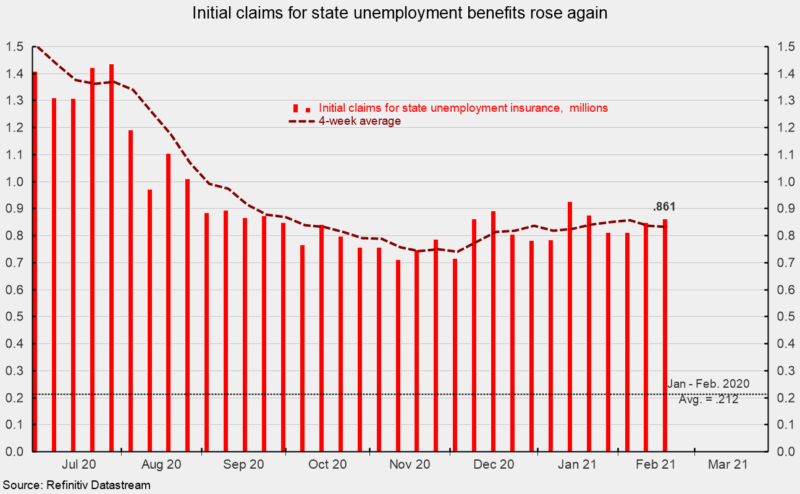

Initial Claims Hold Above 800,000 for Sixth Consecutive Week

Initial claims for regular state unemployment insurance totaled 861,000 for the week ending February 13, up 13,000 from the previous week’s upwardly revised tally of 848,000 (see first chart). Claims have been above the 800,000 level for six consecutive weeks and nine of the past eleven weeks since posting a 716,000 result for the week of November 28. Initial claims have continued to run in the 700,000 to 1 million range for 25 consecutive weeks and remain well above the pre-pandemic level of 212,000 in early 2020 (see first chart).

The four-week average fell 3,500 to 833,250, the second weekly decline in a row. However, the four-week average has been above the 800,000 level for 10 consecutive weeks. Persistent initial claims at such a historically high level remain a threat for the labor market recovery and the economy.

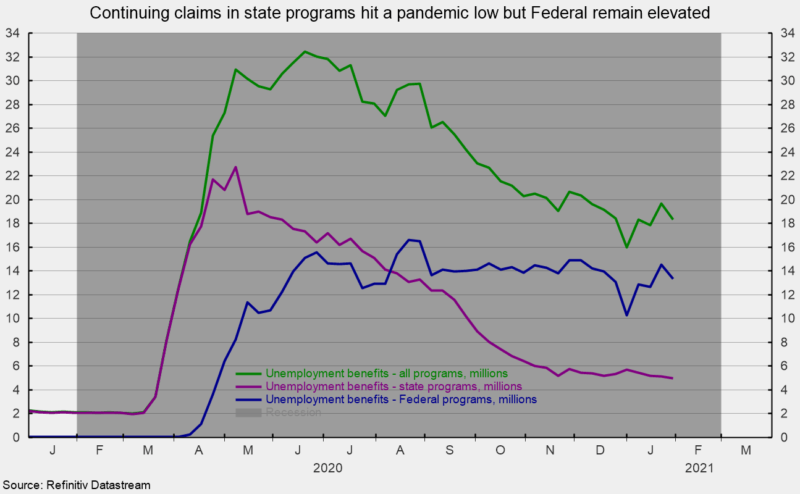

The number of ongoing claims for state unemployment programs totaled 5.003 million for the week ending January 30, down 153,878 from the prior week. State programs had been trending lower since early March, but the downward trend has turned to a flattish trend since the week ending November 21 decreasing by an average of just 21,067 0.3 percent per week over the past 10 weeks (see second chart). For the same week in 2019, ongoing claims were 2.149 million.

Continuing claims in all federal programs fell in the latest week after a jump in the prior week, coming in at 13.337 million for the week ending January 30 (see second chart). Since the beginning of June 2020, continuing claims in all Federal programs have averaged 14.049 million.

The total number of people claiming benefits in all unemployment programs including all emergency programs was 18.340 million for the week ended January 30, down 1.326 million from the prior week.

Government restrictions on consumers and businesses remain a significant threat to the outlook for economic growth. The development and distribution of vaccines is a very positive factor and should eventually lead to sharply less government restrictions. In the meantime, the claims data combined with the disappointing jobs report for January suggest the labor market remains fragile. The longer the virus continues to spread (along with the possibility of mutations prolonging the outbreak), consumers remain restricted, and businesses remain closed or limited, the more uncertain a labor market recovery becomes and the higher the probability of a slow and drawn-out economic recovery.