ISM Indexes Suggest Manufacturing Recession Continues

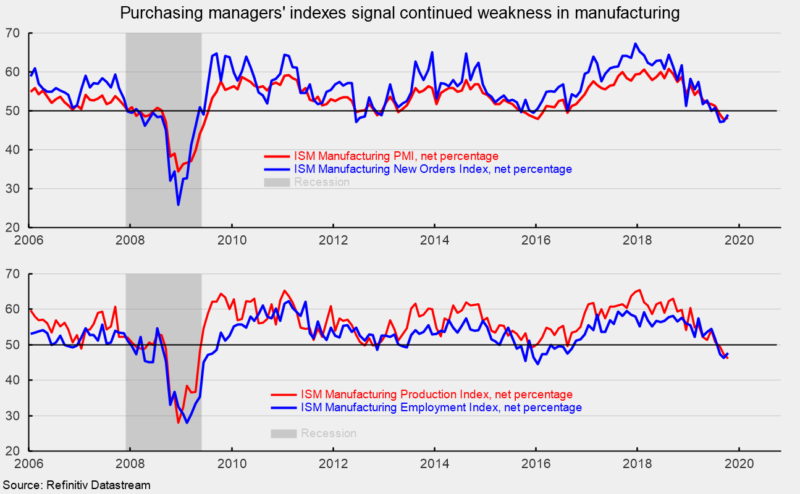

The Institute for Supply Management’s manufacturing PMI composite index remained below the neutral 50 level for the third consecutive month in October, rising to 48.3 from 47.8 in September (see top chart). For this index, 50 is neutral, with readings above 50 suggesting expansion and readings below 50 suggesting contraction in manufacturing. Historically, readings above 42.9 have suggested expansion of the overall economy. The October result is the 126th consecutive month above 42.9 but the third straight month below 50.

Among the key components of the manufacturing index, the production index was 46.2 in October, down from 47.3 in September, suggesting manufacturing output slowed for a third month and the pace of decline accelerated (see bottom chart). For October, just six industries in the manufacturing survey reported growth while 11 reported contraction.

The manufacturing new-orders index came in at 49.1, up from 47.3 in September (see top chart). The index has posted three consecutive months below 50 for the first time since 2012. Five industries reported growth in new orders in October versus 10 industries with declining new orders.

The new-export-orders index, a separate index that measures only orders for export, was 50.4 in October, the first reading in positive territory following three months below neutral. The weak results over the past few months are consistent with slowing global economic activity and deteriorating trade relations.

The manufacturing employment index increased to 47.7 in October from 46.3 in September. The employment index has also posted three consecutive months below neutral.

Supplier deliveries, a measure of delivery times for suppliers to manufacturers, came in at 49.5, down from 51.1 in September. It suggests suppliers are shortening delivery times of supplies to manufacturers. This is the first reading below 50 since February 2016.

Backlogs of orders, prices and imports all showed readings below the neutral 50 level in October, with backlogs at 44.1, prices at 45.5, and imports at 45.3.

Today’s report from the Institute of Supply Management suggests that the manufacturing sector continued to contract in October. Comments from the survey participants suggest business confidence is “more cautious than optimistic.” Furthermore, global trade remains a significant issue for many manufacturers and sentiment overall remains cautious regarding growth prospects in the short term.