Initial Unemployment Claims Register Lowest Talley Since March

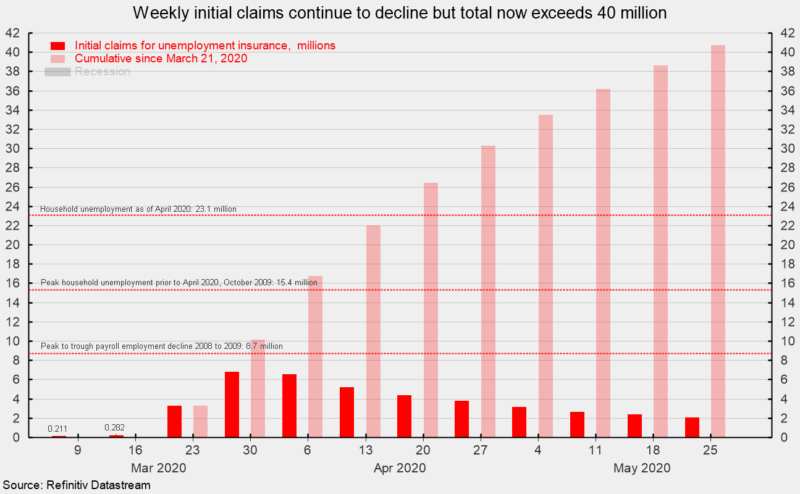

Initial claims for unemployment insurance totaled 2.12 million for the week ending May 16, marking the tenth consecutive week of massive layoffs (see chart). However, claims have slowed for the eighth straight week after registering 6.87 million for the week ending March 28.

The current 10-week total of 40.77 million initial claims is about four and a half times the total 8.7 million job losses that occurred over 25 months versus during the Great Recession (see chart). The current total is also two and a half times the 15.4 million peak number of unemployed people for the Great Recession, as measured in the household survey portion of the monthly Employment Situation report (see chart).

The national Employment Situation report for April was released on Friday, May 8 and showed a drop of 20.5 million in nonfarm jobs while the unemployment rate surged to 14.7 percent (though the Bureau of Labor Statistics noted that improper responses likely underreported the rate and is likely about 5 points higher, near 20 percent); total unemployed in April was 23.1 million. The previous cycle peak in the unemployment rate was 10 percent in October 2009 while the highest unemployment rate since 1950 came in November 1982 at 10.7 percent. Though data collection was much less reliable, the unemployment rate following the Great Depression was estimated to have peaked at about 25 percent in 1933.

Massive layoffs as a result of government shutdown policies have occurred over the last ten weeks, crushing the labor market, consumer confidence, and retail spending, sending the economy into recession. Despite massive government spending and extraordinary monetary policy efforts, the outbreak of COVID-19 and ensuing policy responses brought the longest economic expansion in U.S. history screeching to a sudden end. Extraordinarily weak economic reports are likely to continue over the next several months, but as government restrictions are eased, signs of healing are likely to emerge.