How Not to Reform Tax Filing

I’m naturally suspicious of any legislation being backed by Elizabeth Warren, the Senator from Massachusetts who, more than most in Congress, has an uncanny knack for pushing legislation that targets commercial freedom for abolition or, at the very least, extreme hobbling. Her record is not even as good as a broken clock, which is correct twice per day. She doesn’t seem to commit herself to any cause that doesn’t directly attack property owners, free enterprise, and the capitalist experience itself. Sorry to put it this way but it must be said: this person despises freedom.

It turns out that Warren has a plan to make your tax filings simpler for you. I’m naturally suspicious of what she means by this. It turns out that she is mighty upset about the profits currently being made by Turbo Tax, the software company that has been a lifesaver for many people in this and many previous tax seasons. But if someone is making a private profit, she is invariably all over the case. She blames a program by the IRS called Free File, which has complicated rules for gaining access. But the model is meanwhile being used by commercial services that individuals far prefer.

She wants to abolish the program and make it a matter of law that the IRS not work with commercial services. Instead, she wants the government itself to put together a universally accessible system of free filing. Actually, she wants to go one step further and essentially have the IRS file your taxes themselves to themselves. The IRS would stop outsourcing to outside services and bring the entire process in house. That’s right: more government-built software.

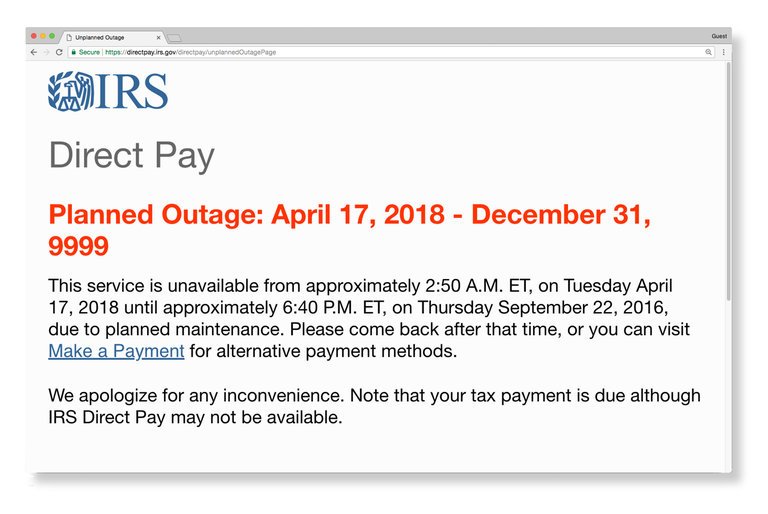

UPDATE: on tax day, the IRS website has collapsed for electronic filing, and it sported the following message that tells you everything you need to know:

Simple Is Not Better

Here legislation is called the Tax Filing Simplification Act. Sounds great right? So did the Affordable Care Act. So does every piece of legislation.

Now, when I first heard this, my mind raced back to other attempts by government to develop services as good as that which are provided by private services. The website that came with Obamacare was an epic fail, and it took months to become truly usable. Even today, it is nowhere near as good as private alternatives.

Hardly anyone remembers this but there was a time when the government tried to create its own mass email service. It didn’t work. People prefer to use services that are focused on the consumer, not the needs of the government. So the idea of the IRS doing our tax preparation for us strikes me as nothing but trouble.

The advocates of this system counter that the IRS already has records on what we owe. For most people, filing taxes consists of sending to the government a copy of what the government already has, forms such as W2s and 1099s. If we make a mistake, government catches it and sends a bill and we pay it. So in their thinking, having government file for you merely saves a step. This would be nothing more than doing what is already done in Japan. Says Vox:

In a number of countries, like Japan and the UK, the vast majority of people don’t have to file tax returns at all, pre-populated or otherwise. Instead, through a system known as “precision withholding,” the government takes exactly the right amount out of every paycheck. If they find that a mistake was made — not accounting for a charitable donation or mortgage interest, for example — they find that mistake in charity and bank records, and they fix it for you.

What this actually means is the elimination of the last element of “voluntary” from the system. Every dollar you make would have to go to the government first, they take their cut, and they decide to send you what the government decides can be yours. You are left out of the process entirely. It becomes invisible to you. Completely. Imagine how much easier it would be to raise taxes, how much more difficult it would become to challenge mistakes, and how much this would diminish public anger toward taxes.

What this program would do is shift the entire moral narrative of taxation. Right now, people presume to own what they make and they send government its cut. Under this system, the government owns everything and sends you what they think you need. The change in the psychology alone would seriously diminish what remains of the idea of private property.

It is also unviable in the age of the gig economy. As Max Gulker has pointed out concerning alternative forms of work: “94 percent of net job creation between 2005 and 2015 (9.1 million jobs) fits these alternative arrangements (8.6 million), job creation that raised the percentage of workers engaged in such arrangements from 10.7 percent in 2005 to 15.8 percent in 2015.”

