Improving Job Market Pushes Consumer Sentiment Up Again in Early June

The preliminary June results from the University of Michigan Surveys of Consumers show overall consumer sentiment rose again in early June following a sharp gain in May. The May rise followed the largest single-month decline on record in April. While the two consecutive gains are consistent with other signs that the unprecedented plunge in economic activity (a result of government shutdowns intended to slow the spread of COVID-19) may be starting to reverse, the survey notes that high levels of uncertainty persist for many consumers.

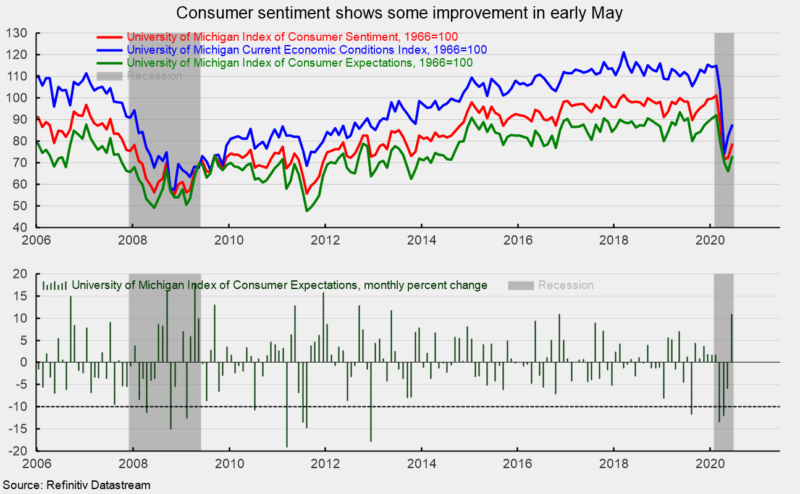

Consumer sentiment increased to 78.9 in early June, up from 72.3 in May, a 9.1 percent rise (see top chart). From a year ago, the index is still down 19.7 percent. Both sub-indexes posted gains in early June. The current-economic-conditions index rose to 87.8 from 82.3 in May (see top chart). That is a 6.7 percent gain but still leaves the index with a 21.5 percent decrease from June 2019.

The second sub-index — that of consumer expectations, one of the AIER leading indicators — rose 7.2 points or 10.9 percent for the month (see bottom chart) but is 18.1 percent below the prior year. According to the report, “The turnaround is largely due to renewed gains in employment, with more consumers expecting declines in the jobless rate than at any other time in the long history of the Michigan surveys.”

However, the report goes on to add, “Despite the expected economic gains, few consumers anticipate the reestablishment of favorable economic conditions anytime soon. Bad times financially in the economy as a whole during the year ahead were still expected by two-thirds of all consumers, and a renewed downturn was anticipated by nearly half over the longer term.” Those concerns may act as a restraint on consumer spending, resulting in a slow and drawn out recovery from the sharp plunge in economic activity. The report states, “The resulting record level of income uncertainty has had a significant impact on consumers’ willingness to make discretionary purchases, although uncertainty has slightly eased recently.” Furthermore, “Importantly, these concerns have also been mitigated by deep discounts on prices and interest rates.”

The path of recovery may ultimately depend on progress understanding the virus that causes COVID-19 and the ability to develop and deploy a vaccine. The survey notes, “The most often cited cause of a renewed downturn is a resurgence in the spread of the coronavirus, and the most often cited cause of a slow economic recovery is the financial damage from persistently high unemployment.”