Industrial Output Posted A Solid Gain in October

Industrial production rose 1.1 percent in October following a drop of 0.4 percent in September. Industrial output has risen in five of the last six months. However, the gains were not enough to overcome the back-to-back declines of 4.4 percent and 12.7 percent in March and April, respectively. Over the past year, industrial production is down 5.3 percent and 4.8 percent below the pre-pandemic level in February.

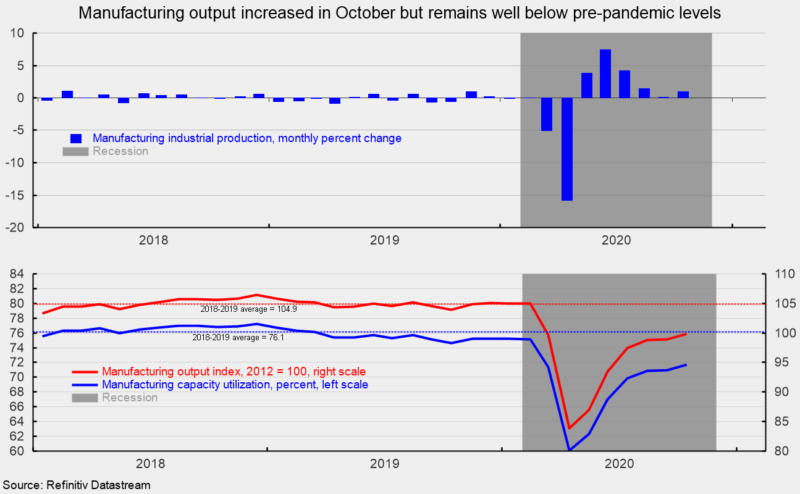

Manufacturing output, which accounts for about 75 percent of total industrial production, rose 1.0 percent after a gain of 0.1 in September (see top of first chart). Manufacturing output has risen for six straight months and follows declines of 5.0 percent and 15.8 percent in March and April. The six consecutive gains still leave manufacturing output 3.9 percent below year-ago levels and 4.6 percent below the 2018-2019 average index level (see bottom of first chart).

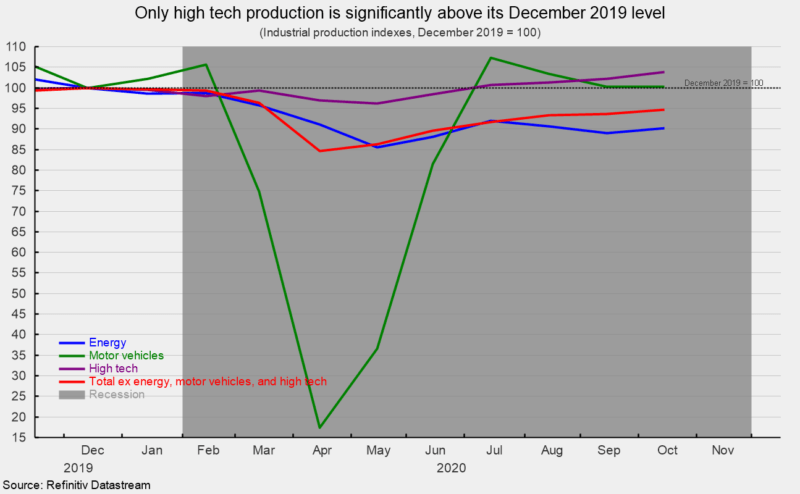

The gains in industrial production in October were generally widespread across nearly all major market and industry groups. Among the key segments, energy production rose 1.3 percent for the month after declines of 1.9 percent in September and 1.5 percent in August. From a year ago, energy production is still down 10.8 percent and 9.9 percent below December 2019 (see second chart).

Motor-vehicle production, one of the hardest hit industries during the lockdowns, fell 0.1 percent in October after drops of 3.0 percent in September and 3.7 percent in August. Motor-vehicle production is up 6.9 percent from a year ago and 0.2 percent above December 2019 (see second chart).

High-tech industries output rose by 1.7 percent in October, the fifth monthly gain in a row and is up 6.2 percent versus a year ago. All other industries combined gained a healthy 1.1 percent in October but are still 4.4 percent below October 2019. Compared to pre-pandemic levels, high tech is up 3.9 percent versus the December 2019 level while total production excluding energy, motor vehicles and high-tech index (all other) was still 5.1 percent below the December 2019 level (see second chart).

Total industrial utilization rose to 72.8 percent in October from 72.0 percent in September. That is well below the long-term (1972-2019) average utilization of 79.8 percent. Manufacturing utilization rose 0.7 percentage points to 71.7 percent, well below the long-term average of 78.2 percent and below the 2018-2019 average of 76.1 percent (see bottom of first chart).

October data suggest that while manufacturing output continues to recover, output and utilization remain soft and it may take a while longer to return to pre-pandemic levels. Furthermore, reinstated government restrictions have the potential to delay the economic recovery.