IMF economists criticize “neoliberalism”

In a recent Finance & Development piece, several IMF economists came together to criticize neoliberal reforms made by governments across the globe. Their main argument is that, “Instead of delivering growth, some neoliberal policies have increased inequality, in turn jeopardizing durable expansion.” More specifically, they criticize “capital account liberalization” and austerity reforms. These measures can harm both the economy and society as a whole.

Really, the problem lies in short-term financial investments, not in long-term or foreign direct investments. Short-term capital flows can add volatility to exchange rates, affect financial sector balance sheets, and even produce a sudden stop. Austerity reforms, on the other hand, can produce effects ranging from welfare costs to negative supply shocks. According to the authors, both capital account liberalization and austerity reforms, increase inequality.

It is, however, curious that the article uses the term “neoliberal,” a term which seemingly lacks any real meaning. If neoliberalism were to have a concrete meaning, it would likely be drawn from the Washington Consensus’ ten key principles. One of neoliberalism’s golden-boys was Argentina in the 1990s. A close look, however, reveals that Argentina failed to apply five (if not more) of neoliberalism’s ten key ingredients. One point, fiscal balance, was overlooked throughout the 90s, although the IMF continued to extend new credits to Argentina.

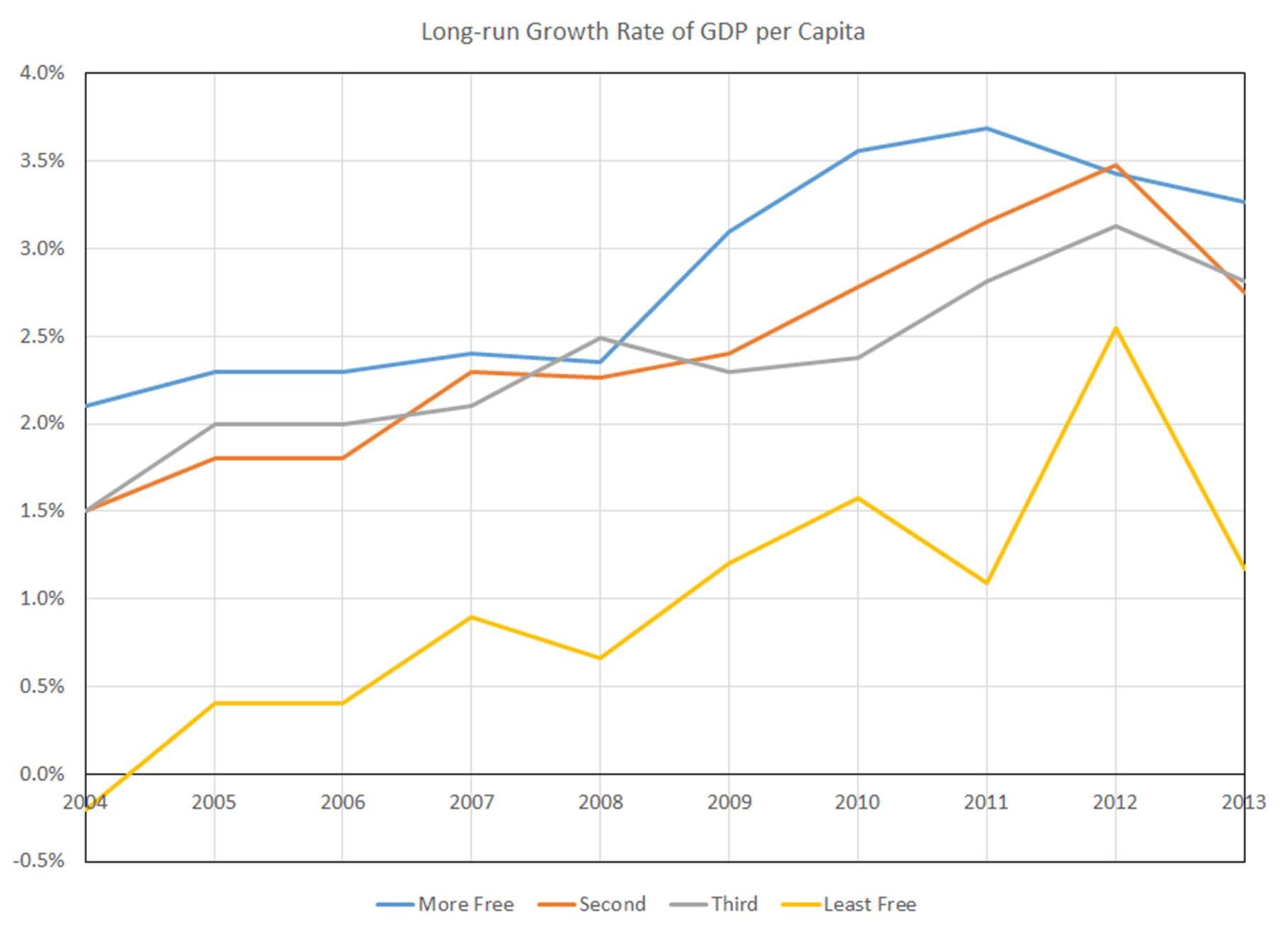

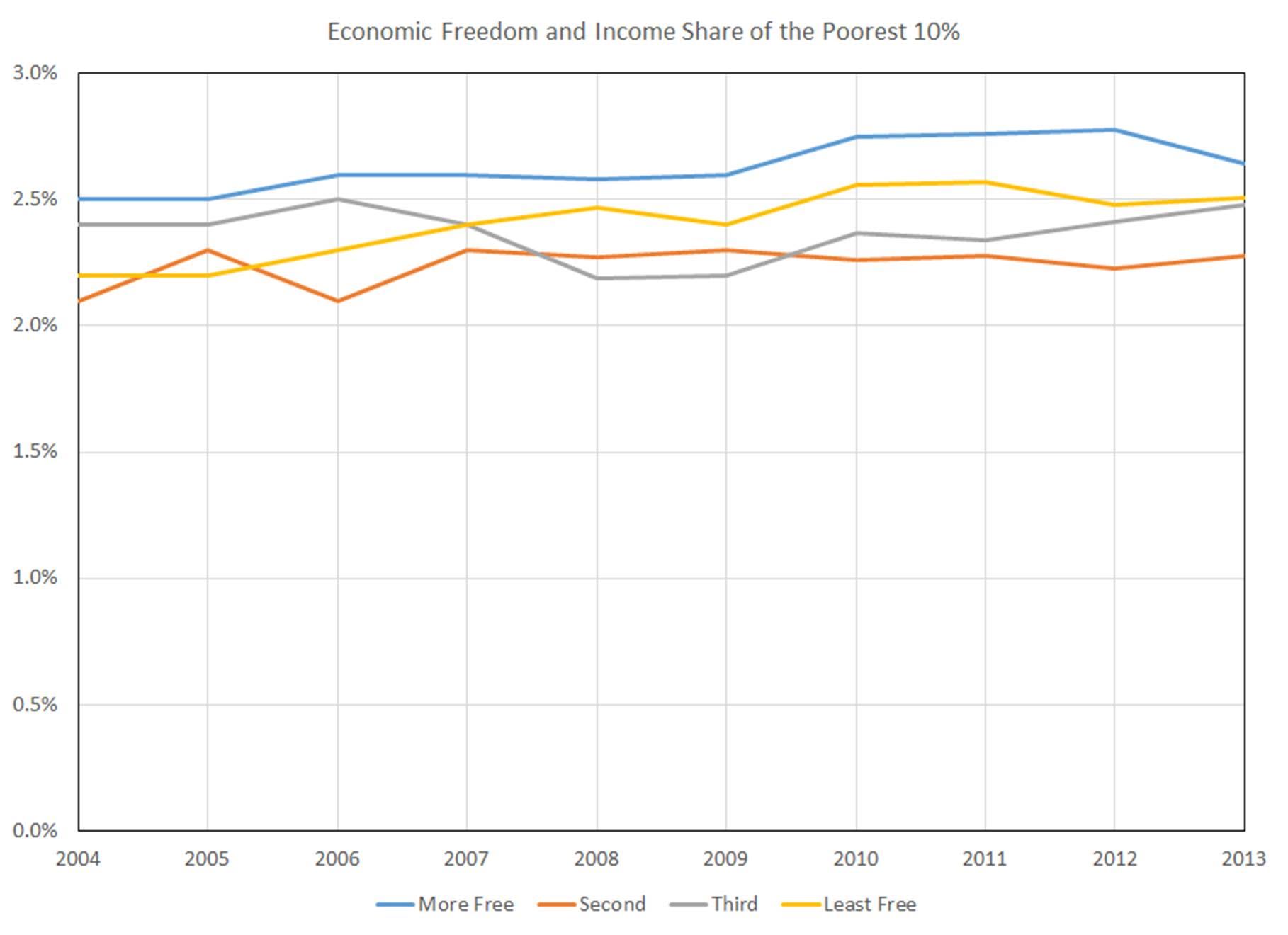

Although the term neoliberalism remains widely undefined, it is clear that the authors of the article in question are thinking of free-market reforms. Let’s look, then, at the growth rates and the income inequality figures of countries grouped according to their levels of economic freedom, as listed in the Economic Freedom of the World Index. The first figure shows the long-run growth rate of GDP per capita for four groups of countries according to their economic freedom. The second figure shows the share of income enjoyed by the poorest 10% of the population.

These charts show that (1) countries with more economic freedom grow faster in the long run and (2) income inequality is unrelated to economic freedom. The difference between more and less freedom does not lie in income inequality, but rather in income or social mobility, something which is absent in less free economies. To focus on income inequality is to disregard the factors behind the very issue.