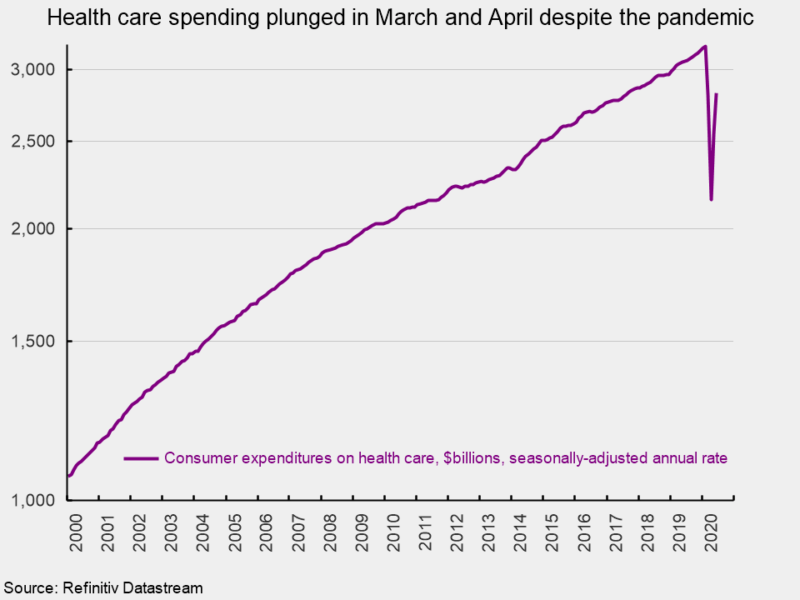

How Did Spending on Health Care Plunge During a Pandemic?

Americans spend on health care. In 2019, the total was just over $3 trillion or about 14.3 percent of gross domestic product, measured in nominal terms. For the 20 years through the end of 2019, nominal spending on health care grew at a 5.5 percent annualized rate. Such numbers are not surprising given the aging of the population. Baby boomers, those people born between 1946 and 1964, account for a significant share of the population and as of 2011, the leading edge of this group began turning 65. For most people, the vast majority of health care expenditures over a lifetime is spent in the later part of life. In addition, costs for health care have been rising faster than overall prices, reflecting a number of regulatory and market forces.

With all these things driving up health care expenditures, how could health care spending plunge during a health care panic? Such a turn of events seems completely counterintuitive. The answer is actually quite simple: health care spending plunged for the same reason many other types of spending plunged; namely, government shutdowns.

While hospitals were overrun with COVID-19 cases, nearly all other types of medical procedures were suspended and postponed. Elective procedures (which are often very profitable for hospitals), routine office visits, therapy, everything that wasn’t considered essential (life threatening) was delayed.

As of June, spending on hospital visits (about a 37 percent share of pre-pandemic health care spending), saw a 13.1 percent decline compared to year ago levels despite caring for all the COVID-19 victims. Office visits to physicians (about 19 percent of total health care spending before the pandemic) was off 5.1 percent from the year ago level. Nursing homes (about a 6 percent share) saw a 12 percent decline in spending while dentists (about a 4.4 percent share) saw a 33.9 percent plunge in spending on office visits compared to a year ago. Home health care (about a 4 percent share) had a 5.9 percent decline from a year ago.

What areas have experienced increases in spending? The two areas that are benefitting the most are medical laboratories (only about 1.2 percent of spending before the outbreak) where spending is up 25.3 percent versus a year ago and pharmaceutical products (just under an 18 percent share) where spending is up 5.2 percent, driven largely by prescription drugs (15.3 percent share) where spending is up 5.6 percent from a year ago. Nonprescription drug spending (2.4 percent share) is also up, but by a more moderate 2.7 percent from a year ago.

While it may indeed seem illogical that health care spending could plunge during a health care panic, large portions of health care services were subject to the same closure mandates as most other businesses. Those mandates had the same impact on the health care industry as they had on so many other industries, namely hardship. But even worse, the impact on consumers having to forego health care could be far more dangerous than giving up happy hour at the local pub.