ISM Nonmanufacturing Index Posts Record Gain in June

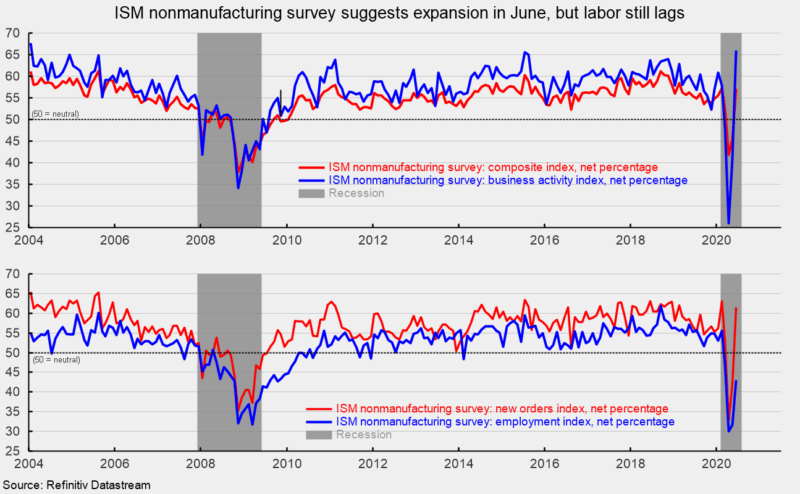

The Institute for Supply Management’s nonmanufacturing index posted a record 11.7 percentage-point increase in June, rising to a reading of 57.1 from 45.4 in the prior month. The June result follows two consecutive months below the neutral 50 threshold including a record monthly decline in April (see top chart). The results suggest expansion for the services sector and the broader economy. They are also consistent with other signs of an emerging rebound, coming amid efforts to ease government-imposed restrictions on people and businesses implemented to slow the spread of COVID-19. However, the emerging rebound is at risk as new cases of COVID-19 surge around the country and policymakers consider slowing the easing of lockdown restrictions or even possibly reinstating some forms of lockdown requirements.

Among the key components of the nonmanufacturing index, the business-activity index (comparable to the production index in the ISM manufacturing report) surged to 66.0 in June, up from 41.0 in May and 26.0 in April (the lowest reading since the survey began in 1997, see top chart). The June result is the highest since January 2004. For June, 15 industries in the nonmanufacturing survey reported expansion versus 1 reporting contraction.

The nonmanufacturing new-orders index rose to 61.6 from 41.9 in May and 32.9 in April (see bottom chart). Fifteen industries reported expansion in new orders in June while just one reported contraction. The new-export-orders index, a separate index that measures only orders for export, was 58.9 in June, versus 51.4 in May and 36.3 in April (the lowest since November 2008.) Seven industries reported growth in export orders, equaling the seven industries reporting declines.

The nonmanufacturing employment index came in at 43.1 in June, up from 31.8 in May and 30.0 in April. Employment remains one of the weaker areas of the economy despite the large gain in jobs reported in the June jobs report.

Supplier deliveries, a measure of delivery times for suppliers to nonmanufacturers, came in at 57.5, down from 67.0 in the prior month and 78.3 in April. It suggests suppliers are falling further behind in delivering supplies to nonmanufacturers, though the slippage has decelerated from the prior two months. Typically, slower deliveries are consistent with a strong economy but in this environment, the slower deliveries are a result of production constraints and transportation difficulties, not strong economic conditions.

The latest report from the Institute of Supply Management suggests that the nonmanufacturing sector and the broader economy expanded in June following two months of contraction. The results are consistent with the ISM manufacturing survey suggesting the economy may have bottomed, setting the stage for growth. However, significant risks remain as challenges containing the spread of COVID-19 continue.

The emerging recovery is supported and encouraged by the easing of restrictions placed on people and businesses around the country. However, as COVID-19 cases rise in many states, it is possible that consumers may be reluctant to return to pre-pandemic spending patterns. Furthermore, it is possible that policymakers may decide to slow down the pace of easing restrictions or possibly reinstate some lockdown measures. Either development would likely slow the pace of economic recovery.

The focus going forward will be to monitor the progression of the pandemic, consumer behavior, and policy response. Furthermore, identifying areas of the economy that are showing signs of recovery versus those that may be burdened with longer-lasting damage or facing new or accelerating pressures for structural change will be an important element in understanding medium-term economic growth.