ISM Nonmanufacturing Index Rises in November; Initial Claims trending higher

Following Monday’s report from the Institute for Supply Management suggesting that the manufacturing sector expanded at a faster pace in November, today’s report from the ISM suggests a similar pickup for the nonmanufacturing sector.

The ISM’s nonmanufacturing index rose to a reading of 60.7 from 60.3 in October. For this index, 50 is neutral, with readings above 50 suggesting expansion and readings below 50 suggesting contraction. Typically, the NMI ranges between 50 and 60, with dips below 50 during recessions. Historically, readings above 49.0 have suggested expansion of the overall economy. The November result is the 106th consecutive reading above 50.

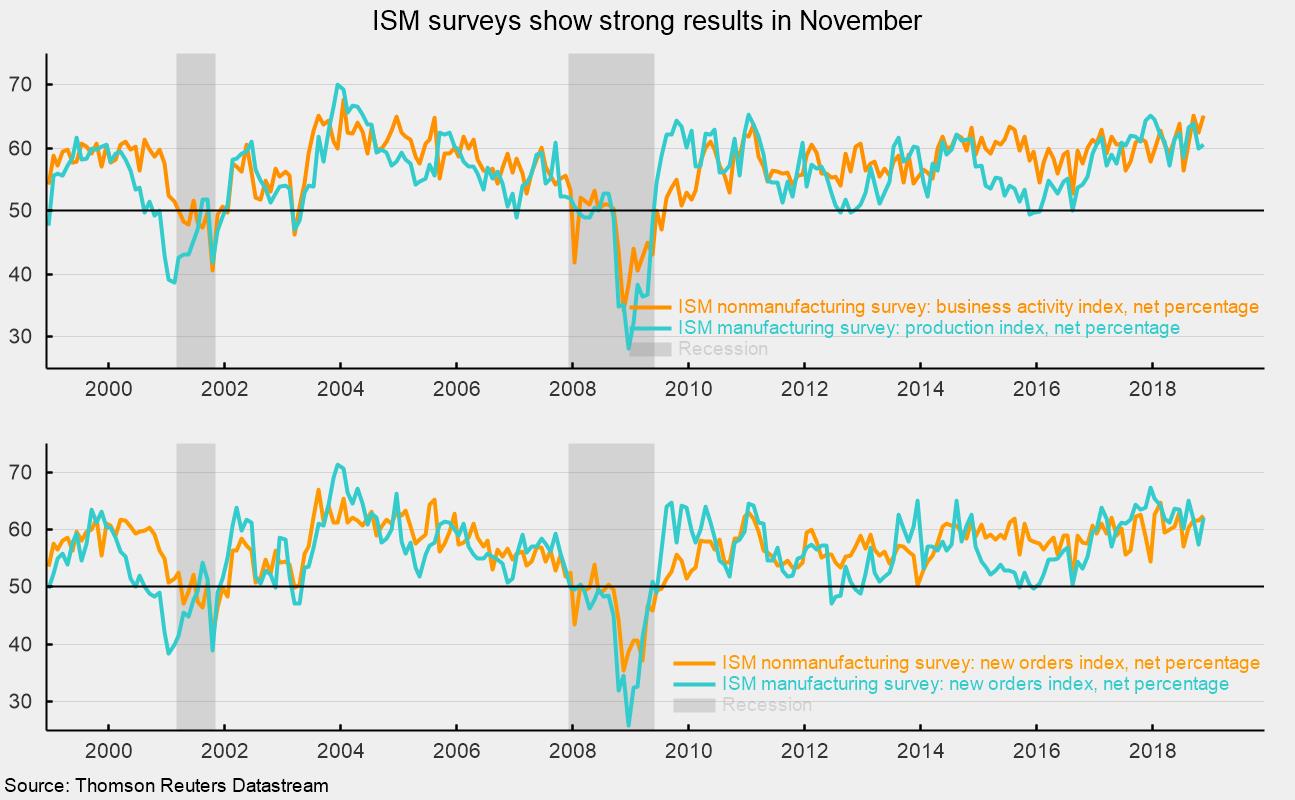

Among the key components of the NMI, the business-activity index (equivalent to the production index in the ISM manufacturing report) was 65.2 in November, up from 62.5 in October. Monday’s manufacturing report showed the production index came in at 60.6. For November, 17 industries in the nonmanufacturing survey reported growth while 1 reported contraction.

The nonmanufacturing new-orders index came in at 62.5, up from 61.5 in October. November was the 94th month with readings above 50. The new-export-orders index, a separate index that measures only orders for export, was 57.5 in November and has been above 50 for 22 consecutive months. The manufacturing new-orders index released on Tuesday came in at 62.1 last month. With all four indexes (activity and new orders for nonmanufacturing released today, and production and new orders for manufacturing released Monday) above 60, the overall message is ongoing economic strength (see chart).

The nonmanufacturing employment index decreased to 58.4 in November, versus 59.7 in October. The favorable readings from this and the manufacturing survey suggest employment likely increased in November. The Bureau of Labor Statistics will be releasing its own employment report for November tomorrow (Friday, December 7).

Supplier deliveries, a measure of delivery times for suppliers to non-manufacturers, came in at 56.5, down from 57.5 in October. It suggests suppliers are falling farther behind in delivering supplies to non-manufacturers, but the slippage has decelerated a bit from the prior month.

The one component that raised concern in the nonmanufacturing report was the prices index. It rose to a reading of 64.3 in November. November was the 33rd month in a row that the prices index has been above 50. This result suggests nonmanufacturers are experiencing materials-costs increases. The price index in the ISM manufacturing report fell sharply in November to a still-elevated 60.7, versus 71.6 in October.

Today’s report from the Institute of Supply Management suggests the nonmanufacturing sector continued to grow in November. That performance is in line with the report for the manufacturing sector and other recent data that point to ongoing expansion for the overall economy.

The latest weekly initial claims for unemployment insurance fell 4,000 to 231,000 for the week ending November 24. The four-week average, calculated to help reduce volatility, rose 4,250 to 228,000. Claims have drifted higher in recent weeks after hitting a low of 202,000 on September 20. The rise may be nothing more than normal volatility, or it may be related to seasonal adjustment, but it may also reflect elevated uncertainty regarding economic policy. Still, claims remain at historically low levels. The strong labor market continues to be the cornerstone of the economic expansion and is complementing strong consumer spending and upbeat consumer attitudes regarding the current economy.