ISM Manufacturing Survey Posts Strong Results in October

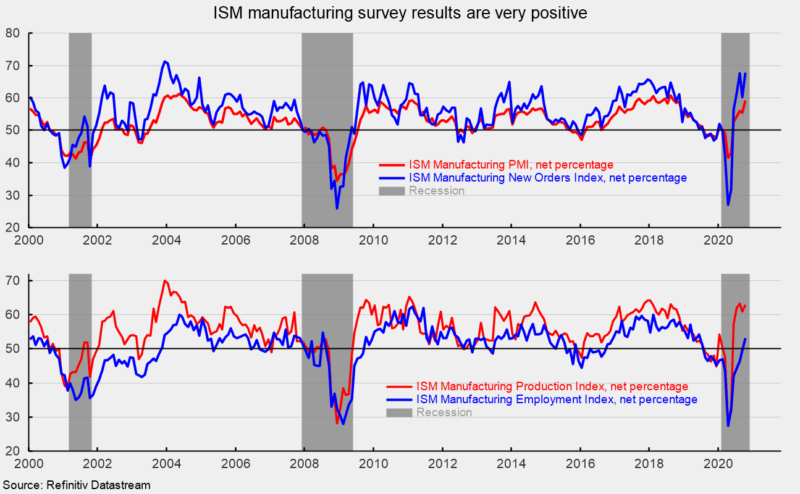

The Institute for Supply Management’s Manufacturing Purchasing Managers’ Index rose again in October, posting a 59.3 percent reading for the month, up from 55.4 percent in September. The latest result is the fifth consecutive reading above the neutral 50 threshold and the highest level since September 2018 (see top of first chart). Overall, the report notes, “The manufacturing economy continued its recovery in October. Survey Committee members reported that their companies and suppliers continue to operate in reconfigured factories; with every month, they are becoming more proficient at expanding output. Panel sentiment was optimistic (two positive comments for every cautious comment), a slight decrease compared to September.”

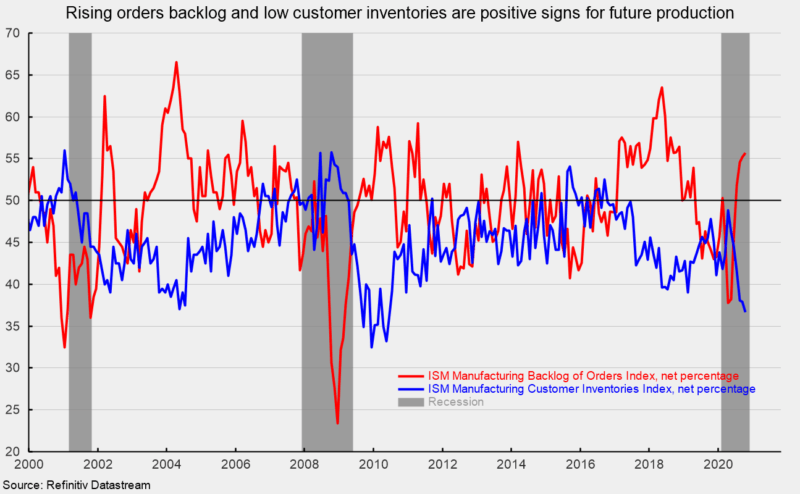

Among the key components, the New Orders Index came in at 67.9 percent, up from 60.2 percent in September, and the highest result since January 2004 (see top of first chart). Sixteen of eighteen industries in the survey reported growth in new orders in October. The New Export Orders Index came in at 55.7 percent in October, up 1.4 percentage points from a 54.3 percent result in September. The Backlog-of-Orders Index came in at 55.7 percent in October, up from 55.2 percent in the prior month and the highest level since November 2018 (see second chart).

The Production Index registered a 63.0 percent result in October, up from 61.0 percent in September and the fourth month above 60 (see bottom of first chart). Eleven industries reported growth in the latest month, including: nonmetallic mineral products, fabricated metal products, plastics and rubber products, primary metals, food, beverage and tobacco products, machinery, paper products, transportation equipment, chemical products, electrical equipment, appliances and components, and computer and electronic products.

The Employment Index posted another solid gain, rising 3.6 percentage points to 53.2 percent in October, versus 49.6 percent in September and the first month above the neutral 50 threshold since July 2019 (see bottom of first chart). The Bureau of Labor Statistics’ Employment Situation report for October is due out on Friday, November 6th. Consensus expectations are for a gain of 600,000 nonfarm-payroll jobs including the addition of 50,000 jobs in manufacturing. The unemployment rate is expected to fall to 7.6 percent from 7.9 percent in September.

The Supplier Deliveries Index, a measure of delivery times from suppliers to manufacturers, rose to 60.5 percent from 59.0 percent in September. Slower supplier deliveries are usually consistent with stronger manufacturing activity. According to the report, “Suppliers continue to struggle to deliver, with deliveries slowing at a faster rate compared to September. Transportation challenges and continuing challenges in supplier labor markets are still constraining production growth. The Supplier Deliveries Index reflects the difficulties suppliers continue to experience due to COVID-19 impacts amid expanding new orders and production. Supplier constraints are not expected to diminish soon and represent a continuing hurdle to production output and inventories growth.”

The Prices Index rose to 65.5 percent in October from 62.8 percent in September and the highest level since October 2018. Fifteen industries paid higher prices for raw materials in October. Higher prices were reported for: aluminum, aluminum products, base oils, copper, corn, corrugate, ethylene, freight, high-density polyethylene products, lumber, plastic products, plastic resins, polyethylene film, polyethylene resins, polyethylene terephthalate bottles, polypropylene, polyvinyl chloride, precious metals, propylene, soybean products, steel, cold rolled steel, galvanized steel, hot rolled steel, steel products, and wood pallets.

Customer inventories in October are still considered too low, with the index remaining below 50 at 36.7 percent versus 37.9 percent in the prior month and the lowest level since June 2010 (index results below 50 indicate customers’ inventories are too low; see second chart). The index has been below 50 for 49 consecutive months. Insufficient inventory may be a positive sign for future production.