In the ICO Race, First May Not Be Best

A recent article on the news site Bitcoin.com declares that we are “past the point of peak token.” Startups based on blockchain technology seem like they’re sprouting up everywhere, pushing the limits of the ICO model.

ICOs, or initial coin offerings, are a way for new firms to get funding from a wide base of investors, like IPOs, except that the tokens they sell usually entitle the holder to some future product or service from the company rather than a direct equity share in order to avoid current SEC regulations.

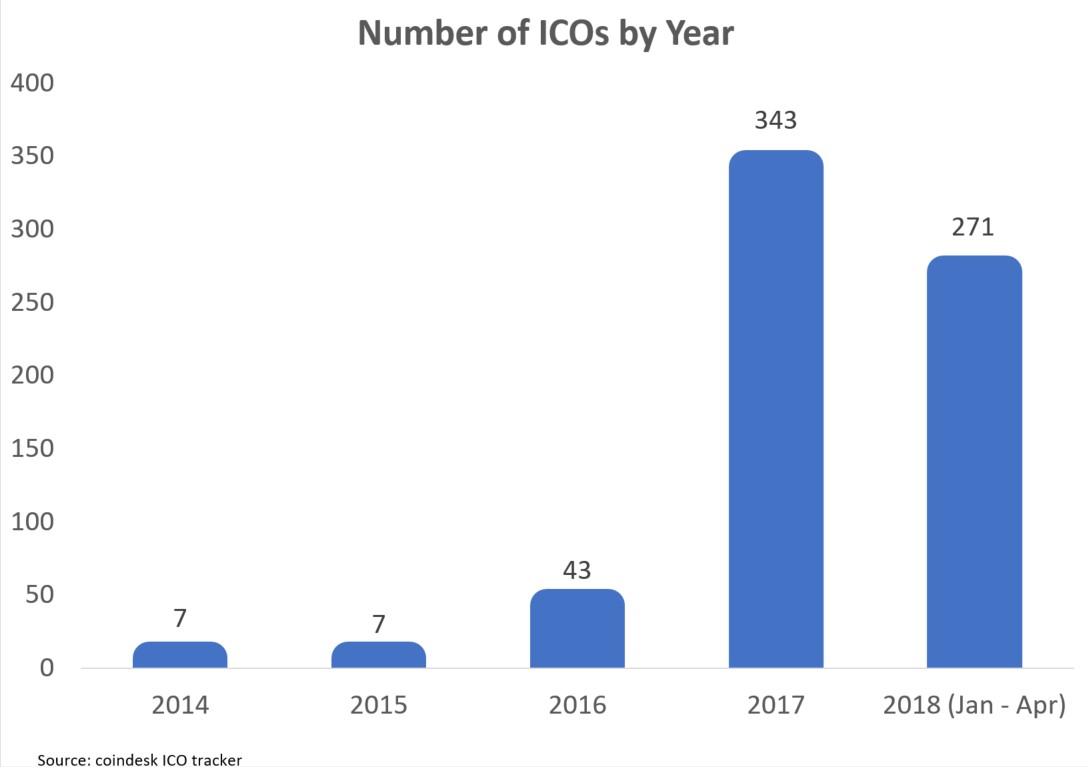

The graph below, using data from the site CoinDesk, tells you all you need to know about the current deluge of ICOs.

Telling an entrepreneur with a great idea in a blossoming industry to sit on their hands for a couple of years is a tough sell, but there are reasons why sitting down and taking a deep breath today might lead to greater success down the road.

At the Gates

The most zealous enthusiasts of blockchain technology often assume that getting rid of all intermediaries is a good thing. They see the ICO model as eliminating gatekeepers that pronounce from on high who can and cannot seek funding from the public. The enthusiasts are correct, up to a point. Costs of initial and continued compliance with SEC regulations are high, not to mention getting listed on a prominent stock exchange.

But eliminating these gatekeepers is not a win-win. They also serve the crucial function of curation. By analogy, I’m a huge music fan, but I certainly don’t have the time to listen to the literally hundreds of new albums released each week. So I turn to a few websites and blogs that I generally trust, and let them make recommendations.

My use of these gatekeepers for new music comes at a cost: I’m certain to miss an obscure band somewhere that I’d absolutely love if only I heard it. And yes, just as with the SEC and stock exchanges, people complain that a few music publications become kingmakers, determining the success of musicians’ careers on a whim. But these costs are certainly justified by the time I save.

As the ICO model matures, gatekeepers will inevitably emerge. Popular crypto exchanges already have high listing fees that mean not just anyone off the street can hold an ICO. But more discerning rules about public documentation, for example, would go far to engender trust. As AIER President Ed Stringham has shown, stock exchanges have had great success governing themselves privately.

