How Did the Life Insurance Industry Survive the Pandemic?

Why don’t newspaper headlines blare warnings about the impending collapse of the global life insurance industry? Of the bankruptcy of US life insurers great and small? Why aren’t life insurers banging on the doors of Congress looking for trillion-dollar bailouts?

Because they are doing just fine for now.

Sure, financial market volatility injured the asset side of some insurers’ balance sheets but they have weathered that because most companies have experienced no discernible shock to the liability side, i.e., no big spike in net claims during the pandemic. (For details, see AM Best’s Market Segment Outlook: US Life/Annuity Insurance, 7 December 2020.) Some of that may result from mortality offsets (fewer lives lost in auto accidents, for example) but official CDC data claim significant excess mortality, some directly attributable to Covid and some to lockdowns, especially rampant unemployment. According to The Economist, most other countries have also reported excess deaths.

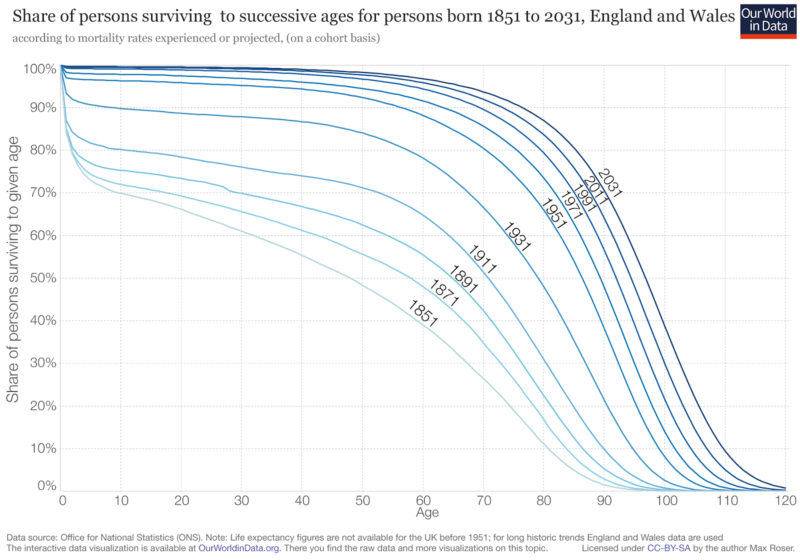

How can the life insurance industry be standing strong, then? Over half a million Americans have died, let’s say in the vicinity of, Covid-19, plus millions more worldwide. You may have read someplace that life expectancy in the U.S. dropped a full year in 2020, and that was, like, the worst drop ever. Yes, but that “finding” is essentially meaningless because life expectancy is a forecast model, and a crude one at that, that estimates future average age of death based on previous experience. When fewer deaths than expected occur over the next few years — which is likely given that people expected to die in 2021, 2022, etc. have already passed — the model will dutifully report rising life expectancy. What really matters to people is the structure of mortality tables/the shape and position of curves depicting the percentage of people who live to various ages. In rich countries, like the US and UK, mortality has improved for over a century as more and more people live longer and longer:

Covid-19 has shifted the 2021 curve a little down/left, mostly at its far right tail. That’s tragic, of course, but not nearly as heart-wrenching as a downward shift in the left tail would be.

As for the resiliency of life insurers, not everyone owns a life insurance policy anymore. Those who do tend to be more affluent and hence to be less likely to die, of anything, at any given age. Insurers use the Law of Large Numbers to estimate with considerable precision the mortality rates of their insureds and plan accordingly. Only deviations outside of a range of expected mortality volatility should cause them any problems. Nevertheless, due to regulations and hard won experience they maintain several additional prudential backstops.

For starters, many life insurers also sell life annuities, financial contracts (much like Social Security) that periodically pay a stipulated sum until the annuitant (and sometimes a survivor, like a spouse) dies. So life insurers are both long and short on changes in mortality rates. Collectively anyway, what life insurers lose in claims when more people than expected die they make up for in annuity payments that they no longer have to make.

Life insurers also maintain three additional buffers against shocks: capital (owner equity), reinsurance (insurance for insurers), and so-called death bonds. As AM Best — sort of the S&P or Moody’s of the insurance industry — notes in its recent report, capitalization of life insurers remains strong, i.e., capable of absorbing considerable shocks from either side of the balance sheet.

Reinsurance allows life insurers to share the risk of excess mortality events with other insurers, typically specialized reinsurance companies including behemoths Swiss Re and Munich Re. Their stock prices tanked along with everyone else’s a year go but since have rebounded. Swiss Re is not back to its pre-pandemic highs but it is back into its normal 5-year trading range. Munich Re’s stock price has almost fully returned to its 5-year high. If either company is in trouble, it is doing a good job of hiding it!

Reinsurers spread some of their risk via retrocession agreements. Such private B2B contracts are pretty opaque to outsiders, but I could not find any evidence of distress in that area of the industry.

Insurers and reinsurers also issue so-called death or XXX bonds or life insurance securitization/life insurance-linked securities (ILS), the payouts of which are linked to mortality rates. Insurers use them to spread the risk of excess mortality events to institutional capital market investors looking for returns not correlated with the major securities markets. Liquid public markets for such securities do not exist so price data is not readily available but there are no indications that such bonds are under pressure.

It is of course a good thing that life insurers did not exacerbate the financial stresses brought on by the pandemic or its mitigation policies, which did indeed turn out to be the worst since the New Deal as I suggested in April 2020. ‘Tis a shame that nobody followed my suggestion, made that same month, to use life insurance data to provide an independent assessment of the pandemic’s progress. But now that the end of the pandemic is nigh, we can see from the life industry’s solid condition that the pandemic was never the existential threat some made it out to be. Too bad our uncompetitive healthcare system needed to be bailed out by “two weeks to flatten the curve” policies that turned into 52-week lockdowns in too many places. Economists like John C. Goodman and Sean Masaki Flynn had the healthcare problem solved before the pandemic struck, but systemic idiocy apparently prevents the adoption of even the simplest and most obvious reforms.