Initial Claims for Unemployment Benefits Shrank Again but Remain High

Labor-market conditions remain in flux as some workers are getting called back to work while others are still being cut. The last two jobs reports showed big gains in employment and big drops in unemployment, yet new claims for unemployment benefits continue at historically high levels.

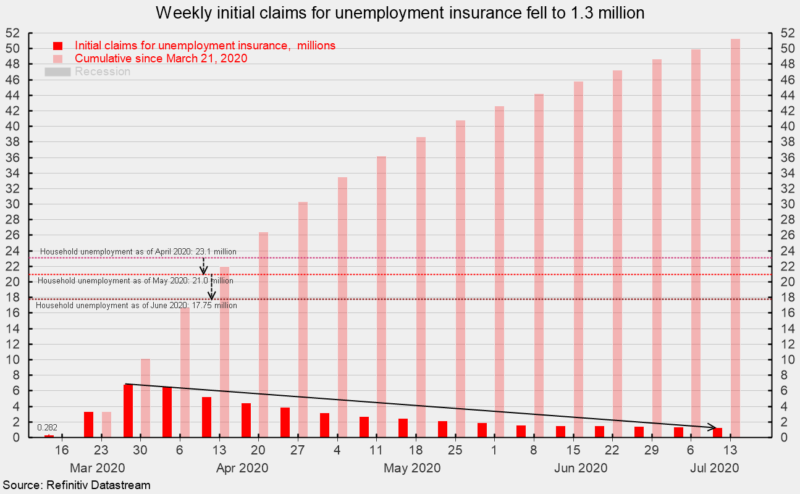

Initial claims for unemployment insurance totaled 1.30 million for the week ending July 11, marking the seventeenth consecutive week of historically massive layoffs following the implementation of business and consumer lockdowns intended to fight the COVID-19 pandemic (see chart). However, claims have slowed for the fifteenth straight week after registering 6.87 million for the week ending March 28 and have been below 1.5 million for the last four weeks. However, the declining trend in initial claims appears to be flattening with claims holding at historically high levels. Recent news stories have suggested that the claims numbers may be inaccurate or inflated as government processors attempt to catch up on backlogs of filings.

The national Employment Situation report for June was released on Thursday, July 2 and showed a gain of 4.8 million jobs following a 2.7 million rise in May, as reported in the establishment survey portion of the report. The total number of officially unemployed fell to 17.8 million in June, a drop of 3.2 million from the 21.0 million in May (and from 23.1 million in April – see chart). The number of officially unemployed in February before lockdowns were implemented was just 5.8 million, as reported in the household survey portion of the report.

The unemployment rate fell to 11.1 percent (though the Bureau of Labor Statistics noted that improper responses likely underreported the rate and is likely about 1 point higher, near 12 percent) versus 13.3 percent in May (and nearly 20 percent if corrections were made to the April number). The previous cycle peak in the unemployment rate was 10 percent in October 2009 while the highest unemployment rate since 1950 came in November 1982 at 10.7 percent. Though data collection was much less reliable, the unemployment rate following the Great Depression was estimated to have peaked at about 25 percent in 1933.

The sharp gains in employment, sharp drops in unemployment and the declining but still historically high level of initial claims appear somewhat contradictory, suggesting either problems with data or enormous churn in the labor market, or perhaps a bit of both. Regardless, with new COVID-19 cases surging around much of the country, the emerging recovery is at risk from consumer retrenchment and reinstated lockdown policies.

The next Employment Situation report covering the month of July is due out on Friday, August 7.