Industrial Production Rebounds but Growth Remains Weak

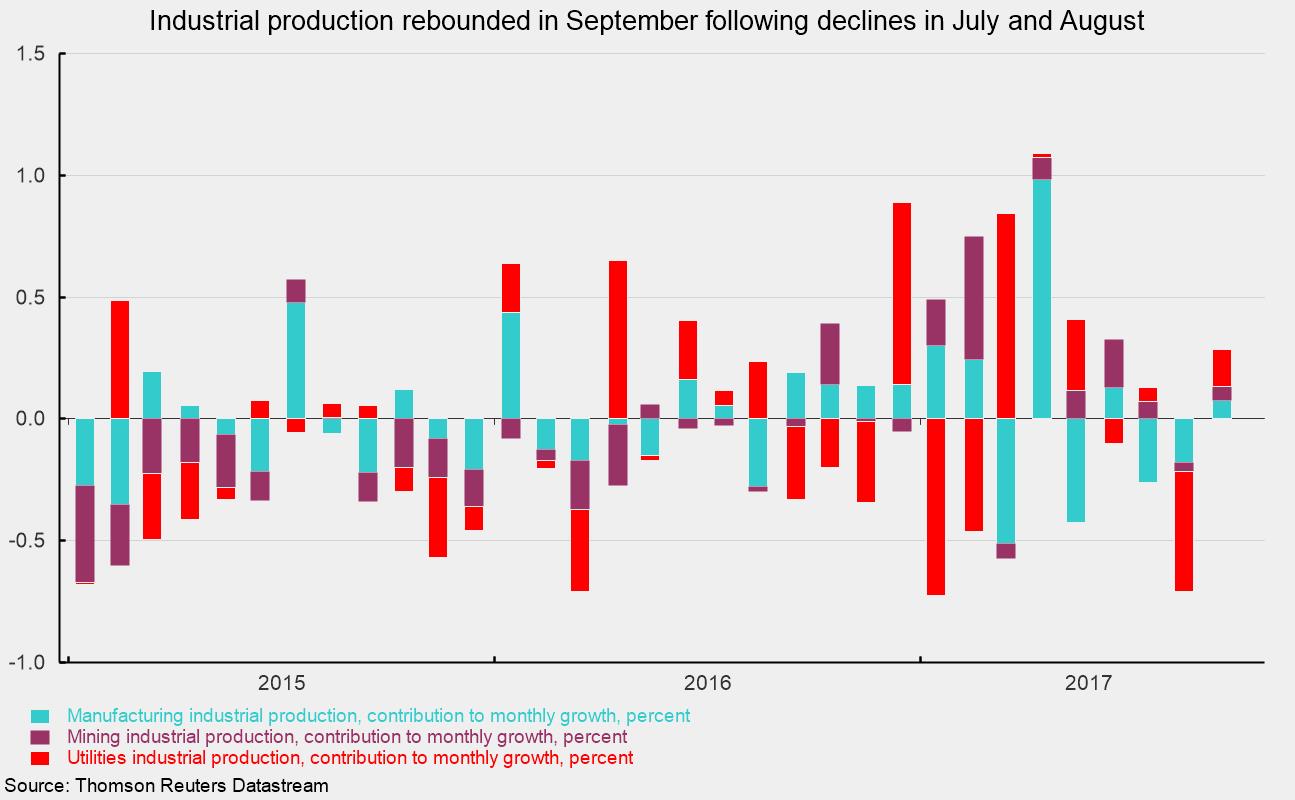

Industrial output from the nation’s factories, mines, and utilities rose 0.3 percent in September following a 0.7 percent decline in August. According to the report, the effects from hurricanes continue to restrain output, reducing September growth by about ¼ percentage point and growth for the entire third quarter by at least 2 percentage points.

Among the major sectors of industrial production, manufacturing, which accounts for 75 percent of total industrial production, rose 0.1 percent in September, contributing about 7 basis points to the monthly rise while mining output rose 0.4 percent in the month (contributing about 6 basis points) and utility output jumped 1.5 percent (adding about 15 basis points). Over the past year, total industrial production is up 1.6 percent with manufacturing up 1.1 percent, mining up 9.8 percent but utility output down 4.1 percent.

Within manufacturing, durable-goods production rose 0.8 percent led by wood products, computers and electronics, and motor vehicles. Nondurable-goods production rose 0.2 percent as petroleum and coal production jumped 2.1 percent and textiles production rose 0.9 percent. Those gains were partially offset by a 6.0 percent drop in apparel and leather goods production and a 1.9 percent drop in printing production.

Capacity utilization, the percent of potential output, rose to 76 percent overall from 75.8 percent in the prior month. Manufacturing utilization held steady at 75.1 percent while mining utilization rose to 83.5 percent and utility utilization jumped to 74.9 percent from 73.7 percent in the prior month. Manufacturing utilization has been in a slow drift down over the past few decades but has remained relatively stable since 2012.

Overall, data continue to be impacted by distortions from hurricanes. Despite the distortions, the broad trend of very slow growth appears to be intact, suggesting support for continued economic expansion.