despite the ease, the price index has been above 50 for 31 months. The continuing high level of this index suggests manufacturers remain under difficult pressure from rising input costs.

Lastly, the latest weekly initial claims for unemployment insurance fell 8,000 to 207,000 for the week ending September 29. The four-week average, calculated to help reduce volatility, rose 500 to 207,000. Initial claims remain near multi-decade lows and as a percentage of total employment, remain near all-time lows. The strong labor market continues to be the cornerstone of the economic expansion and supports strong consumer spending and upbeat consumer attitudes regarding the current economy.

Overall, today’s reports suggest strong positive momentum for the U.S. economy and support a favorable outlook for continued economic expansion.