Another promising idea is the ICO mutual fund. For a fee, I pay someone who specializes in the field to pick the most promising tokens on the market.

Some in the blockchain community associate free markets with total disintermediation. That’s just not right. All of the examples above involve that hallmark of free markets, the division of labor. These institutions will emerge over time because they are advantageous, and will create an environment in which the best ideas more reliably rise to the top.

Future Starts Slow

People often adopt the false narrative that startup bubbles are about people irrationally buying into bad ideas. But one big driver of this boom-bust cycle is simply timing. The blockchain adoption curve for software developers is quite a bit steeper than it is for regular consumers. Your blockchain-based application might be a billion-dollar idea, but consumers might also need a few years to develop enough intuition about this technology to appreciate it.

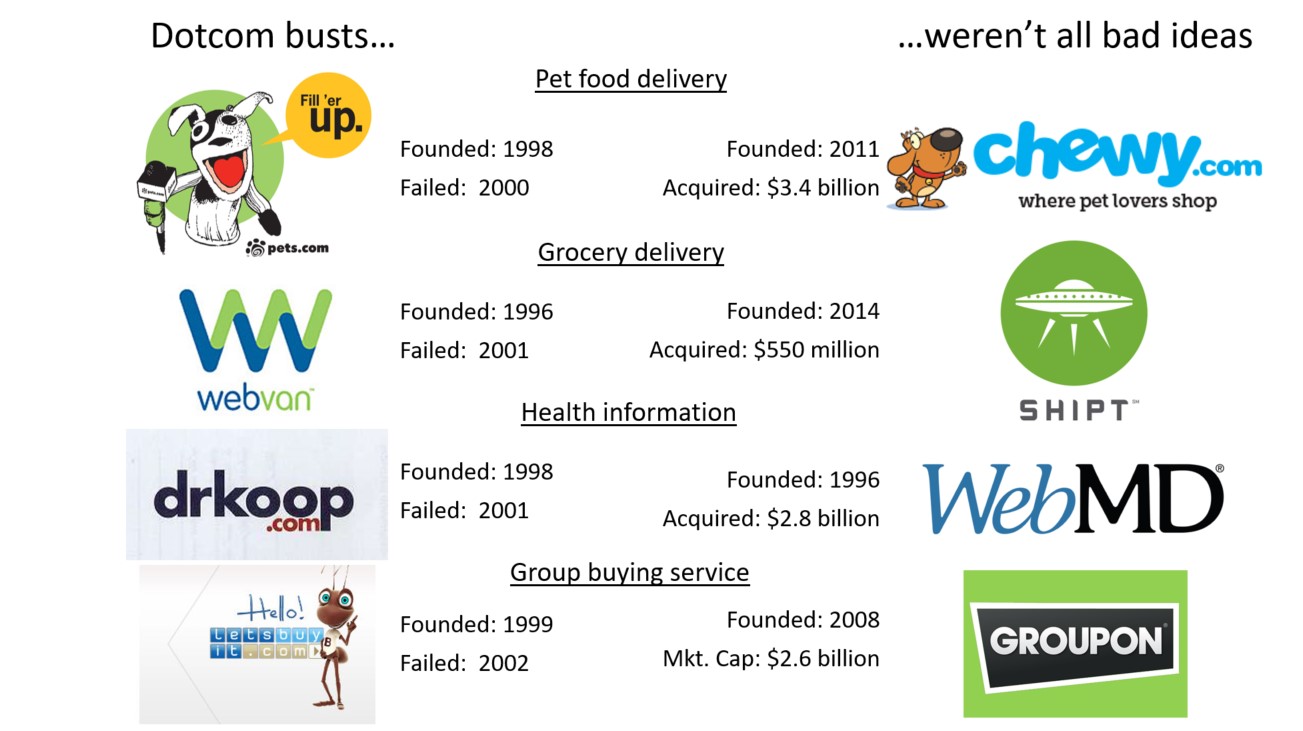

Many of the dot-com stocks that crashed in the early 2000s didn’t do so because they were bad ideas. They did so because consumers needed years or even a decade to be ready for them. Here are four examples of dot-com busts that turned into hugely profitable ideas down the road.

Pets.com somehow remains a punchline for dot-com excess. The irony is that Chewy.com, with a very similar concept over a decade later, was acquired by PetSmart for over $3 billion. Millions likely also purchase pet products on sites like Amazon. There are reasons why it’s individually rational for many startups in a new industry to rush their ideas to market, but there are also many risks.

If I had a great idea for a blockchain application, especially one I didn’t expect anyone else to replicate, I would quietly go to a venture capitalist, get just enough funding to continue developing my idea for a while, and take a vacation. In a couple of years, we’ll likely see less of a free-for-all in token markets, as well as more consumers eager to adopt new and innovative blockchain-based products.