Not all of this kind of work fits into traditional models. For the IRS to obtain information on all sources of income would mandate a level of privacy intrusion that we’ve not yet experienced. It would provide a pretext to end all channels of income earning that require voluntary reporting.

Withholding Is Bad Enough

A much better tax reform would put 100% of the onus for paying and filing on the taxpayer, as a matter of making the biggest possible impression on the public about the costs of government itself. This would be the honest way to go about collecting money. That would entail, for starters, the end of the withholding system.

The withholding tax came about in wartime as a means of giving government an advance on taxes owed. It might be seen as an understandable wartime measure but it proved so efficient that it was continued later. Milton Friedman, in fact, never stopped expressing regret for having created this system when he was working as an economist for the government in those years. It would be a striking thing to observe the effects on politics if every American had to cough up the full amount they own each year, rather than getting a return based on money already collected.

How Much Is Voluntary?

To be sure, there is something of a misnomer to the current system of filing that doing so makes the system voluntary. What makes a tax different from a contribution or a trade is that the revenue is extracted by force. You can choose not to comply just as you can choose to resist arrest. But then you must face the consequences. A truly voluntary tax is like a friendly insult, a peaceful war or a healthy cancer. The two words just don’t go together.

You sometimes hear that excise taxes are voluntary because no one is forcing you to buy the taxed good or service. This is false. The point is that if you buy gasoline, cigarettes or anything else that is taxed at the point of sale, you have no choice but to fund the government with part of your purchase price. That is not voluntary.

Yet many people, convinced that they should take the government at its word, persist in believing otherwise. The courts have been dealing with these people for decades. They file what the government calls “frivolous lawsuits.” In fact, the IRS has heard this claim enough to actually address it on a special webpage it has created to address these and other far-flung claims made by people who imagine that they have a right to keep what they earn.

The agency writes:

“Any taxpayer who has received more than a statutorily determined amount of gross income is obligated to file a return. Failure to file a tax return could subject the noncomplying individual to criminal penalties, including fines and imprisonment, as well as civil penalties. “[A]lthough Treasury regulations establish voluntary compliance as the general method of income tax collection, Congress gave the secretary of the Treasury the power to enforce the income tax laws through involuntary collection…The IRS’ efforts to obtain compliance with the tax laws are entirely proper.” United States v. Tedder, 787 F.2d 540, 542 (10th Cir. 1986).”

In other words, you are free to comply. If you choose not to comply, you could go to prison. As proof that this is law, the agency cites court cases from 1938-88. Guess what? The courts, as creations of the government, have sided with the government’s right to collect taxes from your income. But you say that this is not fair. This is not just. This is un-American. This contradicts the government’s own claim that its system is voluntary.

Well, if you are writing the dictionary, you get to define words however you want to define them. However the government uses language, the reality is that the money is being taken from you without your consent. The only real difference between the robber (such as what was once called a “highwayman”) and the government, as Lysander Spooner said, is that the robber doesn’t claim to be doing this for your own good:

“The highwayman takes solely upon himself the responsibility, danger and crime of his own act. He does not pretend that he has any rightful claim to your money, or that he intends to use it for your own benefit. He does not pretend to be anything but a robber. He has not acquired impudence enough to profess to be merely a ‘protector,’ and that he takes men’s money against their will, merely to enable him to ‘protect’ those infatuated travelers who feel perfectly able to protect themselves, or do not appreciate his peculiar system of protection. He is too sensible a man to make such professions as these. Furthermore, having taken your money, he leaves you, as you wish him to do. He does not persist in following you on the road against your will, assuming to be your rightful ‘sovereign’ on account of the ‘protection’ he affords you. He does not keep ‘protecting’ you by commanding you to bow down and serve him; by requiring you to do this, and forbidding you to do that; by robbing you of more money as often as he finds it for his interest or pleasure to do so; and by branding you as a rebel, a traitor and an enemy to your country, and shooting you down without mercy if you dispute his authority or resist his demands. He is too much of a gentleman to be guilty of such impostures and insults and villainies as these. In short, he does not, in addition to robbing you, attempt to make you either his dupe or his slave.”

What Elizabeth Warren intends is to make the highwayman rob you in your sleep, so that you never know he is there and come to expect less ownership in the morning than when you went to bed. Her proposed change to tax filing would diminish property rights, make tax increases easier, reduce your privacy, and fundamentally upend what remains of the idea that you are entitled to the wealth you earn. It would also end up restricting your possible sources of income.

Keep in mind that there was no income tax in this country for the 126 years after the Constitution was ratified, except for a brief period during the Civil War. Even after the Constitution was amended to make income taxes possible, only a few actually paid. It was much later before it hit most every American. No question: the 16th amendment fundamentally changed the relationship of the citizen to the state in a way that would have horrified the founders, which is precisely why the Constitution had to be amended in 1913.

Before that, your income was your own, period. Returning to that system would be a reform to support.