ISM Manufacturing PMI Rose in November With Most Components Suggesting Faster Expansion

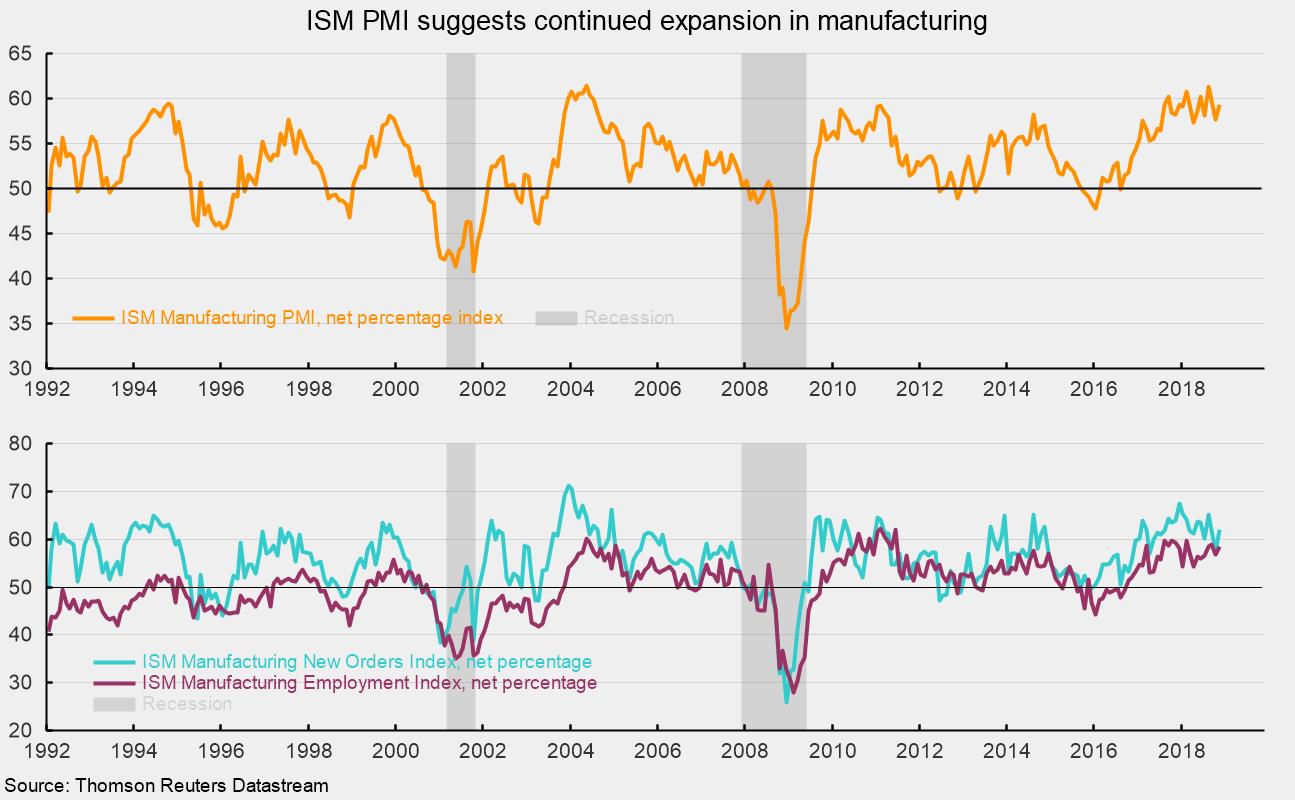

The Manufacturing Purchasing Managers Index from the Institute for Supply Management registered a 59.3 percent reading in November, up from 57.7 in October (see top chart). The index has been bouncing around in the 57–61 range since August 2017, an unusually long period, putting the 12-month average at 59.2, the highest since 2004 and a very positive sign for the manufacturing sector. November is the 27th month in a row above the neutral 50 level and the 115th above the 43.2 percent threshold consistent with expansion in the overall economy. While demand, production, and employment remain strong, supply-chain constraints and rising input costs remain significant issues for manufacturers.

Among the key components of the Purchasing Managers Index, the New Orders Index came in at 62.1 percent, up from 57.4 in October. November was the 35th consecutive month with readings above 50, and the rebound makes November the 18th reading above 60 in the last 19 months (see bottom chart).

The production index was at 60.6 percent in November, up from 59.9 in October. November marks the 27th month in a row above 50. Historically, readings above 51.5 are consistent with growth in the industrial-production index from the Fed. In November, 11 industries surveyed reported growth while 3 reported a decrease in production.

The employment index rose to 58.4 percent in November, up from 56.8 in October (see bottom chart). The stronger result suggests employment in manufacturing likely increased in November. The Bureau of Labor Statistics’ Employment Situation report for November is due out on Friday, December 7. Consensus expectations are for 200,000 new nonfarm-payroll jobs including 20,000 new jobs in manufacturing.

Supplier deliveries, a measure of delivery times from suppliers to manufacturers, came in at 62.5, down from 63.8 in October. November was the 26th consecutive month above 50, and the results suggest suppliers delivering to manufacturers are still falling behind but at a somewhat slower pace.

The prices index eased considerably, though it is still at an elevated level. The index fell 10.9 percentage points to 60.7 in November from 71.6 in October. However, the index has been trending higher since early 2016 and has been above 50 for 33 months. These results suggest manufacturers are experiencing materials-costs pressures. Some inputs may be pressured by both strong demand and higher tariffs.

Customer inventories in November are still considered too low, with the index falling to 41.5 from 43.3 in the prior month (index results below 50 indicate customers’ inventories are too low). Among manufacturers’ customers, only one industry reported excessive inventories: electrical equipment, appliances, and components.

Today’s report from the Institute for Supply Management suggests the manufacturing sector continued to grow in November. Despite some month-to-month volatility, solidly positive readings for new orders, production, and employment suggest a positive outlook for manufacturing. Those results are in line with other recent data that point to ongoing expansion for the overall economy.