Is the U.S. the right geographical benchmark for the Fed?

Last Wednesday, the Federal Reserve announced that the QE policy has reached its end. After commenting on the improvement of U.S. economic indicators, the announcement states that “[a]ccordingly, the Committee decided to conclude its asset purchase program this month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee’s holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.” (italics are mine).

A short commentary on the effects of QE by Sam Bowman and George Selgin can be found here. I want, however, to focus on a different and more general problem. Note that the Fed’s decision is based on the U.S. economic performance. The U.S. dollar, however, is used internationally, either for exchanges or as reserves by other central banks. This means that in practice, the U.S. dollar is not a U.S. currency, but an international currency, and therefore the Fed is not the U.S. monetary authority, but an international monetary authority. It follows, then, that by focusing mostly in the U.S. economy the Fed is biasing its sample of economic performance.

This issue was brought by a few economists with the 2008 subprime crisis. John Taylor, for instance, in his book Getting of Track calls attention to the feedback effects that the U.S. monetary policy produces on other major central banks. When a big central bank, like the Fed, goes into an expansionary monetary policy, the best response by other major central banks might be to follow a similar policy to avoid exchange rate appreciation. The result is an international setting of easy monetary policy. Couple this with the price level as the main target (explicit or implicit) of central banks and you get, as Axel Leijonhufvud argues, the feedback loop broken. Because the domestic price level is not independent of other central banks exchange rate policies, to follow domestic variables by a central banks that manage an international currency might bias what the optimal policy should look like. For instance, cheap imports from China happened because China’s central bank did not allows its currency to appreciate against the U.S. dollar after 2002.

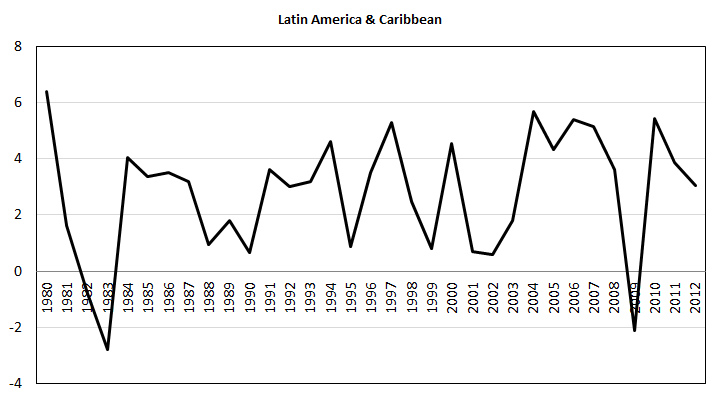

The international effects of the Fed’s monetary policy are not veiled. Look, for instance, at Latin America’s business cycle. Research has found that this regions is particularly sensitive to the Fed’s monetary policy. The following chart (p. 430) shows three decades of real GDP growth rates for the whole Latin America region. The graph shows that the two largest crisis of the region as a whole occurred in the early 1980s and in 2009. Either by using the Taylor Rule or Selgin, Beckworth, and Bahadir’s productivity gap as a benchmark of optimal monetary policy deviation, both crisis in Latin America occurred after the two largest deviation by Fed’s monetary policy from its optimal path.

Let’s, for the sake of argument, assume that the world is composed only by the U.S. and another country called Latin America. Think now what this result means for the NGDP Targeting prescription. Assuming, also, that NGDP is the right nominal target (which may not be the case), should the Fed target U.S. NGDP or U.S. plus Latin America’s NGDP? I can’t say, at least for what I’ve seen, that NGDP Targeting Market Monetarists have pointed the potential issues of wrongly choosing what NGDP is being targeted.